Bits Blockchain Crypto Exchange Review: Fees, Features, and Why It Stands Out for All the Wrong Reasons

Feb, 21 2026

Feb, 21 2026

When you're looking for a crypto exchange, you don't just want another platform that says it lets you trade Bitcoin. You want one that actually works well - low fees, solid security, decent liquidity, and real customer support. Bits Blockchain claims to offer all of that. But after digging into the facts, it's clear this exchange doesn't just fall short - it's noticeably behind the curve.

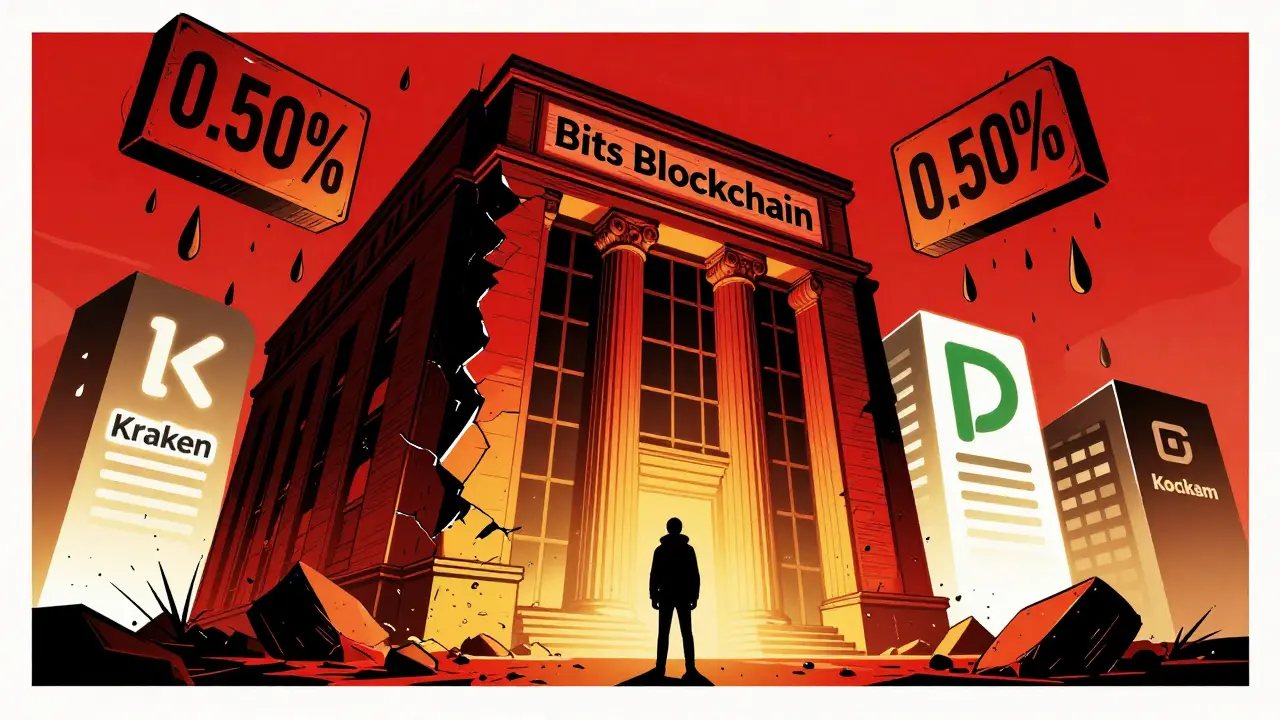

Flat 0.50% Trading Fee? That’s Expensive

Most crypto exchanges today use a maker-taker model. Makers (people who add liquidity by placing limit orders) pay less - often nothing. Takers (those who remove liquidity by buying or selling at market price) pay a little more. This encourages trading volume and rewards active participants. Bits Blockchain doesn’t do that. Instead, it charges a flat 0.50% fee on every single trade, no matter what you do. That’s double the industry average of around 0.25%.

Let’s put that into dollars. If you trade $1,000 worth of Ethereum, you pay $5 in fees. On Binance US or Kraken, you’d pay between $0 and $0.60. Even Coinbase, which is known for higher fees, charges as low as 0.5% only on small purchases via credit card - and drops to 0% for larger trades using bank transfers. Bits Blockchain doesn’t offer discounts for volume, loyalty, or even holding their native token. It’s one-size-fits-all, and it’s priced at the high end.

Withdrawal Fees Are Even Worse

Trading fees are bad enough. But the withdrawal fee is where things get ridiculous. To send Bitcoin out of Bits Blockchain, you’re charged 0.004 BTC. As of early 2026, that’s over $200 in fees just to move your coins. Compare that to Bitstamp, Kraken, or Coinbase - all charge under $0.01 in BTC equivalent for withdrawals. Even smaller exchanges like KuCoin charge less than half of what Bits Blockchain does.

