HiveSwap (HIVP) Token Review: What You Need to Know Before Trading

Dec, 17 2025

Dec, 17 2025

People keep asking if HiveSwap is a crypto exchange. It’s not. HiveSwap (HIVP) is a token - a digital asset you can buy and trade, but it doesn’t run a platform like Binance or Uniswap. If you’re looking to trade HiveSwap, you’re not signing up for an exchange. You’re buying a low-cap coin on a decentralized exchange. That’s a big difference.

What HiveSwap Actually Is

HiveSwap (HIVP) is a cryptocurrency token, not a platform. It’s listed on decentralized exchanges like Gate.io and a few others, but it doesn’t offer trading pairs, liquidity pools, or swap interfaces of its own. Think of it like buying a rare baseball card - you don’t own the stadium where it’s sold, you just own the card.

As of December 2025, HiveSwap trades around $0.0000955 on Gate.io. That’s up from $0.000028 in May, but don’t get fooled by the rise. Its 7-day range has swung from $0.000042 to $0.000053. One day it’s up 5%, the next it’s down 8%. That’s not volatility - that’s chaos.

Its market cap sits around #1916 out of thousands of tokens. That means it’s tiny. Most institutional investors ignore tokens this small. You won’t find HiveSwap on Coinbase or Kraken. You won’t see it in any major DeFi dashboard. It’s a niche play, traded mostly by people chasing quick flips.

