Centralized Exchange Token Risks: What You Need to Know Before Depositing Crypto

Jan, 26 2026

Jan, 26 2026

When you deposit Bitcoin or Ethereum into a centralized exchange like Binance, Coinbase, or Kraken, you’re not really holding your own crypto. You’re trusting someone else to hold it for you. And that’s where the real danger lies.

The Custody Trap

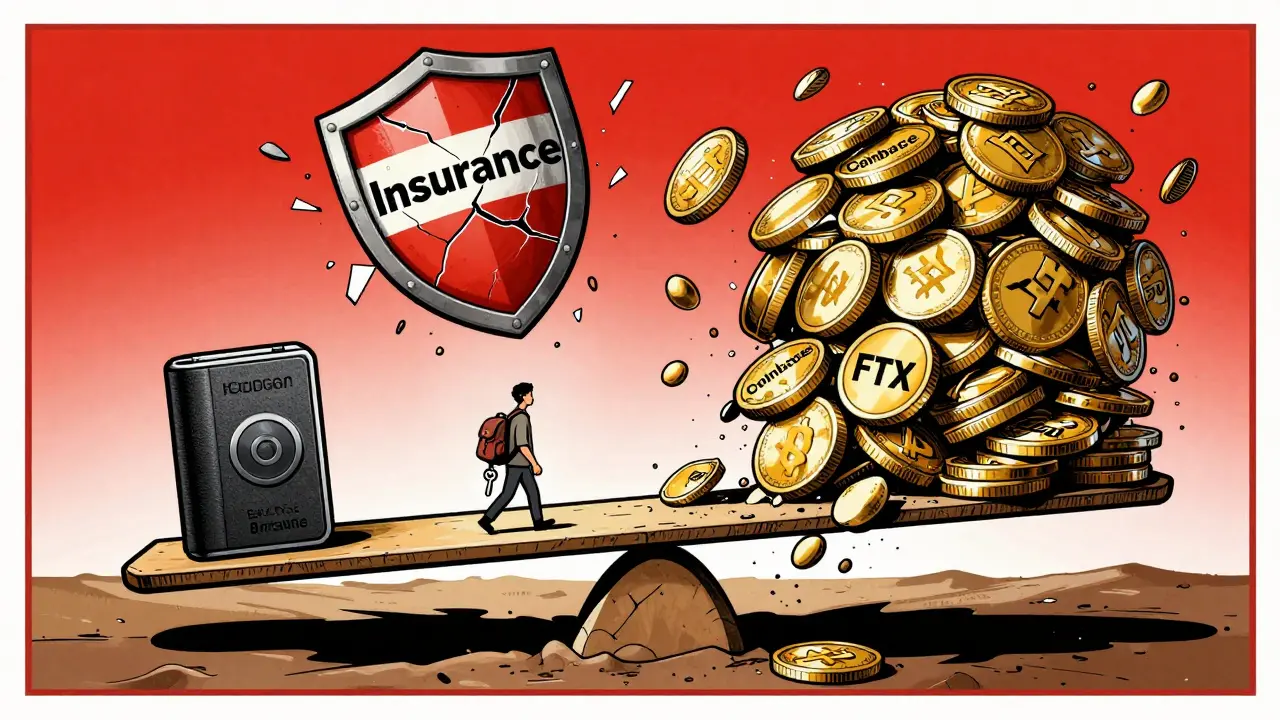

Most people think buying crypto on an exchange means they own it. It doesn’t. When you buy Bitcoin on Coinbase, the exchange puts it into a wallet they control. Your balance is just a number on their ledger. You don’t have the private keys. You can’t move it without their permission. And if they get hacked, go bankrupt, or decide to freeze withdrawals - your coins vanish with them. This isn’t theoretical. In 2014, Mt. Gox lost 850,000 BTC - worth about $450 million back then - and never paid users back. In 2022, FTX collapsed, leaving over 1 million users with empty accounts. In 2023, WazirX was hacked for $235 million. Users lost everything. And in February 2024, DMM Bitcoin lost $305 million before users were even notified. The pattern is clear: centralized exchange token risks aren’t about market crashes. They’re about trust failures. You’re handing over your assets to a company that’s not a bank, not insured by the government, and not legally required to keep your money safe.Security Isn’t What You Think

Exchanges say they’re secure. They use “cold storage.” They have “multi-sig wallets.” But the numbers tell a different story. According to CipherTrace’s 2023 Security Report, only 38% of the top 20 exchanges use true multi-signature wallets - the kind that require multiple approvals to move funds. The rest rely on single keys, which are one phishing attack or insider breach away from disaster. Cold storage? The average exchange keeps just 63% of assets offline. Experts recommend 95% or higher. That means nearly 4 out of 10 coins are sitting on hot servers - always connected to the internet, always vulnerable. And when a breach happens, how fast do they respond? CoinGecko found the average exchange takes 47 days to fix a known security flaw. That’s over a month of exposure. In the crypto world, that’s an eternity.The Insurance Lie

You’ve probably seen ads saying “Your funds are insured.” But here’s the catch: that insurance rarely covers you. In the U.S., crypto exchanges are not FDIC-insured. That’s for bank deposits. Crypto insurance is private, limited, and often excludes losses from hacks, fraud, or regulatory actions. A Harris Poll in February 2024 found 87% of users didn’t even know their crypto wasn’t protected by government insurance. Most exchange insurance policies cap payouts at 15-25% of total losses - and only if you’re lucky enough to be in a jurisdiction with strong regulations. Take the WazirX hack. The exchange had insurance, but it only covered a fraction of the $235 million stolen. Users got nothing. On Reddit, one victim wrote: “I lost $18,500. Customer support took 17 days to reply. No compensation. No explanation.”Withdrawal Freezes Are Common

You think you can withdraw anytime? Think again. During the May 2021 market crash, Coinbase temporarily blocked withdrawals for 1.2 million users. Why? Because they couldn’t keep up with the volume. It wasn’t a hack. It was a liquidity crunch. In 2023, over 1,200 Trustpilot complaints mentioned “withdrawal delay.” Some users waited weeks. Others got locked out entirely. And when you can’t move your funds, you’re not an investor - you’re a hostage. Even big exchanges like Binance have paused withdrawals during market stress. Why? Because they don’t have enough liquid assets to cover all withdrawals at once. They’re not banks. They’re trading platforms with fractional reserves.