Why does this matter? Because if you’re serious about crypto, you move your coins. You don’t leave them on an exchange. You use cold wallets. You stake. You diversify. If your exchange makes it expensive to leave, that’s a red flag. It’s like a bank charging you $100 every time you want to withdraw cash.

Deposit Methods Are Basic - And Not Unique

Bits Blockchain lets you fund your account with wire transfers and credit cards. That’s it. No PayPal, no Apple Pay, no bank-to-crypto on-ramps like Ramp or MoonPay. And here’s the thing: every major exchange - Coinbase, Kraken, Gemini, Binance US - already offers those exact same options. So what’s the point? There’s no innovation here. No advantage. Just the bare minimum.

Some exchanges even let you buy crypto with cash via ATMs or peer-to-peer deals. Bits Blockchain doesn’t. If you’re new to crypto and want to start with a credit card, you’ve got dozens of better, cheaper options.

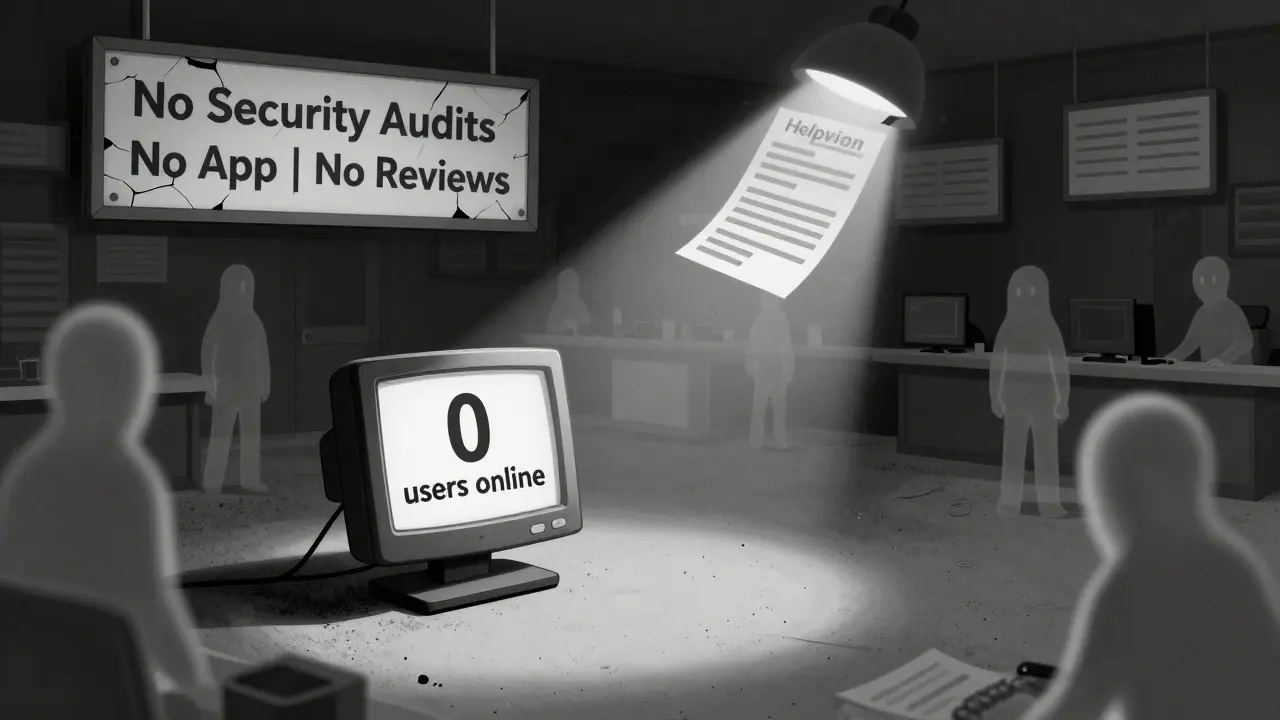

No Transparency on Security or Regulation

Here’s something that should scare you: nobody knows if Bits Blockchain is regulated. There’s no mention of licensing in any jurisdiction - not in the U.S., not in Europe, not in Canada or Australia. No public record of audits. No proof of cold storage. No third-party security certifications. No mention of insurance funds.

Compare that to Kraken, which is licensed in multiple U.S. states and has undergone independent security audits. Or Coinbase, which is publicly traded and reports its reserves. Bits Blockchain doesn’t even publish a security page on its website - at least, not one that’s visible in public records.

That’s not just a gap. It’s a risk. If your coins disappear, who do you call? And more importantly - who’s responsible?

