ADEN Crypto Exchange Review: Is This New Decentralized Derivatives Platform Worth Trying?

Jan, 4 2026

Jan, 4 2026

ADEN launched on July 23, 2025, and it’s already one of the most talked-about names in decentralized finance. But here’s the real question: is it just another flashy new crypto project, or does it actually solve a problem traders face every day? If you’re tired of paying high fees on centralized exchanges, dealing with KYC forms, or getting stuck with gas fees on every trade, then ADEN might be worth your attention. But it’s not for everyone.

What Exactly Is ADEN?

ADEN is a decentralized derivatives exchange built on the Orderly Network. That means it’s not like Coinbase or Binance where you sign up, deposit cash, and let them hold your coins. With ADEN, you trade directly from your wallet using WalletConnect. No registration. No ID checks. No middleman. You control your keys. That’s the whole point.

It focuses on one thing: perpetual futures contracts. You can trade these with either USDT or USDC as collateral. That’s it. No spot trading. No altcoins. No staking. Just leveraged derivatives. If you’re looking to go long on Bitcoin with 50x leverage or short Ethereum without giving up custody of your assets, ADEN gives you that power.

It runs on multiple chains: BNB Chain, Arbitrum, Optimism, Base, Ethereum, and Solana. That’s a lot of flexibility. You can pick the network that’s cheapest or fastest for you at any given moment. And because it uses Orderly’s orderbook system - the same one powering ASTER - you get deep liquidity and fast execution. Think of it as a CEX interface with DeFi back-end.

The Fees Are Crazy Low - But Is That Enough?

ADEN’s fee structure is its biggest selling point. Maker fees? 0%. Taker fees? Just 0.0009%. That’s lower than almost every major exchange out there. Kraken Pro charges 0.00% for makers but 0.04% for takers on high-volume trades. Coinbase charges up to 3.99% for small trades. Robinhood is free, but only for 25 coins and no leverage.

ADEN doesn’t just beat them on price - it removes another pain point: gas fees. Most DeFi platforms make you pay Ethereum or Solana network fees every time you place, cancel, or fill an order. ADEN handles that for you. It’s gasless. You don’t need to hold ETH, BNB, or SOL just to trade. That’s huge for new users who don’t want to juggle multiple tokens just to get started.

But here’s the catch: low fees mean nothing if no one’s trading. As of October 2025, ADEN shows up on CoinMarketCap as an “Untracked Listing.” That means no reliable volume data. No charts. No order book depth. That’s not normal for a platform that’s been live for over five months. If you’re used to seeing billions in daily volume on Binance or Coinbase, ADEN’s numbers are barely visible.

Who Is ADEN For?

ADEN isn’t trying to be everything to everyone. It’s built for one group: experienced crypto traders who want derivatives access without KYC. If you’re someone who values privacy, hates filling out forms, and knows how to manage your own wallet, then ADEN is a rare option.

But if you’re a beginner? You’re going to struggle. You need to understand what perpetual futures are. You need to know how leverage works. You need to know what liquidation means. And you need to be comfortable with the fact that if something goes wrong, there’s no customer support hotline to call. No email ticket system. No live chat. Just a smart contract.

Also, if you’re in the U.S. and care about regulation, ADEN won’t help you. It’s registered in Seychelles. That means it doesn’t offer FDIC insurance. It doesn’t comply with U.S. financial laws. If you’re using a U.S.-based wallet like MetaMask, you’re trading at your own risk. There’s no legal recourse if the platform gets hacked or shuts down.

How Does It Compare to the Big Players?