Price Predictions? Don’t Trust Them

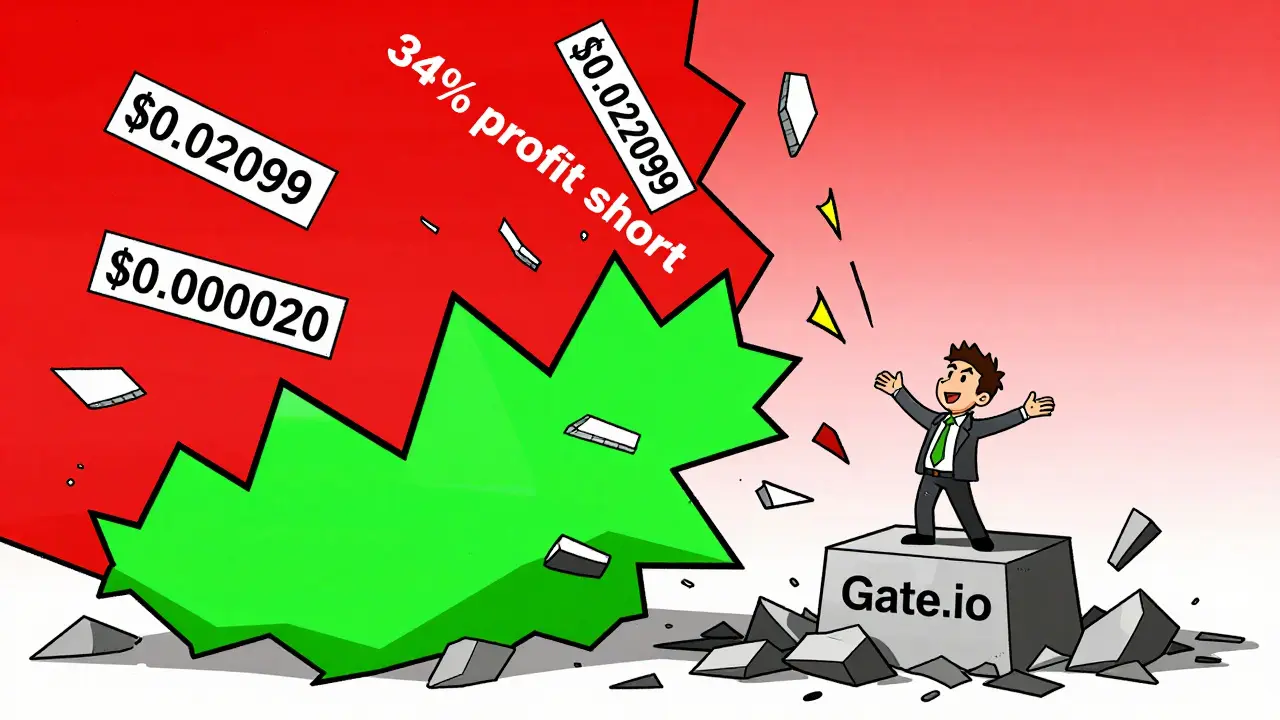

Some sites say HiveSwap could hit $0.02099 by 2026. That’s a 21,900% jump from today’s price. Sounds insane? It is. Other forecasts, like CoinCodex’s, say it’ll drop to $0.000020 - a 79% loss. One prediction says you could make 34% profit shorting it. Another says you’ll lose money holding it.

Why the wild differences? Because no one knows. There’s no team, no roadmap, no whitepaper, no utility. No one’s building anything on HiveSwap. No dApps, no staking, no governance. It’s just a ticker symbol with price charts.

Even the technical indicators are mixed. The 50-day moving average is below the 200-day - a classic bearish sign. But the RSI is at 49.9, meaning it’s not overbought or oversold. It’s stuck in neutral. No momentum. No trend. Just noise.

How to Buy HiveSwap (If You Really Want To)

If you still want to buy HIVP, here’s how it works:

- Sign up on a crypto exchange that lists it - Gate.io is the most common.

- Deposit USDT, BTC, or ETH into your account.

- Go to the trading pair: HIVP/USDT or HIVP/ETH.

- Place your order. That’s it.

You don’t need a DeFi wallet like MetaMask to buy it on Gate.io. But if you want to move it off the exchange, you’ll need to send it to a wallet that supports BEP-20 or ERC-20 tokens. There’s no official HiveSwap wallet. No app. No website with instructions.

Gas fees? They’re standard. Around $1-$3 to transfer. Confirmation time? 10-30 seconds. But if you mess up the address? Too bad. No customer support. No refunds. That’s crypto.

No Community. No Trust.

Here’s the real red flag: there’s no community. No Reddit thread with 10,000 comments. No Twitter account with 50,000 followers. No Telegram group with active devs answering questions. No YouTube videos explaining what HiveSwap does.

Compare that to Uniswap. Uniswap has forums, GitHub commits, developer grants, and weekly updates. HiveSwap? Nothing. Not even a Twitter handle that’s been updated since 2023.

When a token has no community, it means no one cares enough to defend it. No one’s building tools for it. No one’s writing tutorials. No one’s even trying to explain why it exists. That’s not a project. That’s a gamble.

Is HiveSwap a Scam?

Not necessarily. But it’s not a legitimate project either. It doesn’t meet the basic criteria of a crypto asset with long-term value. No team. No tech. No utility. No transparency.

It looks like a pump-and-dump setup. The kind that rises slowly for months, then explodes on a random tweet or influencer post - then crashes 80% in a week. That’s the pattern with tokens like this. You see it over and over: low cap, low volume, no news, sudden spike, then silence.

There’s no evidence HiveSwap is fraudulent. But there’s also no evidence it’s anything more than a speculative symbol. If you buy it, you’re betting on luck, not logic.

Who Should Avoid HiveSwap?

If you’re new to crypto - avoid it. If you’re trying to build a portfolio - avoid it. If you’re investing for the long term - avoid it.

This isn’t a coin for people who want to hold. It’s a coin for people who want to flip. And even then, it’s risky. The liquidity is thin. One big sell order could drop the price 30% in minutes. There’s no market maker. No depth. Just a few hundred traders.

Compare HiveSwap to a token like UNI or CAKE. Those have billions in locked value. They’re used every day. HiveSwap? It’s a ghost town.

Final Verdict

HiveSwap (HIVP) is not a crypto exchange. It’s a low-cap token with no clear purpose, no community, and no reliable data. Its price swings wildly. Its future is pure speculation. Its only value is the hope that someone else will pay more for it tomorrow.