Regulation Isn’t a Safety Net

People assume if an exchange is “regulated,” it’s safe. But regulation doesn’t mean protection - it just means they follow paperwork rules. The EU’s MiCA law, effective June 2024, forces exchanges to hold minimum capital and monitor transactions. But it doesn’t guarantee your coins won’t disappear. The SEC filed 57 enforcement actions against exchanges in 2023 - up from 29 in 2022. That’s not oversight. That’s a crackdown on companies breaking rules. And when regulation cracks down, exchanges flee. Binance pulled out of Canada in 2023. Thodex collapsed in Turkey after regulators moved in. In both cases, users lost everything. Regulation doesn’t stop fraud. It just changes who gets punished - and who gets left holding the bag.What About the Big Names?

Coinbase and Kraken are often called “the safest.” But even they aren’t bulletproof. OSL Academy’s 2024 security rating gave Coinbase a 7.1/10. Kraken got 7.3. Binance? 5.2/10. That’s barely above average. And remember - these are ratings based on what’s publicly known. What’s hidden? No one knows. Coinbase now offers multi-party computation (MPC) wallets - a more secure tech that splits keys across multiple devices. But it’s only available for new users. Old accounts still use the old, riskier system. Kraken launched insurance covering up to $1 million per user in April 2024. Sounds great - until you realize that’s only a fraction of what most serious traders hold. And insurance payouts are slow, bureaucratic, and often denied.The User Error Problem

Even if an exchange is secure, you’re still the weakest link. Only 12% of users connect their exchange accounts to hardware wallets. Only 41% use authenticator apps for two-factor authentication - the rest rely on SMS, which can be hacked with a simple SIM swap. MetaMask’s 2023 analysis found only 22% of users properly verify transaction details before signing. That means most people blindly approve transfers - even if the address looks suspicious. And how many users actually read the Terms of Service? Coinbase’s 2023 update says clearly: “Funds held in your Account are not your property until withdrawn.” That’s not a loophole. That’s the legal reality.

What Should You Do?

If you’re using a centralized exchange, treat it like a temporary holding pen - not a vault.- Only keep what you’re actively trading on the exchange.

- Withdraw the rest to a hardware wallet like Ledger or Trezor.

- Enable two-factor authentication using an authenticator app (Google Authenticator, Authy), not SMS.

- Set up withdrawal address whitelisting - so you can’t accidentally send funds to a scammer.

- Check your exchange’s security page. Do they publish a detailed whitepaper? If not, be extra cautious.

Adam Fularz

January 26, 2026 AT 08:20lol so basically every exchange is a scam waiting to happen? cool i guess. i just leave my shit on binance and hope for the best. if it goes poof, at least i got some fun trades in before it did. 🤷♂️

Barbara Rousseau-Osborn

January 26, 2026 AT 19:35YOU IDIOTS STILL USE EXCHANGES?!?!?!? 😭 This isn't 2017. If you don't control your keys, you don't own shit. I've seen people lose life savings because they 'trusted' Coinbase. You think they care? They'll refund your $100 gas fee before they touch your $100k portfolio. STOP BEING NAIVE. 🚨

David Zinger

January 28, 2026 AT 15:57Interesting how you ignore that the US government is actively pushing exchanges to become more transparent… Canada’s regulators actually forced OSL to publish their reserve proofs. You want safety? Move to a jurisdiction that doesn’t let exchanges run wild. But no, you’d rather complain on Reddit while holding your coins on Binance. Classic.

Mathew Finch

January 29, 2026 AT 01:38Let’s be honest - most people who use exchanges are retail sheep who can’t be bothered to learn how to use a wallet. The fact that you need a 2000-word essay to explain why you shouldn’t leave your crypto on an exchange proves how broken this ecosystem is. I don’t trust institutions. I don’t trust exchanges. I don’t trust your ‘security ratings.’ I trust my Ledger. Everything else is theater.

Jessica Boling

January 30, 2026 AT 21:04so like… i just use kraken bc they have a cute logo and i think their customer service might be less terrible than binance’s? 🤔 also i’m pretty sure my grandma has more crypto than i do and she still thinks ‘bitcoin’ is a type of coffee. so… yeah. i’m not proud. but i’m not dumb either. just lazy.

Jennifer Duke

January 31, 2026 AT 13:24It’s funny how people act like self-custody is some kind of revolutionary act. It’s literally just basic financial hygiene. You wouldn’t leave your house keys under the mat, so why leave your private keys on an exchange? I’ve been using a Trezor since 2019. My portfolio grew 12x. My stress levels? Down 90%. It’s not hard - it’s just not convenient. And convenience is the enemy of security.

Abdulahi Oluwasegun Fagbayi

February 1, 2026 AT 18:23Back home in Nigeria, we learned long ago that if you put your money in someone else’s hand, you better trust them with your life. Crypto is no different. The real revolution isn’t the blockchain - it’s the idea that you don’t need permission to own something. If you still let exchanges hold your coins, you’re still living in the old world. The future doesn’t ask for your ID. It just asks for your keys.