Litecoin Halving and How Crypto Supply Cuts Work

Jan, 6 2026

Jan, 6 2026

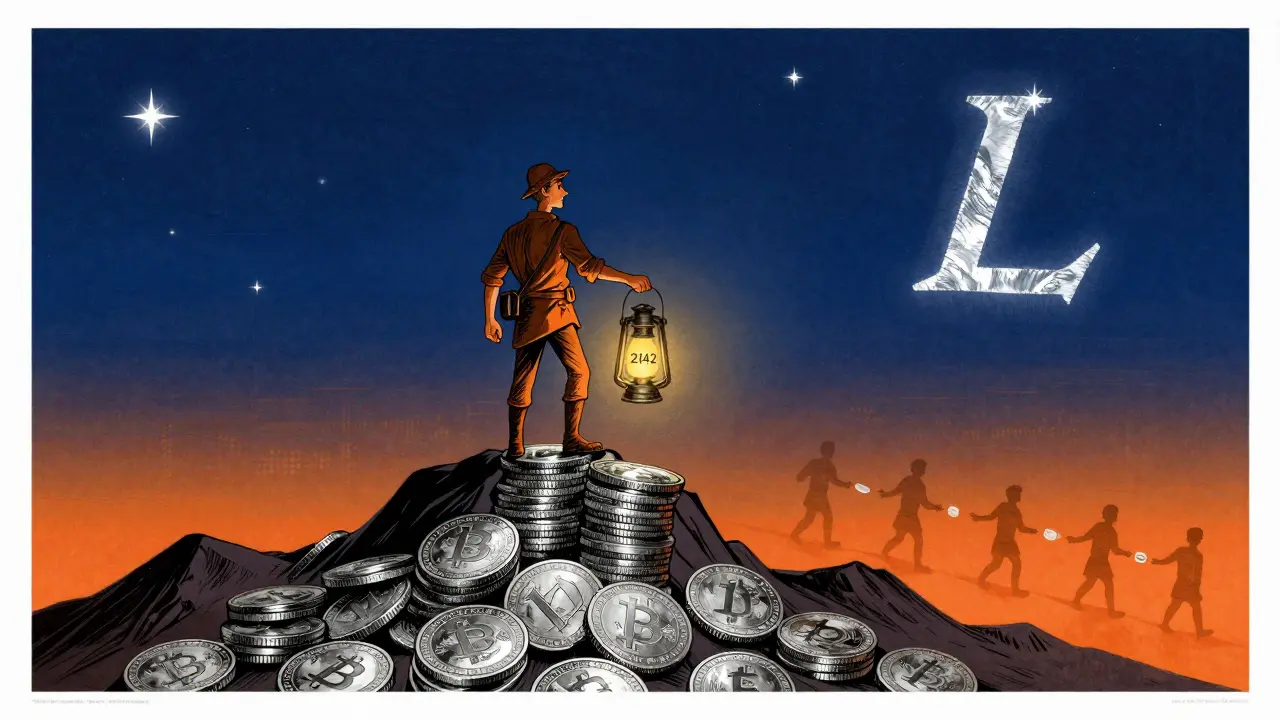

On August 2, 2023, Litecoin’s mining reward dropped from 12.5 LTC to 6.25 LTC per block. That’s a 50% cut - and it wasn’t a glitch. It was the third Litecoin halving, built into the code since day one. If you’re wondering why this matters, you’re not alone. Halvings are the quiet engines behind crypto’s scarcity model. They don’t make headlines like price spikes, but they shape long-term value - and they’re happening again soon.

What Exactly Is a Crypto Halving?

A halving is when the reward for mining a new block gets cut in half. It’s automatic, predictable, and built into the blockchain’s code. No one votes on it. No CEO decides it. It just happens, like clockwork. Litecoin started in 2011 with a 50 LTC reward per block. Every 840,000 blocks, that number drops by half. That’s roughly every four years. The first halving happened in 2015 (25 LTC), then 2019 (12.5 LTC), and 2023 (6.25 LTC). The next one? Around 2027. Bitcoin does the same thing - but every 210,000 blocks. So while Bitcoin’s halvings are more famous, Litecoin’s are just as important. Both are designed to limit supply. Only 84 million Litecoins will ever exist. That’s four times more than Bitcoin’s 21 million, but the math is the same: fewer new coins enter circulation over time. That’s deflationary by design.Why Does Scarcity Matter?

