Sidechain Use Cases and Benefits in Modern Blockchain Systems

Mar, 21 2025

Mar, 21 2025

Sidechain Cost & Speed Calculator

Calculate Your Savings

See how much time and money you save by using a sidechain versus Ethereum main chain.

Ethereum Main Chain

$1.50 avg feeSidechain (Polygon Example)

$0.0001 avg feeWhy This Matters

Using a sidechain like Polygon can save you $0.0001 per transaction versus $1.50 on Ethereum. For 1,000 transactions, that's $1,498.99 in savings! Sidechains process transactions in under 3 seconds compared to Ethereum's 13-15 seconds.

Based on current network conditions. Actual fees may vary based on network congestion.

Blockchains are powerful, but they’re not perfect. Bitcoin and Ethereum, the two biggest networks, can only handle so many transactions per second. Ethereum tops out around 15-30 TPS. Bitcoin is even slower. That’s fine for payments or storing value, but it doesn’t work for apps that need speed-like online games, NFT marketplaces, or real-time financial tools. That’s where sidechains come in.

What Exactly Is a Sidechain?

A sidechain is a separate blockchain that runs alongside the main chain-like Bitcoin or Ethereum. It’s not part of the main network, but it’s connected to it through a two-way peg. This means you can move assets back and forth between the main chain and the sidechain securely. When you send ETH from Ethereum to a sidechain, it gets locked up. On the sidechain, an equivalent amount is minted. When you want to go back, the sidechain tokens are burned, and the original ETH is released. This setup lets sidechains do things the main chain can’t. They can use different consensus methods, have faster block times, and charge near-zero fees. They’re not trying to replace Ethereum or Bitcoin. They’re designed to extend them.Why Do Sidechains Exist?

The main reason? Scalability. Ethereum’s base layer was never built to handle millions of users doing DeFi trades, minting NFTs, or playing blockchain games. Every transaction costs money and takes time. Sidechains solve this by offloading work. Take Polygon PoS. Launched in 2020, it’s one of the most popular sidechains. It handles over 6,700 dApps-from Starbucks’ loyalty program to Adobe’s content verification tools. On Polygon, a transaction takes about 2.1 seconds to confirm. On Ethereum? 13-15 seconds. Fees? Around $0.0001 versus $1.50 on Ethereum during normal times. Liquid Network, Bitcoin’s sidechain, lets exchanges move BTC faster and privately. Instead of waiting 10 minutes per block, Liquid confirms transactions in under two minutes. It’s used by major crypto firms like Bitfinex and Kraken for internal transfers.Key Use Cases for Sidechains

- High-Speed Gaming and NFTs: Immutable X, a sidechain built for gaming, handles 9,000 transactions per second. That’s 300 times faster than Ethereum. Players can trade NFTs in real time without worrying about gas fees or delays.

