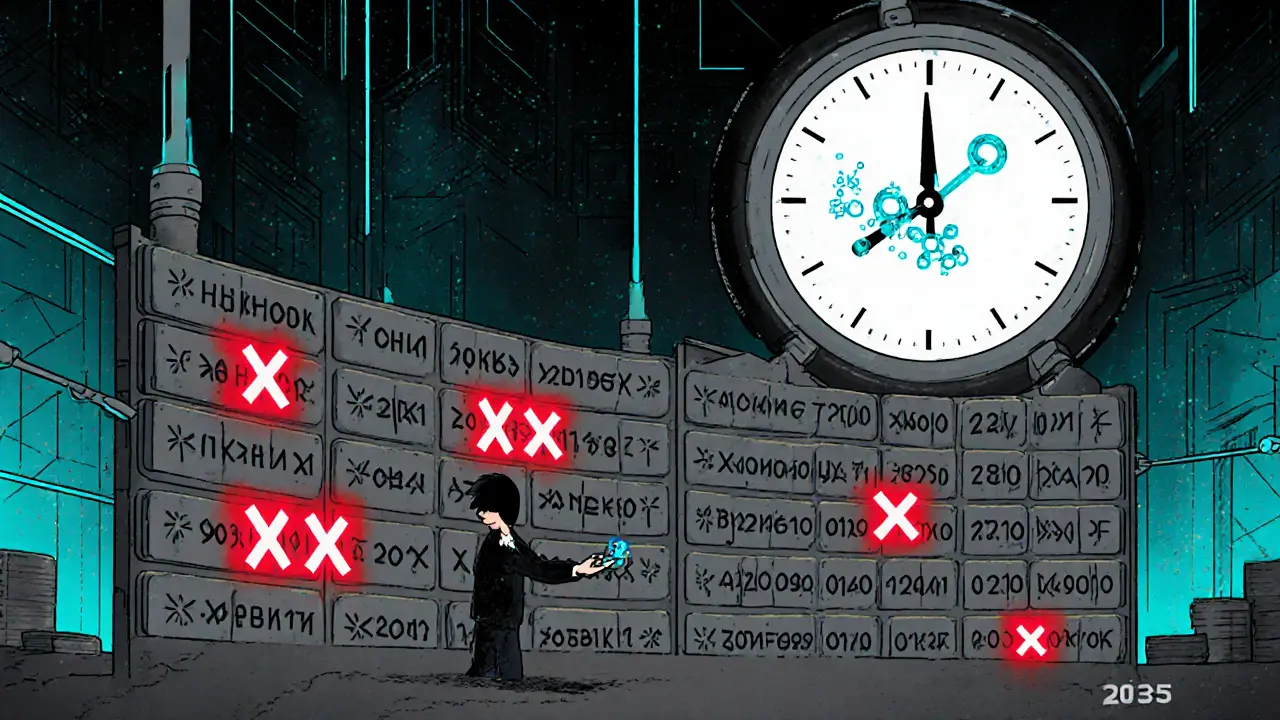

Quantum Computing Threat to Crypto Encryption: What You Need to Know Before 2035

Jul, 28 2025

Jul, 28 2025

Quantum Address Risk Checker

Address Security Assessment

Check if your cryptocurrency address is vulnerable to quantum attacks. According to Deloitte's 2025 analysis, 25% of Bitcoin is at risk due to address reuse.

How It Works

Quantum computers could steal funds from addresses where the public key is visible on the blockchain. This happens when you reuse addresses or send from old Bitcoin addresses.

- High Risk: Addresses that have been reused or have visible public keys

- Medium Risk: Addresses that were recently created but may contain reused transaction data

- Low Risk: Fresh addresses created after October 2025 with no previous transactions

Right now, billions of dollars in Bitcoin, Ethereum, and other cryptocurrencies are protected by encryption that quantum computing could break in minutes. It’s not science fiction. It’s a countdown that started years ago-and most people still don’t realize they’re at risk.