Think of it like gold. Gold isn’t printed. You can’t just dig more up easily. That’s why it holds value. Litecoin and Bitcoin mimic that. They’re digital gold with a fixed supply. Fiat currencies - like the dollar - can be printed whenever governments need to spend more. That leads to inflation. Over time, your money buys less. Crypto flips that. With halvings, the supply of new coins slows down. If demand stays the same or grows, but fewer new coins are added, the price can rise. It’s basic economics: scarcity + demand = higher value. But here’s the catch: it doesn’t always happen. Halvings don’t guarantee price spikes. In 2019, Litecoin’s price dropped after the halving. In 2023, it rose slowly over months. Why? Because markets are messy. Investor sentiment, macro trends, regulation, and even social media can override the halving effect.How Litecoin Differs from Bitcoin

Litecoin isn’t just a “Bitcoin clone.” It was built to be faster and more accessible for everyday use. - Block time: Bitcoin takes 10 minutes to confirm a block. Litecoin takes 2.5 minutes. That means transactions clear four times faster. - Algorithm: Bitcoin uses SHA-256. Litecoin uses Scrypt. Scrypt was designed to be more memory-heavy, making it harder for ASICs (specialized mining rigs) to dominate early on. That meant regular people with GPUs could mine Litecoin in the early days. Today, ASICs are everywhere - but Scrypt still keeps mining more decentralized than Bitcoin’s network. - Total supply: 84 million LTC vs. 21 million BTC. That’s not a flaw - it’s intentional. Litecoin was meant to be the “silver” to Bitcoin’s “gold.” More coins for smaller transactions. So while both halve every four years, Litecoin’s faster blocks and different mining setup make its halving feel different to users and miners alike.

What Happens to Miners After a Halving?

Miners are the backbone of any Proof-of-Work blockchain. They use powerful computers to solve math problems, validate transactions, and earn new coins as a reward. When the reward drops, their income drops too. Before the 2023 halving, miners earned 12.5 LTC per block. After? 6.25. That’s a 50% pay cut - and it’s not just about coins. Transaction fees are tiny on Litecoin. Most miners rely on block rewards, not fees, to stay profitable. This forces a shakeout. Small miners with old equipment, high electricity costs, or poor setups often quit. They can’t afford to keep running. Only the efficient survive: big farms with cheap power, cooled rigs, and optimized software. That sounds bad - but it’s actually good for the network. Less mining power means less centralization. If only a few big players remain, the network becomes more secure. It’s like a natural selection process. The weakest drop out. The strongest adapt. Studies from TokenMetrics and SpectroCoin show that most miners don’t immediately sell their LTC after a halving. They hold. Why? Because they believe in the long-term. Selling right after the cut would mean locking in losses. Waiting lets them ride potential price increases.Price History After Halvings

Let’s look at what actually happened after each halving:- 2015 Halving: Price hovered around $2.50 before the event. Three months later, it hit $4.50. Six months later? Over $10.

- 2019 Halving: Price was about $50 before. Three months after? Down to $35. It didn’t recover until nearly a year later, when the broader crypto bull market kicked in.

- 2023 Halving: Price was $70 before. It dipped to $55 in the following weeks. Then, slowly climbed to $150 by early 2024 - a 114% gain over six months.

What Comes Next? The 2027 Halving and Beyond

The next halving is expected around 2027. By then, mining rewards will drop to 3.125 LTC per block. That’s less than 4% of the original reward. And the supply of new LTC entering circulation will be tiny. By 2142, all 84 million Litecoins will be mined. No more new coins. Miners will survive on transaction fees alone. That’s the endgame. Experts agree: the halving mechanism is critical for Litecoin’s survival. Without it, inflation would erode trust. With it, the network has a clear, transparent, and math-based economic model. But the real test isn’t the halving itself. It’s whether people keep using Litecoin. If merchants accept it. If developers build on it. If users trust it as a fast, cheap way to send money. The halving ensures scarcity. But adoption ensures relevance.How to Prepare - Whether You Mine or Invest

If you’re a miner:- Calculate your break-even point. How much electricity do you pay per kWh? What’s your hardware efficiency?

- Upgrade before the halving. Old rigs won’t survive. Newer ASICs cut power use and increase hash rate.

- Don’t sell all your LTC. Hold at least 50%. You’ll need it to cover future costs.

- Don’t chase price spikes. Halvings are long-term events. Look at 12-24 month horizons.

- Track network hash rate. If it drops sharply after a halving, that’s a red flag. If it recovers, the network is healthy.

- Compare LTC to Bitcoin. Both halve. But Litecoin’s faster transactions make it better for payments. Bitcoin is seen as digital gold. Know which role you’re betting on.

- Start with learning. Read Litecoin’s official documentation. Watch videos on Scrypt vs. SHA-256.

- Use a simple wallet like Exodus or Ledger. Don’t try to mine unless you have technical skills.

- Remember: crypto is volatile. Halvings are just one part of the story.

Final Thoughts: It’s Not Magic - It’s Math

Litecoin halvings aren’t magic. They’re not a secret signal from the crypto gods. They’re a rule written in code. A way to control supply. A guarantee that no one can flood the market with new coins. The beauty? It works. Even after three halvings, Litecoin is still alive. Still used. Still growing. Miners still mine. Investors still watch. Developers still build. The next halving isn’t a date to mark on your calendar. It’s a reminder that digital money can be designed differently - not by banks, not by politicians, but by math. And that’s powerful.When is the next Litecoin halving?

