Cross-Chain Bridge Technology Explained: How Tokens Move Between Blockchains

Jun, 15 2025

Jun, 15 2025

Bridge Security Assessment Tool

This tool helps you assess the security risk of using a cross-chain bridge based on key factors from the article.

Recommendations

What Is a Cross-Chain Bridge?

A cross-chain bridge is a tool that lets you move crypto assets from one blockchain to another. Think of it like a ferry between two islands that don’t have a direct road. Bitcoin lives on its own network. Ethereum has its own rules. Solana, Polygon, Avalanche - each runs independently. Without a bridge, you can’t send ETH to a wallet on Solana or use your BTC in a DeFi app on Polygon. Bridges fix that. They let you lock your asset on one chain and get a version of it on another - so you can trade, lend, or stake across networks.

How Do Cross-Chain Bridges Work?

There are three main ways bridges move assets. The most common is lock and mint. You send your ETH to a smart contract on Ethereum. That contract locks it up. Then, a separate contract on, say, Avalanche, mints an equivalent amount of “wrapped ETH” (wETH). You now have wETH on Avalanche. To get your original ETH back, you burn the wETH, and the original ETH is unlocked. It’s like trading a voucher for the real thing.

Another method is lock and unlock. Instead of minting new tokens, the bridge uses a pool of native assets on the destination chain. You lock your BTC on Bitcoin. The bridge then unlocks an equal amount of BTC from its reserve on, say, Polygon. No wrapping. You get real BTC, not a copy. This is how THORChain works - and it’s more trustless, but it needs big liquidity pools to function.

The third way is burn and mint. You burn your tokens on the source chain - permanently. Then, the bridge mints new tokens on the destination chain. This avoids keeping locked funds, but if something goes wrong, you can’t undo it. One wrong signature, and your coins vanish forever.

Wrapped Assets: The Most Popular, But Risky

The biggest example of a wrapped asset is wBTC. Over 185,000 Bitcoin are locked up and represented as ERC-20 tokens on Ethereum. That’s nearly 1% of all Bitcoin in circulation. It lets Bitcoin holders access DeFi apps like Uniswap or Aave. But here’s the catch: wBTC isn’t Bitcoin. It’s a token backed by Bitcoin. And that backing depends on a group of custodians - companies like BitGo, Circle, and Coinbase - who hold the real BTC and sign off on minting wBTC. If even one of them gets hacked or colludes, the whole system is at risk.

This isn’t theoretical. In 2022, the Harmony Horizon Bridge was hacked. Attackers tricked the system into burning $100 million in assets without minting anything in return. The bridge had no way to reverse it. The coins were gone. That’s the danger of wrapped assets: you’re trusting someone else to hold your money.

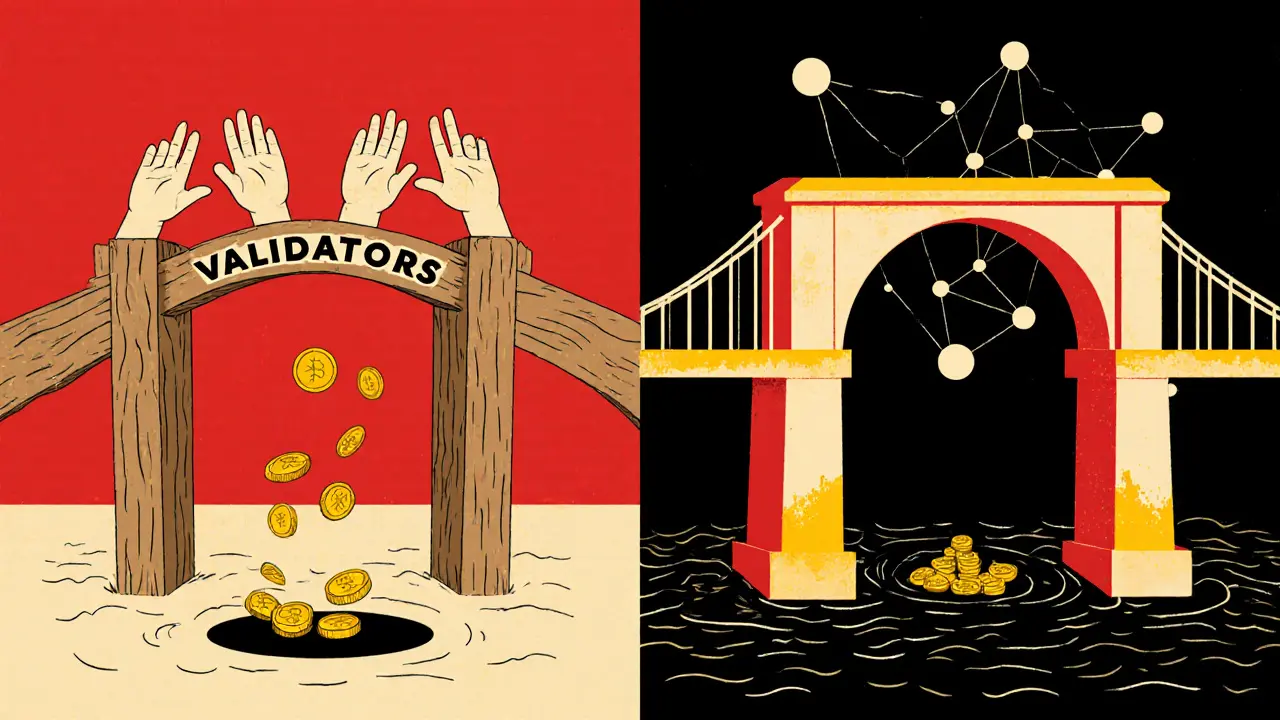

Trusted vs. Trust-Minimized Bridges

Bridges fall into two camps: trusted and trust-minimized.

