Iranian Energy Subsidies for Crypto Mining: How Cheap Power Fuels a National Crisis

Dec, 6 2025

Dec, 6 2025

Bitcoin Mining Cost Calculator

Calculate Your Bitcoin Mining Cost

Estimated Bitcoin Mining Cost

Based on article dataEnter your electricity cost to see results

Iran vs. Other Mining Locations

Iran (Licensed)

Cost per Bitcoin: $1,300

Electricity Cost: $0.01–$0.08/kWh

Grid Impact: Very Low

Government Support: Indirect (sanctions evasion)

United States

Cost per Bitcoin: $8,000–$12,000

Electricity Cost: $0.07–$0.15/kWh

Grid Impact: High

Government Support: Regulated, taxed

Italy

Cost per Bitcoin: $306,000

Electricity Cost: $0.25–$0.40/kWh

Grid Impact: High

Government Support: Banned

Energy Impact Note: One Bitcoin requires over 300 megawatt-hours of electricity. This is enough to power about 35,000 Iranian households for a full day. Source: Article Data

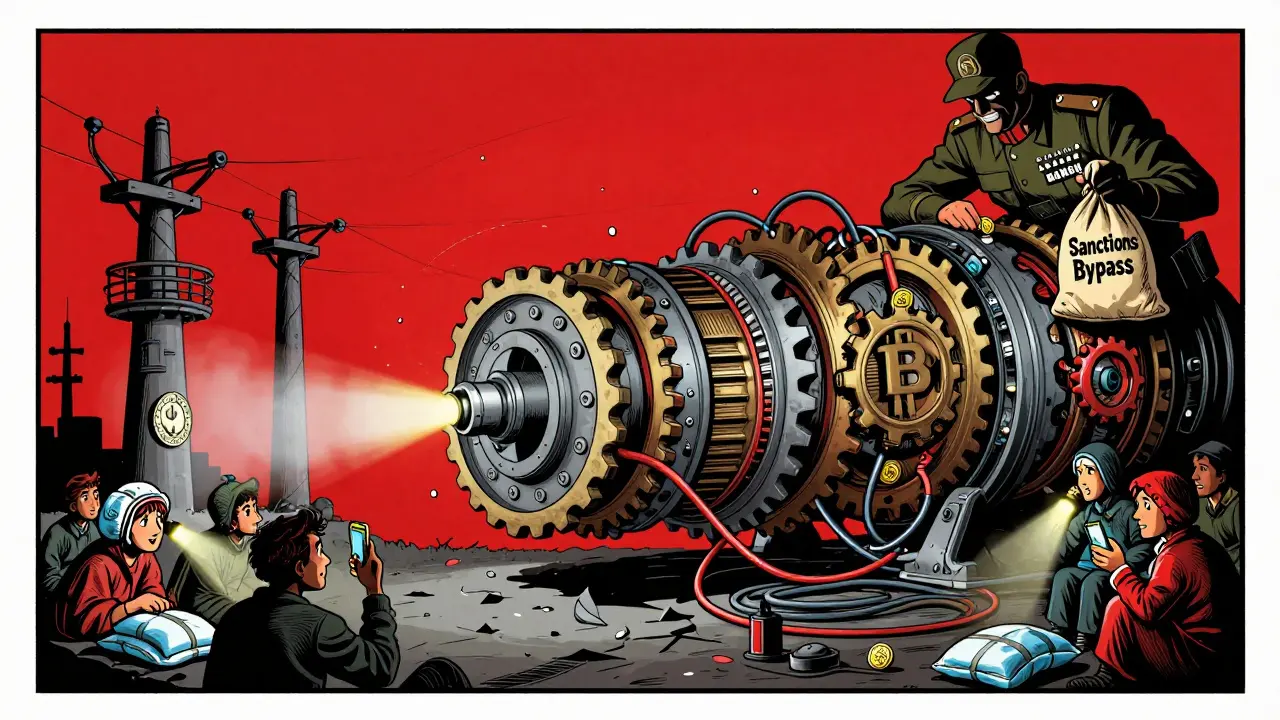

Iran produces Bitcoin for as little as $1,300 per coin. Meanwhile, the average Iranian household faces up to 12 hours of blackouts every day. This isn’t a coincidence-it’s policy.

Why Iran Lets Miners Use Cheap Electricity

Iran’s government doesn’t just allow cryptocurrency mining-it actively encourages it. Electricity for licensed miners costs between $0.01 and $0.07 per kilowatt-hour. That’s less than one-tenth of what miners pay in the U.S., and over 200 times cheaper than in Italy, where Bitcoin mining costs $306,000 per coin. The reason? Iran uses crypto mining as a sanctions-busting tool. By selling mined Bitcoin abroad, the government earns hard currency it can’t get through traditional banking. The Central Bank of Iran bans citizens from using Bitcoin for payments, but it lets licensed miners export their coins to pay for sanctioned imports like medicine, food, and industrial parts. In 2024, around $700 million in cryptocurrency was used this way. That’s not a side effect-it’s the whole point.The Scale of the Problem

Cryptocurrency mining in Iran uses nearly 2,000 megawatts of electricity. That’s 5% of the country’s total power output. But here’s the catch: it’s not evenly distributed. Mining operations account for 15-20% of Iran’s electricity imbalance, meaning the grid is stretched far beyond its limits. In summer, when air conditioning demand spikes, the grid collapses. Power cuts become routine. One illegal mining farm, hidden inside the tunnels of Ahvaz Stadium, was found running 24/7. Meanwhile, residents in the same city reported 21 hours of blackouts in a single week. A Reddit poll from June 2025 showed 92% of 1,450 Iranian users blamed crypto mining for the outages. Telegram channels now post real-time blackout maps that line up perfectly with known mining locations. When Bitcoin’s price jumps, blackouts spike within 48 hours.Who’s Really in Control?