Let’s be honest - ADEN isn’t competing with Kraken or Coinbase on features. It’s competing on philosophy.

| Feature | ADEN | Kraken | Coinbase | Uniswap |

|---|---|---|---|---|

| Type | Decentralized derivatives | Centralized spot & derivatives | Centralized spot & derivatives | Decentralized spot |

| KYC Required | No | Yes | Yes | No |

| Trading Pairs | Perpetual futures only | 400+ assets | 235+ assets | 1000+ spot tokens |

| Maker Fee | 0% | 0.00% (high volume) | 0%-3.99% | 0.05% |

| Taker Fee | 0.0009% | 0.04% (high volume) | 0.5%-3.99% | 0.05% |

| Gas Fees | None | None (on-platform) | None (on-platform) | Yes |

| Customer Support | None | 24/7 email & chat | 24/7 email & chat | Community only |

| Regulatory Status | Seychelles | U.S., EU, Canada | U.S., Canada, EU | Unregulated |

ADEN doesn’t have the asset variety of Kraken. It doesn’t have the user base of Coinbase. It doesn’t even have the proven track record of Uniswap, which has been around since 2018. But it does have something they don’t: a truly permissionless, gasless, ultra-low-fee derivatives experience.

The Risks You Can’t Ignore

Low fees and no KYC sound great - until something goes wrong.

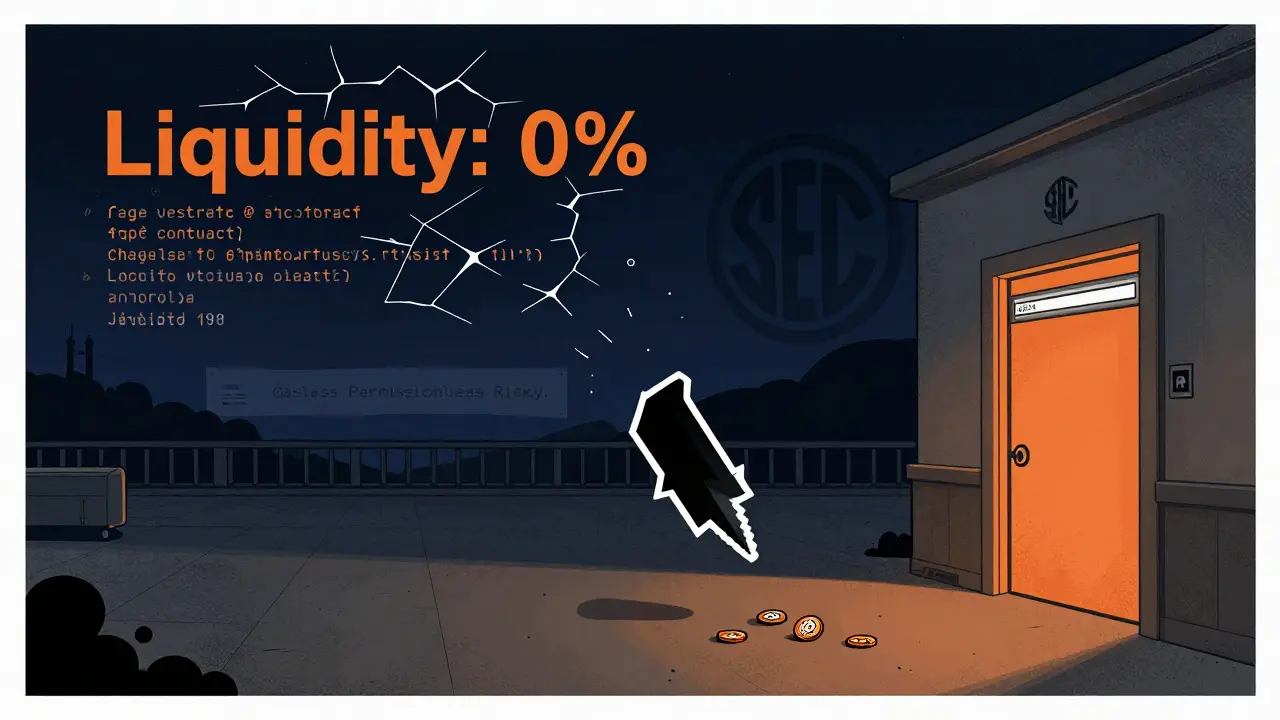

First, there’s the liquidity risk. With low trading volume, your orders might not fill. Or worse, you might get slippage that wipes out your profit. Derivatives trading is already risky. Doing it on a platform with thin order books? That’s playing with fire.