How Quantum Computers Break Crypto

Most cryptocurrencies rely on public-key cryptography to prove ownership. When you send Bitcoin, you sign the transaction with a private key. The network checks it against your public key. That system works because it’s mathematically hard for classical computers to reverse-engineer the private key from the public one. But quantum computers don’t play by those rules. The threat comes from Shor’s algorithm, developed in 1994. This quantum algorithm can factor huge numbers and solve elliptic curve problems exponentially faster than any classical computer. That means it can crack ECDSA-the digital signature algorithm used by Bitcoin and Ethereum-to steal funds from any address where the public key is visible on the blockchain. You might think, "But my wallet is secure." Not if you’ve reused an address. In Bitcoin, when you spend from a pay-to-public-key-hash (p2pkh) address, your public key gets published on the blockchain. Once that’s out there, a powerful enough quantum computer can derive your private key. Deloitte’s October 2025 analysis found that 25% of all Bitcoin in circulation is sitting in addresses where the public key has been exposed. That’s over $120 billion at today’s prices.The Harvest Now, Decrypt Later Attack

You don’t need a quantum computer today to be in danger. Adversaries-nation-states, hackers, intelligence agencies-are already collecting encrypted data. This is called the "harvest now, decrypt later" (HNDL) strategy. They’re storing every Bitcoin transaction, every Ethereum signature, every public key they can find. They’re waiting for quantum hardware to catch up. According to the Federal Reserve Board’s October 2025 report, this isn’t theoretical. It’s happening. The NSA’s $80 million "Penetrating Hard Targets" program, revealed by Edward Snowden in 2013, was one of the first known efforts to build quantum decryption capability. Today, that effort is likely far more advanced. And if a quantum computer can crack your private key in 30 minutes, as Deloitte estimates, then every unspent transaction output with a visible public key is a future target.What’s Vulnerable? What’s Not

Not all crypto is equally at risk.- Bitcoin: High risk. Uses ECDSA. 25% of coins exposed via reused addresses.

- Ethereum: Moderate risk. Also uses ECDSA, but newer wallets (EIP-1559) reduce exposure. Still vulnerable if public keys are revealed.

- Stablecoins: High risk. Tied to traditional banking systems. A quantum breach could compromise both crypto and fiat assets simultaneously, as highlighted in the American Bankers Association’s October 2025 report.

- Quantum-resistant chains: Very low risk. Projects like QANplatform and IOTA already use lattice-based cryptography. But together, they make up less than 0.1% of total crypto market cap.

The Race to Post-Quantum Cryptography

The solution isn’t to abandon crypto. It’s to upgrade it. That’s where post-quantum cryptography (PQC) comes in. In 2022, the National Institute of Standards and Technology (NIST) selected four algorithms to replace today’s vulnerable standards:- CRYSTALS-Kyber: For encryption

- CRYSTALS-Dilithium: Primary digital signature (replaces ECDSA)

- FALCON: Compact signatures for space-limited systems

- SPHINCS+: Hash-based, ultra-conservative backup

Who’s Preparing? Who’s Not

Some players are moving fast. The Post-Quantum Cryptography Alliance, formed in September 2025, includes Coinbase, Chainlink, and 27 other major blockchain companies. They’re building migration roadmaps and testing PQC integration in testnets. Coinbase’s October 2025 guide tells users: "Never reuse addresses." It’s the simplest, cheapest defense right now. If you’ve ever sent Bitcoin from the same address twice, you’re exposing yourself. Move your coins to a fresh address. Use a wallet that generates a new address for every transaction. Banks are also waking up. The European Union’s October 2025 Quantum Security Directive requires all financial institutions to submit quantum migration plans by Q2 2026. In the U.S., 78 of the top 100 banks now offer crypto services-ETFs, custody, retirement accounts. If quantum breaks crypto, it breaks their exposure too. But most individuals? They’re clueless. Reddit’s r/Bitcoin saw a 300% spike in quantum-related posts between August and September 2025. One user, u/CryptoPrepper2025, moved 5.2 BTC after reading Deloitte’s report. "Better safe than sorry," they wrote. That post got 9,200 upvotes. Yet, the vast majority of users still hold coins in reused addresses.