It’s not just random individuals mining Bitcoin. The Islamic Revolutionary Guard Corps (IRGC) controls an estimated 55-65% of all mining operations, either directly or through front companies. These aren’t small setups in garages. They’re industrial-scale farms with thousands of ASIC machines, often located near power plants or military bases. Energy policy analyst Mohammad Bagher Nobandegani called it “state-sanctioned theft of public resources.” The IRGC gets cheap electricity-subsidized by the state-and turns it into hard currency. Meanwhile, hospitals, schools, and homes pay the price. Former Energy Minister Reza Ardakanian warned in 2024 that mining was using up to 10% of Iran’s total electricity generation. That’s more than the entire city of Tehran consumes. And the government knew. They just chose to ignore it-for profit.

The Illegal Mining Epidemic

Legal mining is hard to get into. You need permits from three different agencies, a 3-6 month wait, and you still pay $0.04-$0.07/kWh. But if you’re a regular citizen and you plug a few miners into your home outlet, you pay only $0.01-$0.02/kWh. The incentive to cheat is massive. The government estimates that illegal miners consume up to 2 gigawatts daily-equivalent to the entire power usage of Tehran. In July 2025, a nationwide internet shutdown caused a 2,400 MW drop in electricity demand. That wasn’t due to a blackout. That was because 900,000 illegal mining rigs suddenly went offline. To fight back, the government launched a reward program: citizens who report illegal mining get 10% of the recovered electricity costs. In the first six months of 2025, 8,432 reports led to 2,157 shutdowns. But for every rig taken down, ten more pop up.Why the Grid Can’t Handle It

Iran’s power grid was built in the 1970s and 80s. It’s outdated, poorly maintained, and running at 60-70% of the capacity it needs. There’s no room for growth. Every new mining farm adds pressure to a system already on the edge. Winter is the only season mining runs smoothly. Cold weather means lower household electricity use. But in summer, when demand jumps 30-40%, the government shuts down legal mining operations. The result? A cycle of chaos. Miners wait for winter. Citizens suffer through summer. And the grid gets worse every year. The International Energy Agency predicts power shortages will grow by 25-30% by 2027 if nothing changes. Iran doesn’t have the money to upgrade its grid. So instead, it doubles down on mining.The Human Cost

This isn’t just about electricity bills. It’s about survival. In Tehran, families keep ice packs in freezers to survive 40°C heat during blackouts. Hospitals rely on diesel generators that run out of fuel. Children study by phone flashlight during 10-hour outages. Meanwhile, mining farms in Qom, Mashhad, and Isfahan run on uninterrupted power, cooled by industrial AC units that cost more than a year’s salary for most Iranians. One mother in Shiraz told Iran Focus: “I can’t charge my baby’s oxygen machine. The power goes out. The miners? They never lose power.”

The Irony of Regulation

Iran’s government created a paradox. It bans Bitcoin for everyday use but relies on it to survive international sanctions. It punishes citizens for using subsidized power to mine-but profits from the same activity when done by the IRGC. Licensed miners must use state-approved mining pools that take 15-20% of their earnings. They’re forced to install smart meters that report usage in real time. But the IRGC’s operations? No meters. No oversight. No penalties. Energy Minister Ali Akbar Mehrabian defends the system, saying it brings in $800 million a year in foreign exchange. But Dr. Saeed Laylaz, former economic advisor to President Khatami, called it a “parallel economy”-one where the state controls both the fuel and the output, bypassing every rule meant to protect the public.What’s Next?

Iran won’t stop mining. It’s too profitable. Too useful. Too embedded in the regime’s survival strategy. But the grid is breaking. The people are angry. And the world is watching. The next big move might not be a crackdown-it could be a controlled collapse. The government may eventually force miners to move offshore, selling their equipment to Kazakhstan or Russia. Or they may just let the system burn out, blaming “foreign sabotage” for the blackouts. For now, the choice is clear: Iran chooses Bitcoin over bread. Mining over medicine. Profit over people.How It Compares: Iran vs. Other Mining Hubs

| Country | Cost per Bitcoin | Electricity Cost/kWh | Grid Stability | Government Support |

|---|---|---|---|---|

| Iran | $1,300 | $0.01-$0.08 | Very Low | Indirect (sanctions evasion) |

| Kazakhstan | $5,000 | $0.03-$0.06 | Moderate | Officially permitted |

| United States | $8,000-$12,000 | $0.07-$0.15 | High | Regulated, taxed |

| Italy | $306,000 | $0.25-$0.40 | High | Banned |

| China (pre-2021) | $2,100 | $0.04-$0.07 | High | State-controlled |

Iran’s advantage isn’t technology. It’s not infrastructure. It’s not even efficiency. It’s the willingness to sacrifice its people’s basic needs for a few billion dollars in foreign cash.