What’s Actually Listed? We Don’t Know

How many cryptocurrencies does Bits Blockchain support? The answer: nobody seems to know. There’s no official list. No press release. No update from their team. Cryptowisser’s 2025 review doesn’t even attempt to count them. That’s unusual. Even the smallest exchanges list their assets clearly.

Top exchanges in 2026 offer 150 to 350+ coins. Coinbase lists 235. Kraken has over 350. Binance US offers 158. If Bits Blockchain supports fewer than 50, you’re missing out on trading opportunities. If it supports more, why isn’t that advertised?

Lack of transparency around listings raises questions. Are they adding new coins slowly? Are they delisting unstable ones? Or are they just not keeping up? The silence speaks volumes.

Who Even Uses This Exchange?

There are zero user reviews on Trustpilot, Reddit, or G2. No YouTube videos. No forum threads. No complaints. No praise. Nothing.

That’s not normal. Even obscure exchanges have at least a few users talking. If no one’s talking about Bits Blockchain, either it’s so small it doesn’t matter - or people are leaving quietly because something’s wrong.

And here’s the kicker: none of the major 2025-2026 "best crypto exchanges" lists include it. Not Koinly. Not NerdWallet. Not CoinMarketCap’s rankings. Not even "hidden gems" roundups. It’s completely absent from industry coverage.

Why This Matters in 2026

The crypto exchange market isn’t just competitive - it’s brutal. Fees are dropping. Features are exploding. Platforms now offer staking, lending, yield farming, NFT marketplaces, and even crypto-backed credit cards. Bits Blockchain offers trading - and that’s it.

There’s no mobile app mentioned. No API for traders. No educational resources for beginners. No customer service hotline or live chat. No clear path for account verification beyond "KYC required for withdrawals." You’re left guessing.

Meanwhile, alternatives are stepping up. Kraken added stocks and ETFs. Coinbase launched its own wallet with biometric login. Binance US improved its withdrawal speed to under 10 minutes. Bits Blockchain? Nothing. Not even a blog update since 2024.

Final Verdict: Skip It

Bits Blockchain doesn’t feel like a platform built for users. It feels like a placeholder - a website with a trading engine, but no vision. The fees are too high. The withdrawals are too expensive. The security is invisible. The support is silent. The community is nonexistent.

If you’re looking for a simple, no-frills exchange, there are dozens of better ones. Coinbase is user-friendly. Kraken is cheaper and more transparent. Binance US has higher liquidity. Even Gemini, with fewer coins, offers better security and clearer terms.

Bits Blockchain doesn’t offer anything unique. And what it does offer - a flat 0.50% fee and a $200 Bitcoin withdrawal charge - is actively harmful to your returns. In 2026, paying double the market rate for worse service isn’t a choice. It’s a mistake.

Is Bits Blockchain a scam?

There’s no public evidence that Bits Blockchain is a scam - no regulatory warnings, no lawsuits, no confirmed thefts. But that doesn’t mean it’s safe. The lack of transparency - no regulatory licenses, no security audits, no user reviews - makes it impossible to trust. A legitimate exchange doesn’t hide its credentials. It displays them.

Can I use Bits Blockchain in the U.S.?

It’s unclear. Bits Blockchain doesn’t state which countries it serves. Most U.S.-based exchanges must register with FinCEN and comply with state-level regulations. Since Bits Blockchain doesn’t mention licensing or compliance anywhere, it’s risky to assume it’s legal to use in the U.S. If you’re in the U.S., stick to platforms like Coinbase, Kraken, or Binance US that clearly state their regulatory status.

Why is the withdrawal fee so high?

The 0.004 BTC withdrawal fee is roughly $200 as of early 2026. That’s 50 times higher than what most exchanges charge. The reason? There’s no good one. It’s likely either a flawed pricing model or an attempt to discourage users from moving funds off the platform - a tactic used by some low-quality exchanges to keep assets locked in. Either way, it’s a major red flag.

Does Bits Blockchain have a mobile app?

There is no public information about a mobile app. No mentions on the website, no listings on the Apple App Store or Google Play, and no user reports of using one. If you need to trade on the go, this exchange is not an option.

What are better alternatives to Bits Blockchain?

For U.S. users: Coinbase (easy to use, regulated), Kraken (low fees, 350+ coins), and Gemini (strong security) are top choices. For global users: Binance (highest liquidity), KuCoin (wide coin selection), and Bybit (advanced trading tools) offer better fees, features, and transparency. All of them have mobile apps, customer support, and public security reports - things Bits Blockchain lacks.

Robert Kromberg

February 21, 2026 AT 21:00Honestly, I tried Bits Blockchain out of curiosity last year. Paid the fee once, then immediately moved everything to Kraken. The withdrawal fee alone was enough to make me panic - $200 just to get my BTC out? That’s not a fee, that’s a ransom. I’m not even mad, just disappointed. There are so many better options, and none of them treat you like a walking ATM.