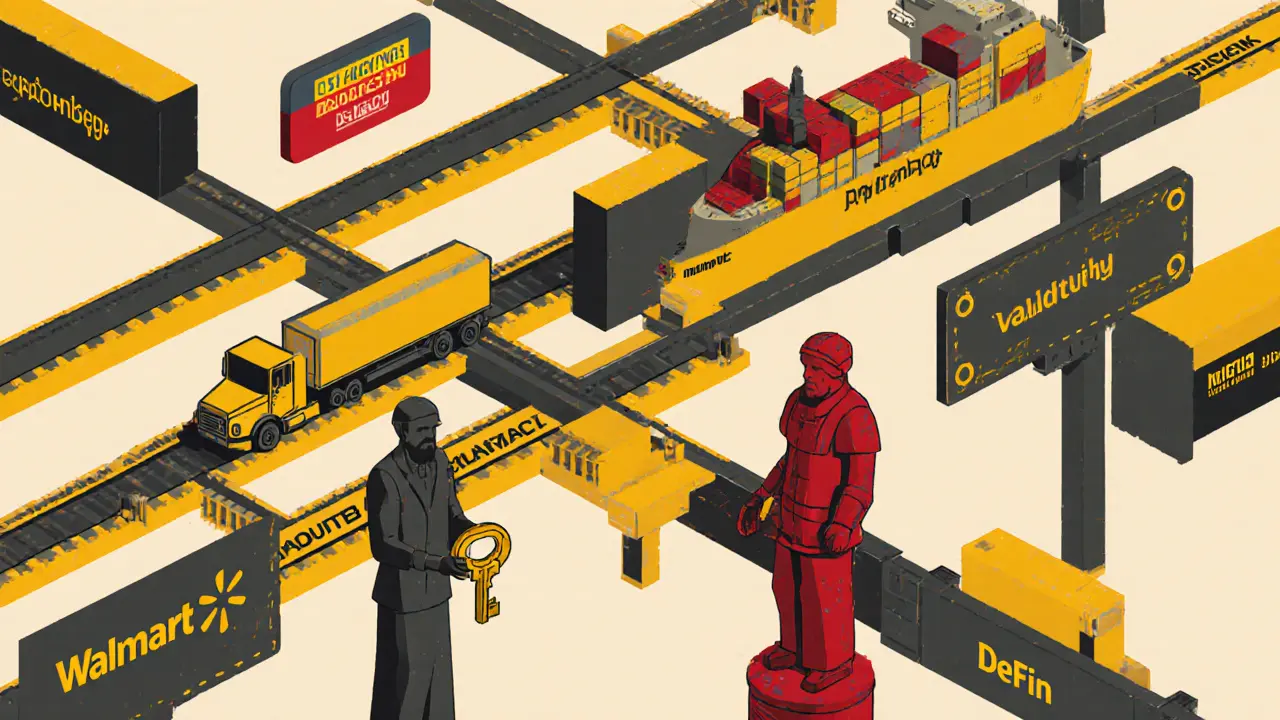

- Enterprise Supply Chains: Companies like Walmart and Maersk use sidechains to track goods across borders. Sidechains let them log shipments, verify authenticity, and share data without exposing sensitive info on public ledgers. Deloitte found 48% of Fortune 500 sidechain projects are for supply chain use.

- Digital Identity: Governments and banks are testing sidechains to issue verifiable digital IDs. These IDs can be used for KYC, voting, or accessing services without storing personal data on a public blockchain.

- Privacy-Focused Transactions: Liquid Network uses confidential transactions to hide amounts and addresses. This is critical for institutions that can’t let competitors know how much they’re trading.

- Smart Contracts on Bitcoin: Bitcoin doesn’t support smart contracts natively. Rootstock (RSK) is a sidechain that adds Ethereum-like functionality to Bitcoin. It lets developers build DeFi apps on Bitcoin’s secure base.

How Do Sidechains Work Technically?

Sidechains don’t inherit the main chain’s security. That’s their biggest trade-off. Ethereum’s Layer-2 solutions like zk-Rollups use Ethereum’s validators for security. Sidechains run their own. Polygon PoS uses a modified Proof-of-Stake system with hundreds of validators. Liquid Network uses a federated model: 15 trusted companies (like Blockstream and Bitfinex) validate blocks together. You need at least 10 of them to agree before a transaction is confirmed. The two-way peg relies on SPV (Simplified Payment Verification) proofs. When you bridge assets, the system waits for 6 confirmations on the main chain before releasing tokens on the sidechain. This prevents double-spending. But it’s not foolproof. In 2022, the Ronin Network-used by Axie Infinity-was hacked because only 5 out of 9 validators were needed to sign off. The hackers compromised 3 of them and stole $625 million.

Benefits of Sidechains

- Speed: Most sidechains process transactions in under 3 seconds. Some, like Immutable X, do it in under a second.

- Low Cost: Fees are often fractions of a cent. That’s why small developers and gamers can build on them without needing venture funding.

- Flexibility: You can choose your consensus model. Want Proof-of-Authority? Fine. Want a hybrid? Go ahead. Layer-2 solutions are locked into the main chain’s rules.