If you’re looking for a reliable crypto exchange, look at Uniswap, PancakeSwap, or even centralized ones like Kraken. If you’re looking for a token with real potential, find one with a team, a roadmap, and users who actually use it.

HiveSwap? It’s a gamble with no odds in your favor.

Shruti Sinha

December 18, 2025 AT 19:49HiveSwap is just a ticker with no substance. No team, no whitepaper, no roadmap - it’s not even a gamble, it’s a lottery ticket you bought without knowing the numbers.

And yet people act like it’s the next Bitcoin. Sad.

Don’t waste your time.

Sean Kerr

December 20, 2025 AT 15:21OMG YES THIS!!

I saw this token pop up on my feed and thought ‘is this real??’

Then I checked the contract… no owner renounced, no liquidity locked, no devs on Twitter since 2023 😭

Bro if you’re buying this you’re basically throwing cash into a void and hoping it screams back at you

PLEASE DON’T DO IT 😭🙏

There are 1000 better low-cap gems out there with actual teams!!

Greg Knapp

December 22, 2025 AT 10:34You guys are overthinking this

It’s a meme coin now get over it

People aren’t buying it for utility they’re buying it because it’s cheap and someone might pump it tomorrow

That’s how this works

You think Bitcoin was built on utility in 2010?

No it was built on weird internet guys with too much time

Same thing here

Just don’t put your rent money in it

But if you wanna play with $50 go ahead

Life’s too short to be this serious about crypto

Also I bought 10k HIVP last week and I’m not selling until it hits 0.0005

Watch me

LOL

Terrance Alan

December 24, 2025 AT 03:04It’s not just HiveSwap it’s the entire culture of crypto right now

People treat tokens like trading cards with no regard for fundamentals

There’s zero accountability

No one asks who’s behind it

No one checks if the team even exists

And when it crashes they blame the market not themselves

It’s pathetic

You don’t need to be a genius to see this is a house of cards

But you do need to have some self-respect to walk away

And most people don’t

They’re addicted to the dopamine hit of a 5% pump

They’d rather gamble than learn

And that’s why crypto keeps eating its own

And that’s why the next generation will look back and call this era the great crypto delusion

Not because it was fake

But because people pretended it was real when it was never meant to be

Cheyenne Cotter

December 25, 2025 AT 22:09Let’s be honest - HiveSwap doesn’t even have a proper website with a contact page, let alone a team bio or technical documentation. The token contract on BSCScan has no metadata, no verification notes, and the deployer wallet has been inactive since 2023. There are no GitHub commits, no Discord server with more than 200 members, and no credible analytics site even tracks its on-chain activity beyond basic price feeds. Even the exchanges listing it - Gate.io, MEXC, and one or two obscure ones - don’t provide any educational content or risk warnings. Meanwhile, the token’s circulating supply is nearly 100% of the max supply, meaning there’s no treasury, no burn mechanism, no staking, no vesting schedule - nothing to prevent the original holders from dumping it all at once. The fact that the 7-day volatility range is narrower than the 24-hour swings suggests the market is artificially constrained by a handful of wallets, and any sudden volume spike is almost certainly a coordinated pump. The RSI being neutral is meaningless when there’s no volume trend, no order book depth, and no institutional interest. Even the gas fees on transfers are irrelevant because if you send it to the wrong address, there’s no recovery protocol, no customer service, no refund policy - just a silent blockchain that doesn’t care. And the worst part? There’s no community outrage when it drops. No one’s posting memes, no one’s rallying, no one’s even arguing about it anymore - just silence. That’s not a dead project. That’s a project that never existed in the first place, and someone just slapped a ticker on it and waited for the next sucker to show up. If you’re reading this and thinking ‘maybe I’ll buy a little’ - you’re not wrong to be curious. But you’re dangerously naive if you think curiosity equals opportunity. This isn’t a coin. It’s a ghost. And ghosts don’t appreciate being haunted.