Second, there’s no insurance. Kraken holds FDIC-insured USD balances. Coinbase has $250M in cold storage insurance. ADEN? Nothing. If the smart contract has a bug, if Orderly Network goes down, if someone exploits a vulnerability - your money is gone. No refunds. No appeals.

Third, there’s the regulatory risk. The U.S. SEC is cracking down on decentralized exchanges that offer derivatives. Uniswap hasn’t been touched yet, but that doesn’t mean ADEN is safe. If regulators decide to target non-KYC derivatives platforms, ADEN could be blocked in the U.S. overnight. You won’t get a warning. You’ll just find the website gone.

Who Should Avoid ADEN?

If any of these sound like you, walk away:

- You’re new to crypto and don’t know how leverage works.

- You rely on customer support when things go wrong.

- You want to trade more than just perpetual futures.

- You’re in a regulated jurisdiction and need compliance.

- You’re looking for a long-term store of value - not a trading platform.

ADEN isn’t a place to hold Bitcoin. It’s not a place to buy Solana for the long haul. It’s a tool for active traders who want to bet on price movements without giving up control. If that’s not your goal, save yourself the headache.

Is ADEN the Future?

The idea behind ADEN - fast, cheap, private, gasless derivatives trading - is absolutely the future. But the future doesn’t always arrive on time.

ADEN has the tech. It has the architecture. It has the fee structure that could disrupt the market. But it’s missing one thing: users. Without volume, even the best platform becomes a ghost town.

Its success depends on three things: attracting serious traders, building liquidity through incentives, and staying ahead of regulators. If Orderly Network can bring more users from ASTER over, or if ADEN launches a liquidity mining program, things could change fast. But right now, it’s still a gamble.

If you’re willing to take that gamble - and you know what you’re doing - ADEN is one of the most exciting experiments in DeFi right now. If you’re looking for safety, stability, or support? Stick with Kraken or Coinbase. They’ve earned it.

Is ADEN safe to use?

ADEN is as safe as the smart contracts it runs on. Since it’s decentralized and non-custodial, your funds never leave your wallet. But that also means there’s no insurance, no recovery options, and no customer support. If there’s a bug, hack, or exploit, you lose your money. Only use funds you’re willing to risk.

Do I need KYC to trade on ADEN?

No. ADEN requires zero KYC. You connect your wallet - like MetaMask, Phantom, or Trust Wallet - and start trading immediately. This is great for privacy, but it also means you can’t use ADEN if you’re subject to U.S. or EU regulations that require identity verification.

Can I trade spot coins on ADEN?

No. ADEN only supports perpetual futures contracts denominated in USDT or USDC. You can’t buy or sell Bitcoin, Ethereum, or any other spot asset directly. If you want to trade the actual coins, you’ll need another exchange like Uniswap or Coinbase.

Why is ADEN not showing trading volume on CoinMarketCap?

ADEN is listed as an "Untracked Listing" because its trading data hasn’t been verified or integrated into major data aggregators. This could mean low activity, incomplete API connections, or the platform not meeting reporting standards. It’s a red flag for new users - volume is critical for liquidity and price stability.

What blockchains does ADEN support?

ADEN supports six blockchains: BNB Chain, Arbitrum, Optimism, Base, Ethereum, and Solana. You can connect any WalletConnect-compatible wallet on these networks. The platform automatically routes your trades through the most efficient chain, but you still need to have the native token (like ETH or SOL) for initial setup, even though gas fees are covered.

Is ADEN better than Uniswap?

It depends on what you want. Uniswap is the leader in spot trading - you buy and sell tokens directly. ADEN is for leveraged trading - you bet on price movements without owning the asset. They serve different purposes. Uniswap is battle-tested and has massive volume. ADEN is new, fast, and focused on derivatives. You can use both, but they’re not substitutes.