- Innovation: Sidechains let you test new features without risking the main chain. If your sidechain fails, Bitcoin or Ethereum keeps running.

- Customization: Enterprises can build private sidechains with access controls, compliance checks, and audit trails built in.

Downsides and Risks

Sidechains aren’t magic. They have serious weaknesses.- Lower Security: Ethereum’s Layer-2 solutions inherit 100% of Ethereum’s security. Sidechains like Polygon PoS only offer 65-70% equivalent security, according to Chainalysis. If the sidechain’s validators get hacked or collude, your funds are at risk.

- Fragmentation: Every sidechain is its own ecosystem. Liquidity gets split. Users have to bridge between chains, which adds complexity. The Terra-Luna collapse in 2022 showed how one broken sidechain can trigger panic across the whole market.

- Bridge Risks: Bridges are the weakest link. Most hacks happen there. Setting up a secure two-way peg requires advanced cryptography. Many projects get it wrong.

- Validator Incentives: If validators don’t get paid enough, they quit. A 2023 Blockchain Council survey found 68% of sidechain projects struggle to keep validators active without giving out big token rewards.

Sidechains vs. Layer-2s: What’s the Difference?

People often confuse sidechains with Layer-2 solutions like Optimistic Rollups or zk-Rollups. Here’s how they differ:| Feature | Sidechains | Layer-2 (e.g., zk-Rollups) |

|---|---|---|

| Security Model | Independent validators | Inherits main chain security |

| Transaction Speed | 1-5 seconds | 1-3 seconds |

| Fees | $0.0001-$0.01 | $0.001-$0.05 |

| Consensus Flexibility | 12+ different models used | Only 3 models possible |

| Best For | Enterprise apps, gaming, privacy | High-security DeFi, trading |

Real-World Examples That Worked (and Didn’t)

Polygon’s success is undeniable. It’s home to over 6,700 apps. But even Polygon has problems. Developers say it takes an average of three weeks to learn how to stake and run validators. Documentation is good, but not perfect. Reddit’s Community Points system ran on Arbitrum, which started as a sidechain but later became a Layer-2. It attracted 1.2 million wallets-but users complained about 72-hour withdrawal delays. That’s not user-friendly. The Ronin hack is the cautionary tale. A sidechain with only 9 validators was compromised. One bad actor, or a few compromised nodes, brought down a $1 billion ecosystem.What’s Next for Sidechains?

Sidechains are evolving. Polygon announced in October 2023 that it’s moving toward zk-Rollups to improve security. That’s a big signal: even successful sidechains are recognizing their limits. New models are emerging. Cosmos’ IBC protocol lets sidechains talk to each other securely. Over 32 chains now use it, reducing individual security risks by 60%. This could be the future-sidechains that trust each other, not just one parent chain. Enterprise adoption is growing fast. Deloitte says 72 Fortune 500 companies are using or testing sidechains. Most are for supply chains and identity. That’s not flashy, but it’s real. Regulators are watching. The EU’s MiCA law treats sidechains as separate financial entities. In the U.S., the SEC has sued companies over sidechain tokens, calling them unregistered securities. Compliance is now part of the build.Should You Use a Sidechain?

If you’re building a game, a loyalty program, or a private enterprise ledger-yes. Sidechains give you speed, low cost, and control. If you’re handling millions in DeFi, trading high-value assets, or need maximum security-stick with Layer-2s or the main chain. Sidechains aren’t the endgame. But they’re the most practical way to scale blockchain for real-world use today. They’re not perfect, but they’re working. And for many developers and companies, that’s enough.Are sidechains safer than the main blockchain?

No, sidechains are generally less secure than the main chain. While Bitcoin and Ethereum rely on thousands of decentralized miners or stakers, sidechains often use a small group of validators-sometimes as few as 9 or 15. If those validators are compromised, funds can be stolen. Ethereum’s Layer-2 solutions inherit the main chain’s security, making them stronger for high-value applications.

