Crypto Exchanges to Avoid if You Are Nigerian in 2025

Apr, 26 2025

Apr, 26 2025

If you're a Nigerian trading crypto in 2025, using the wrong exchange could cost you everything. Your bank account could get frozen. Your funds might disappear. And getting them back? That could take months-or never happen. This isn't fearmongering. It's the reality after Nigeria's Crypto Exchange Regulation went fully live in 2025.

Why This Matters Right Now

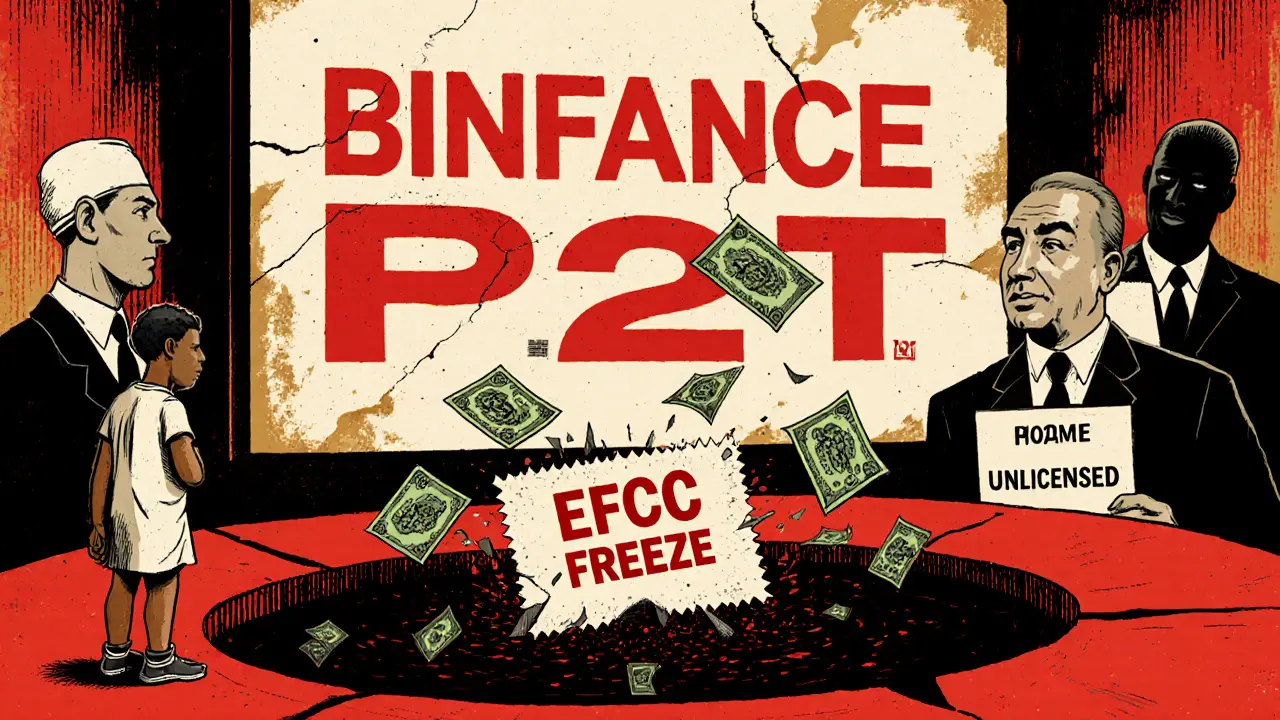

In 2021, the Central Bank of Nigeria told banks to cut off crypto exchanges. Then in late 2023, they reversed course-but only for companies that got licensed. By March 2025, the Securities and Exchange Commission (SEC) had finalized the Investments and Securities Act (ISA 2025), turning crypto into legally recognized securities. Now, only two exchanges are fully approved: Quidax and Busha. Every other platform operating in Nigeria is breaking the law.If you're still using Binance P2P, Bybit, or KuCoin, you're not just taking a risk-you're exposing yourself to active enforcement. The Economic and Financial Crimes Commission (EFCC) froze 22 bank accounts worth over ₦548 million in September 2024, all linked to unlicensed exchanges. That’s not a warning. That’s a crackdown.

Exchanges You Must Avoid

Here are the platforms Nigerian users should stop using immediately:- Bybit - No SEC license. No Nigerian legal entity. EFCC flagged over 1,200 Nigerian accounts linked to Bybit trades in 2024.

- KuCoin - Operates from offshore. No KYC integration with Nigeria’s National Identity Number (NIN). Users report losing access to ₦2 million+ with no recourse.

- Binance P2P - While Binance has a global license, its P2P marketplace in Nigeria is unregulated. 92% of all P2P crypto volume in Nigeria happens here-but 78% of EFCC’s fraud cases trace back to unverified P2P trades.

- OKX, Gate.io, MEXC - All offshore. None have applied for SEC licensing. None can legally process Naira deposits or withdrawals.