Why doesn’t Iran just shut down crypto mining?

Because it needs the money. Iran is under heavy international sanctions that block its access to global banking. Selling mined Bitcoin abroad is one of the few ways it can buy essential goods like medicine, food, and spare parts for oil refineries. Shutting down mining would cripple its ability to survive economically-even if it means millions of citizens go without power.

Is crypto mining legal in Iran?

Yes, but only for licensed operators. The government requires miners to register with the Ministry of Industry, the Power Generation Company, and the Central Bank of Iran. However, the licensing process is slow, expensive, and has a less than 40% approval rate. Most miners operate illegally because the cost of electricity for households is far lower than for licensed operations, making cheating profitable.

Who profits the most from Iran’s crypto mining?

The Islamic Revolutionary Guard Corps (IRGC). Estimates suggest the IRGC controls 55-65% of all mining operations, either directly or through front companies. These operations are not subject to the same regulations as civilian miners. They use subsidized power without oversight and export Bitcoin to fund sanctioned imports. The government benefits indirectly, but the IRGC pockets the majority of the profits.

How much electricity does one Bitcoin mine use in Iran?

Producing one Bitcoin requires over 300 megawatt-hours of electricity. That’s enough to power about 35,000 Iranian households for a full day. With millions of mining devices operating, the total consumption is equivalent to the entire power usage of a major city like Tehran.

Are there any alternatives to crypto mining for Iran’s economy?

Possibly. Iran has vast solar and wind resources, especially in the south. It also has a young, tech-savvy population. Instead of using cheap electricity to mine Bitcoin, it could invest in renewable energy exports, tech startups, or digital services. But those require long-term planning, transparency, and accountability-things the current regime avoids. Mining is quick, profitable, and controllable by the state. That’s why it persists.

Jon Visotzky

December 6, 2025 AT 18:34So the government lets the IRGC run industrial mining farms while regular people can't even charge their phones

and they wonder why everyone's mad

it's not even close to a fair trade

they're literally stealing electricity from hospitals and babies' oxygen machines to fund their own empire

and calling it 'sanctions evasion' like that makes it okay

the real crime is pretending this is a policy and not a robbery

Isha Kaur

December 7, 2025 AT 18:20As someone from India where we also face rolling blackouts and power shortages, this feels painfully familiar but even more twisted

in our case, it's usually due to poor infrastructure and corruption in distribution, but here it's deliberate, calculated, and weaponized

the fact that they're using crypto not just to bypass sanctions but to actively enrich a military arm while civilians suffer is beyond unethical

it's like the state is running a parallel economy on the backs of its own people

and the worst part? They know exactly what they're doing

they're not clueless, they're choosing

they chose Bitcoin over bread, over medicine, over children studying by flashlight

and that's the real horror here - it's not an accident, it's policy with a price tag

Glenn Jones

December 7, 2025 AT 18:27OH MY GOD THIS IS WILD

THE IRGC IS RUNNING MINING FARMS LIKE A CRIMINAL ENTERPRISE AND THE GOVT IS ACTUALLY PROFITING FROM IT

LIKE BRO THEY'RE NOT EVEN TRYING TO HIDE IT

15-20% OF THE ENTIRE GRID IS GONE BECAUSE SOME MILITARY BRASS IS MINING BITCOIN IN A STADIUM TUNNEL

AND THE MOMENT THE PRICE DROPS THEY SHUT DOWN LEGAL MINING BUT KEEP THE IRGC RUNNING??

THEY'RE NOT EVEN TRYING TO BE COVERT

THEY'RE JUST SO POWERFUL THEY DON'T NEED TO

AND THE REWARD PROGRAM? 10% OF RECOVERED ELECTRICITY??

THAT'S LIKE PAYING PEOPLE TO BE SPYING ON THEIR NEIGHBORS FOR THE STATE

THIS ISN'T A CRISIS

THIS IS A DYSTOPIAN COMEDY WRITTEN BY A CORRUPT BUREAUCRAT WITH A DEGREE IN PSYCHOPATHY

Nelson Issangya

December 9, 2025 AT 16:00Stop pretending this is about economics - this is about power

the IRGC doesn’t need money, they need control

every bitcoin mined is another tool to silence dissent, fund proxies, and keep the regime alive

they don’t care if kids can’t study or hospitals run out of fuel

because those people don’t vote, they don’t matter

the only thing that matters is keeping the machine running

and right now, that machine runs on stolen electricity and suffering

if you think this is unique to Iran - you’re wrong

it’s just the most honest version of what authoritarian states do everywhere

they take from the poor to give to the powerful

and call it survival

Richard T

December 11, 2025 AT 09:21One sentence: They’re not mining Bitcoin - they’re mining people’s lives.