The next Litecoin halving is expected around 2027. It happens every 840,000 blocks, which, given Litecoin’s 2.5-minute block time, translates to roughly every four years. The last one occurred on August 2, 2023, reducing the block reward from 12.5 LTC to 6.25 LTC.

Does a halving always make Litecoin’s price go up?

No. Halvings don’t guarantee price increases. While scarcity can drive demand, price is also affected by market sentiment, macroeconomic trends, regulation, and overall crypto adoption. Litecoin’s price rose after the 2015 and 2023 halvings but dropped after the 2019 halving. The long-term trend often follows, but short-term movements are unpredictable.

How does Litecoin’s halving compare to Bitcoin’s?

Both halve every four years, but Bitcoin does it every 210,000 blocks, while Litecoin does it every 840,000 blocks. Bitcoin’s block time is 10 minutes; Litecoin’s is 2.5 minutes. Bitcoin uses SHA-256 mining; Litecoin uses Scrypt, which was originally designed to be more accessible to regular users. Litecoin has a larger total supply (84 million vs. 21 million), making it more suited for everyday transactions.

Do miners sell their coins right after a halving?

Most serious miners don’t. Studies from SpectroCoin and TokenMetrics show that miners typically hold their LTC rewards after a halving. Selling immediately would lock in losses, especially since operational costs remain high. Instead, many hold to ride potential price increases or use their holdings to fund future mining upgrades.

Will Litecoin still be mined after the final halving?

Yes. After the last Litecoin is mined around 2142, miners will no longer receive new LTC as block rewards. Instead, they’ll rely solely on transaction fees paid by users to validate blocks. This model already works on Bitcoin and is expected to work on Litecoin too - as long as the network remains active and transaction volume stays high.

LeeAnn Herker

January 6, 2026 AT 17:53Oh wow, another ‘digital gold’ fairy tale? 🙄 Let me guess - next you’ll tell me the blockchain is powered by unicorns and good vibes. Halvings don’t create value, they just create hype cycles for people who think math can replace human greed. I’ve seen this movie before: ‘This time it’s different!’ Spoiler: it’s not. LTC is just Bitcoin’s second cousin who still lives in his mom’s basement. And don’t even get me started on ‘Scrypt = decentralized’ - ASICs took over in 2014. Wake up, sheeple.

Sherry Giles

January 8, 2026 AT 04:36Canada’s got better things to do than babysit some altcoin’s supply schedule. You people act like Litecoin’s halving is the Second Coming, but the US Fed prints money faster than your miner rig can cool down. Meanwhile, our central bank’s actually responsible - and we still have a functional economy. This ‘digital gold’ nonsense? It’s a distraction. Real wealth is in infrastructure, not hash rates. If you’re investing in LTC because of a code update, you’re not an investor - you’re a gambler with a PhD in wishful thinking.

Veronica Mead

January 8, 2026 AT 15:40It is imperative to recognize that the halving mechanism, as implemented within the Litecoin protocol, constitutes a rigorously engineered deflationary monetary policy, predicated upon algorithmic scarcity and immutable consensus rules. The reduction in block subsidies, while ostensibly reducing miner revenue, simultaneously reinforces the network’s long-term economic integrity by mitigating inflationary pressures inherent in fiat-based systems. Furthermore, the Scrypt algorithm, despite widespread ASIC adoption, retains a marginally superior resistance to centralization when compared to SHA-256, owing to its memory-hard characteristics. One must, therefore, refrain from conflating short-term price volatility with structural decay. The resilience of the network is evidenced not by speculative surges, but by sustained operational continuity and miner retention - metrics which, as documented by TokenMetrics, remain statistically robust post-halving.

Tre Smith

January 9, 2026 AT 07:03Let’s be clear: the 2023 halving had zero measurable impact on LTC’s price trajectory. The 114% gain over six months was entirely driven by BTC’s bull run and FOMO from retail traders. Miner hash rate dropped 18% immediately after, then recovered - but that recovery was fueled by centralized mining pools, not ‘efficient rigs.’ Transaction fees? Still below $0.01 on average. The entire ‘digital silver’ narrative is a marketing lie. Litecoin’s only real use case is being a testnet for Bitcoin devs who don’t want to risk mainnet. And don’t cite 2015 as proof - that was a $2 coin in a crypto graveyard. This isn’t economics. It’s behavioral finance theater.

Kelley Ramsey

January 9, 2026 AT 09:46Okay, but what if… we think about this differently? 🤔 What if the halving isn’t about price at all? What if it’s about patience? About trusting a system that doesn’t need a central authority to say ‘okay, print more’? I mean, think about it - we live in a world where governments can erase your savings with a keystroke, and here’s this thing… this quiet, math-based clock… ticking away, saying ‘nope, not today.’ It’s not magic - it’s discipline. And honestly? That’s kind of beautiful. I don’t know if LTC hits $500… but I do know I’m holding because I want to live in a world where money isn’t a game of musical chairs with central banks. 🌱

Michael Richardson

January 10, 2026 AT 05:41Halving? More like halving your wallet. 💸