When Will It Happen?

No one knows the exact date. But experts agree: it’s coming. IBM’s quantum roadmap projects systems with over 10,000 qubits by 2035. BCG’s 2025 analysis says there’s a better than 50% chance such a machine could break RSA-2048 by then. Since ECDSA is even easier to crack than RSA, Bitcoin could be vulnerable around the same time. Deloitte’s warning is stark: "If a quantum computer will ever get closer to the 10 minutes mark to derive a private key from its public key, then the Bitcoin blockchain will be inherently broken." That’s the threshold. And we’re getting closer. Some, like IBM researchers, say error correction will delay practical attacks until 2045. Others, like the Federal Reserve, say the risk is already here-because data is being harvested now.What You Should Do Today

You don’t need to understand quantum physics to protect yourself. Here’s what matters:- Never reuse addresses. Every time you receive crypto, use a new one. Most modern wallets do this automatically.

- Move coins from old p2pk and reused p2pkh addresses. If you’ve held Bitcoin since 2012 or earlier, check if your funds are in exposed addresses. Use a blockchain explorer to see if the public key is visible.

- Use hardware wallets. They keep private keys offline. Even if a quantum computer cracks your public key, it can’t reach your private key unless it’s exposed.

- Watch for PQC upgrades. Follow updates from Ethereum, Bitcoin Core, and major exchanges. When they announce quantum-resistant wallets or chain upgrades, move your funds to the new system.

- Don’t panic, but don’t ignore it. Quantum computers won’t crash tomorrow. But the window to act is closing. By 2030, the cost of upgrading will be far higher than it is today.

Rachel Thomas

November 26, 2025 AT 14:57This is all just fear porn. Quantum computers can't even reliably flip a qubit without collapsing it, and now you're telling me they're gonna steal my Bitcoin? I've got more than $120 billion in my wallet, and I'm not even worried. You're all panic-buying aluminum foil for your phones.

SHIVA SHANKAR PAMUNDALAR

November 27, 2025 AT 03:51The real question isn't whether quantum computers can break crypto-it's whether we're ready to admit that trust in digital money was always an illusion. We built a system on math that assumes human beings won't cheat. But we cheat anyway. Quantum or not, the system was already broken.

Shelley Fischer

November 28, 2025 AT 12:34While the article presents a technically accurate overview of quantum threats to cryptographic systems, it significantly overstates the immediacy of the risk. The claim that 25% of Bitcoin is exposed is misleading without context: many of these addresses are inactive or belong to exchanges with multi-sig protections. Furthermore, the transition to NIST-standardized post-quantum algorithms is already underway in enterprise-grade systems. The real vulnerability lies not in the blockchain, but in the failure of individual users to adopt best practices-such as address reuse-which has been documented since 2014. The solution is not panic, but education and incremental protocol upgrades.

Puspendu Roy Karmakar

November 30, 2025 AT 01:40Bro, I read this whole thing and I'm not scared-I'm inspired. If quantum computers are coming, then we better build better wallets, better systems, better ways to protect what's ours. I moved my coins to a new address yesterday. No big deal. If you're still using the same Bitcoin address from 2017, that's your problem, not the tech's. We can fix this. We just have to start. One fresh address at a time.

Evelyn Gu

November 30, 2025 AT 10:31Okay, I just want to say-this is terrifying-and also kind of beautiful? Like, imagine if the entire financial world had to upgrade its foundation because of a machine that can think in superpositions? It's not just about Bitcoin-it's about how fragile our trust in numbers really is. I checked my wallet, and I've reused addresses three times since 2021, and now I feel like I've been leaving my front door open for years. I'm moving everything to a new wallet today, and I'm going to learn what lattice-based cryptography even means. I'm not a tech person, but if my money's on the line, I owe it to myself to understand. I'm scared, but I'm also ready. And maybe that's the point.