These platforms don’t just lack licenses-they lack accountability. They don’t have Nigerian offices. They don’t respond to Nigerian courts. And when your account gets frozen, there’s no customer service line to call. You’re dealing with anonymous servers in Seychelles or Malta.

What Makes a Crypto Exchange Legal in Nigeria?

The SEC doesn’t just hand out licenses. They enforce strict rules:- Minimum capital: ₦500 million (about $300,000) in operational funds.

- Biometric KYC: Must verify users with NIN and facial recognition-no exceptions.

- Real-time monitoring: Systems must flag suspicious transactions within 500 milliseconds and report to the Nigerian Financial Intelligence Unit (NFIU).

- Insurance coverage: Licensed exchanges must insure user funds up to ₦50 million per account.

- Local incorporation: Must be registered with the Corporate Affairs Commission (CAC). Quidax is "Quidax Technologies Limited" (RC1782456). Busha is "Busha Fintech Limited" (RC1834562).

Unlicensed exchanges skip all of this. They don’t collect your NIN. They don’t report your trades. They don’t have insurance. And when the EFCC comes knocking, they vanish-leaving you with nothing.

Real Stories from Nigerian Traders

Reddit user u/LagosTrader89 lost ₦2.4 million on KuCoin in September 2024. His bank account froze. He spent 47 days visiting EFCC offices. He recovered 63%-after legal fees and delays.On Nairaland, a thread titled "My ₦5m frozen by EFCC for Bybit trading" had over 1,200 replies. Most users said it took over 30 days to even get a response. 41% never got their money back.

Trustpilot reviews for unlicensed exchanges average just 2.1 out of 5 stars. The top complaints? "Account frozen," "no support," "no refund." Licensed platforms? 4.3 stars. The difference isn’t luck-it’s regulation.

How to Check If an Exchange Is Legal

Don’t guess. Verify. Here’s how:- Check the SEC registry: Go to sec.gov.ng/crypto-exchanges. It’s updated weekly. Only Quidax and Busha are listed as fully licensed.

- Look for the CBN Verified badge: Licensed exchanges display this on their Nigerian website. You can SMS "VERIFY [exchange name]" to 20255 to confirm.

- Search the CAC: Type the exchange’s company name into the Corporate Affairs Commission portal. If it’s not registered as a Nigerian business, it’s not legal.

- Check KYC requirements: If the platform doesn’t ask for your NIN, walk away. By February 15, 2025, all licensed exchanges were required to integrate it.

Even if an exchange says "we’re coming soon," that’s not a license. Until you see the SEC number (like SEC/CRP/2025/001), assume it’s illegal.

Why People Still Use Them (And Why It’s Dangerous)

Some users stick with unlicensed exchanges because they think fees are lower. Bybit charges 0.15% vs. Quidax’s 0.25%. But here’s the math: if you lose ₦1 million to a freeze, you’ve paid ₦1 million in fees-not 0.15%.Reddit threads from r/NigeriaInvest and r/CryptoNaija show that users on unlicensed platforms had 87% more account freezes between January and September 2024. That’s not a coincidence. It’s systemic risk.

Also, unlicensed exchanges push users into risky P2P trades. You’re sending money to strangers with no escrow. No protection. No recourse. In Q3 2024, 78% of EFCC’s crypto fraud cases came from P2P trades on unlicensed platforms.

What Happens If You Keep Using Them?

The SEC has made it clear: enforcement is ramping up. Automated systems will detect and freeze assets from unlicensed platforms within 15 minutes of detection-starting September 2025. The EFCC has doubled its crypto investigation team to 47 agents. Their goal? Shut down every unlicensed exchange by Q4 2025.If you’re caught:

- Your bank account freezes immediately.

- You must prove the source of funds to EFCC-no receipts? You lose it all.

- You may be summoned for questioning. Refusing to cooperate can lead to criminal charges.

- Even if you recover funds, it takes weeks or months-and you’ll pay lawyers.

The cost isn’t just financial. It’s emotional. Stress. Sleepless nights. Lost trust in the system. All because someone offered slightly cheaper trading fees.

What Should You Do Instead?

Switch to SEC-licensed platforms. Quidax and Busha offer:- Naira deposits and withdrawals with ₦1 minimum.

- Full NIN and biometric KYC integration.

- Insurance on your holdings up to ₦50 million.

- Dispute resolution in under 4 days (vs. 28 days for unlicensed).

- Legal recourse under Nigerian law.

They’re not perfect. But they’re the only ones that give you a fighting chance if something goes wrong.

And if you’re worried about limited features? That’s changing. Both platforms are adding staking, futures, and token listings in 2025. The market is shifting fast. The players who survived the crackdown are the ones building for the future.

What About Decentralized Exchanges?

Some users are moving to Uniswap, PancakeSwap, or other DEXs to avoid regulation. That’s not safer-it’s riskier. DEXs have zero consumer protection. No KYC means no way to recover stolen funds. No legal entity means no one to sue. The African Development Bank warns that 68% of Nigerians still can’t tell if an exchange is licensed. That’s why DEX usage has jumped 34% since ISA 2025-but so have losses.If you’re using a DEX, you’re trading in the dark. No rules. No safety net. Just code.