Trusted bridges use a small group of validators - often 10 to 100 - who sign off on transfers. Examples: Polygon PoS Bridge, Multichain. They’re fast and cheap. Polygon’s bridge handles over 2.5 million transactions a day. But if those validators are all controlled by one company - like Polygon Labs - then you’re not really decentralized. In 2022, Nomad’s bridge collapsed because a single misconfigured signature allowed users to claim unlimited funds. The bridge had 9 validators. One was compromised. $190 million vanished.

Trust-minimized bridges try to reduce reliance on any single group. THORChain uses a decentralized network of nodes that monitor both chains and only act when consensus is reached. Chainlink’s CCIP uses a network of 50+ independent oracle nodes to verify state across chains. These are slower and cost more, but they’re harder to hack. In 2023, CCIP processed over 1.2 million testnet transactions with zero failures.

Why Do Bridges Get Hacked So Often?

In 2022, bridges were behind 69% of all major crypto hacks - over $2.4 billion stolen. Why? Because they’re complex, fragile, and underfunded.

Most bridges rely on a small set of signers. If those keys are stolen, the whole thing falls. Halborn Security found that 67% of bridges use fewer than 15 validators. That’s not redundancy - that’s a single point of failure. Even worse, many bridges spend less than 12% of their revenue on security. Experts say they should be spending 25-30%.

Another issue: bridges don’t inherit the security of the chains they connect. Ethereum’s security doesn’t protect a bridge to Solana. The bridge becomes its own attack surface. And most bridge code is rushed. Developers are under pressure to launch fast. Documentation is patchy. One developer told Consensys the hardest part of building a bridge is syncing state across chains - 63% of developers called it “extremely difficult.”

Who Uses Bridges - And Why?

Most bridge users are DeFi traders. If you want to earn 15% APY on a new lending pool on Arbitrum, but your crypto is stuck on Ethereum, you use a bridge. 42% of Ethereum users have bridged at least once. Among active DeFi traders, that number jumps to 78%.

People use bridges because they’re fast. Transfers that used to take hours now take minutes. Gas fees are lower on Layer 2s like Polygon, so users bridge over to save money. Reddit users praise the convenience - “I can access every DeFi app now.” But negative feedback is loud too: 17% report stuck transactions, 9% say fees are too high, and 6% lost assets permanently.

On Trustpilot, bridges average a 3.8/5 rating. Positive reviews mention “easy interface” and “fast transfers.” Negative ones complain about “unresponsive support” and “complex troubleshooting.” If your transfer gets stuck, you’re often on your own.

What’s Next for Cross-Chain Bridges?

The future is in universal messaging. Projects like LayerZero and Chainlink’s CCIP aren’t just moving tokens - they’re moving data. Imagine triggering a loan on Aave from a smart contract on Solana. Or using NFTs from Ethereum in a game on Avalanche. That’s the next level.

Polkadot’s XCMP protocol already does this between its own chains - with sub-second finality and zero trust assumptions. Chainlink’s CCIP is now live on mainnet, using a decentralized oracle network to verify asset ownership across chains without relying on custodians.

But the market is consolidating. In 2023, the top five bridges - Multichain, Polygon PoS, Avalanche Bridge, THORChain, and Synapse - handled 78% of all cross-chain volume. Messari predicts 60% of current bridges will vanish by 2026. Why? Because security failures will kill the weak ones. Only bridges built into the core of a chain - like Polygon’s or Arbitrum’s native bridges - will survive long-term.

Should You Use a Cross-Chain Bridge?

If you’re moving small amounts for a quick trade - yes. Use Polygon PoS or Avalanche Bridge. They’re fast and reliable for everyday use.

If you’re moving large sums - be careful. Use bridges with strong security audits and decentralized validators. THORChain and CCIP are safer bets. Avoid bridges with fewer than 15 validators. Check if they’ve been audited by reputable firms like CertiK or Halborn.

Never bridge to a new, unknown protocol. If you don’t see a public audit, a large TVL (total value locked), or active community support - skip it. And always test with a small amount first.

Remember: bridges are not magic. They’re software. And software breaks. The more you rely on them, the more you need to understand how they work - and where the risks lie.

Joel Christian

November 27, 2025 AT 07:44jeff aza

November 27, 2025 AT 23:16George Kakosouris

November 29, 2025 AT 15:59Tony spart

November 29, 2025 AT 23:58Mark Adelmann

November 30, 2025 AT 17:14imoleayo adebiyi

December 1, 2025 AT 21:19Angel RYAN

December 2, 2025 AT 17:24