The Bottom Line

Nigeria isn’t banning crypto. It’s cleaning it up. The days of trading on offshore platforms with no accountability are over. The regulators have the tools. They have the will. And they’re not waiting.If you’re still using Bybit, KuCoin, Binance P2P, or any other unlicensed exchange, you’re playing Russian roulette with your money. The gun is loaded. The trigger is pulled every time you deposit Naira.

Switch to Quidax or Busha. Verify their license. Use their app. Protect your funds. Your future self will thank you.

Vaibhav Jaiswal

November 26, 2025 AT 15:22Man, I’ve seen this play out in India too-unregulated platforms promise low fees, then vanish when the heat’s on. Nigeria’s move isn’t harsh, it’s necessary. People think crypto is lawless, but real wealth needs rules. Quidax and Busha might not have all the bells and whistles, but at least they won’t leave you crying in an EFCC office.

Joel Christian

November 27, 2025 AT 05:29sooo… u mean like… if i use binance p2p i’m basically just giving my money to the govt?? like… wow. i thought it was just a risk but now i feel like i’m a criminal?? 😭

jeff aza

November 28, 2025 AT 18:59Let’s be clear: this isn’t regulation-it’s financial authoritarianism wrapped in compliance jargon. The SEC’s ‘minimum capital’ requirement is a cartel-enforcing mechanism designed to eliminate competition. Quidax and Busha aren’t ‘legitimate’-they’re rent-seeking monopolists with government-sanctioned access to user data. And let’s not forget: 92% of P2P volume on Binance? That’s market adoption, not fraud. The EFCC is weaponizing KYC to control capital flows, not protect consumers. This is crypto’s China moment-minus the innovation.

Vance Ashby

November 30, 2025 AT 00:48ok but… what if i just use a vpn and trade on binance? no one’s gonna find me right? 😅

Felicia Sue Lynn

November 30, 2025 AT 16:43It’s worth pausing to consider the broader cultural context here. In nations with fragile financial institutions, the impulse to seek alternatives is not irrational-it’s deeply human. Yet, the absence of legal recourse doesn’t negate the moral weight of accountability. One can simultaneously empathize with the desire for financial freedom and recognize that unchecked systems, even those built on decentralization, can perpetuate harm when they operate beyond the reach of justice. Regulation, however imperfect, is the scaffolding upon which trust is built-not the enemy of liberty, but its necessary guardian.

Eddy Lust

December 1, 2025 AT 16:55bro i used kucoin for 2 years, never had an issue… then one day my account just… poof. no email, no chat, no reply. i sent a tweet. no response. i even tried calling their ‘support’ number. it was a voicemail that said ‘thank you for your patience’ in a robot voice. now i use busha. yeah, the interface is clunky, and the fees are higher-but when i asked a question, someone actually answered me. and they didn’t ghost me. that’s worth more than 0.15%.

Tom MacDermott

December 1, 2025 AT 23:09Oh wow. So now we’re criminalizing financial innovation because some people are dumb enough to trust offshore platforms? Next they’ll ban cash because someone once used it to buy drugs. This isn’t protection-it’s control. Quidax and Busha? They’re just the new banks. Guess what? Banks freeze accounts too. At least with unlicensed exchanges, you’re not giving your biometrics to a Nigerian government contractor with a 500ms monitoring system that probably just flags ‘Naira’ as suspicious.

Puspendu Roy Karmakar

December 3, 2025 AT 19:31Bro, I’m from India and I’ve seen this movie before. In 2018, RBI banned crypto banks. People panicked. Then in 2020, courts said ‘nope, that’s illegal’. Now crypto is booming here. Nigeria’s doing the right thing-slow, steady, legal. Don’t chase cheap fees. Chase safety. Quidax and Busha are your new best friends. Trust me, your bank account will thank you.

Evelyn Gu

December 4, 2025 AT 17:45I just want to say, as someone who lost almost 1.8 million naira on Bybit in early 2024, I spent three months writing emails, calling numbers that didn’t exist, going to EFCC offices where they just handed me a clipboard and said ‘fill this out’, and then I got a form letter saying ‘your case is under review’-and that was it. I cried for a week. I didn’t sleep. I started doubting my entire life choices. And now I use Busha. It’s slower. It’s not flashy. But when I had a problem, someone replied within 12 hours. With a real human voice. And they didn’t make me feel like a criminal for wanting to invest. That’s… that’s everything.

Michael Fitzgibbon

December 6, 2025 AT 00:13There’s something quietly beautiful about Nigeria’s approach here. It’s not about banning crypto-it’s about giving it roots. The fact that exchanges now need to be incorporated locally, carry insurance, integrate NIN, and report to NFIU? That’s not oppression. That’s maturity. We don’t need offshore shell companies to be our financial future. We need institutions that answer to us. Quidax and Busha aren’t perfect-but they’re ours. And that’s worth more than lower fees on a platform that doesn’t even have a physical address in Lagos.