Can I use sidechains with Bitcoin?

Yes. Liquid Network is Bitcoin’s official sidechain, launched in 2017. It allows faster, private Bitcoin transfers and supports smart contracts through a Bitcoin-compatible language. Other projects like Rootstock (RSK) let developers build Ethereum-style apps on Bitcoin’s base layer.

Do sidechains have their own tokens?

Many do. Polygon has MATIC, which is used for staking and paying fees. Rootstock uses RBTC. These tokens help incentivize validators and secure the sidechain. But you don’t always need them-you can often bridge ETH or BTC directly and use those for transactions.

How do I bridge assets to a sidechain?

You use a bridge-a smart contract that locks your asset on the main chain and mints an equivalent on the sidechain. Popular bridges include Polygon’s PoS Bridge and Liquid’s Federation Bridge. Always check the bridge’s security audit history. Many hacks happen at the bridge level, not the sidechain itself.

Are sidechains the future of blockchain scaling?

They’re part of it, but not the whole picture. Sidechains are great for flexibility and speed, but their security model limits them for high-value use cases. Layer-2 solutions like zk-Rollups are gaining ground because they offer both speed and main-chain security. The future likely involves a mix: sidechains for enterprise and gaming, Layer-2s for DeFi and trading.

Susan Dugan

November 26, 2025 AT 13:43Sidechains are the unsung heroes of blockchain scalability-no flashy whitepapers, no ICO hype, just real work getting done. Polygon’s $0.0001 fees let indie devs build games that actually run. No more begging for grants just to pay for gas. This isn’t magic-it’s engineering. And honestly? We needed this.

George Kakosouris

November 28, 2025 AT 02:37Let’s be real-sidechains are just centralized proxies with a blockchain sticker on them. Polygon PoS? 100+ validators? More like 10 big players with shared wallets. And don’t get me started on Liquid Network’s federation. It’s not decentralization-it’s cartelized consensus. If you’re using this for anything above $500, you’re gambling. And the bridge hacks? That’s not a feature, it’s a feature request for the next attack vector.

Tina Detelj

November 29, 2025 AT 09:52Ohhh, the fragility of trustless systems… the irony is thick enough to spread on toast. We built blockchains to escape centralization, then we built sidechains with 9 validators… who are, of course, funded by VCs who also own the bridge contracts… who also audit themselves… and then we wonder why people lose millions? It’s not a technical failure-it’s a philosophical one. We traded one god for a committee of gods who all went to the same MBA program.

Mark Adelmann

November 30, 2025 AT 09:03Used Immutable X for a digital art project last year. Zero gas fees, instant trades. My 72-year-old aunt minted an NFT without crying. That’s the real win-not the TPS numbers, but the human access. Sidechains aren’t about beating Ethereum-they’re about letting people who’ve never touched crypto actually use it. And that’s worth more than any whitepaper.

priyanka subbaraj

December 1, 2025 AT 08:28Sidechains are a scam. Ronin stole $625M. That’s not a bug. That’s the design.

Tom MacDermott

December 2, 2025 AT 10:19Oh wow, another article pretending sidechains are ‘innovation’ when they’re just Ethereum’s ugly cousin who got kicked out of the house and now lives in a basement with a federated validator and a dream. Let me guess-next you’ll tell me ‘Bitcoin sidechains are secure’? RSK? Please. It’s a glorified sidecar on a bike with no brakes. And don’t even get me started on ‘enterprise adoption.’ Walmart tracking bananas on a blockchain? That’s not Web3. That’s a PowerPoint slide with ‘blockchain’ pasted in Comic Sans.

Ben Costlee

December 4, 2025 AT 04:07There’s something beautiful about sidechains being the quiet workhorses. No one cheers when a supply chain ledger works flawlessly for 18 months. No headlines when a digital ID saves a refugee 3 weeks of bureaucracy. But that’s where the real impact lives-in the invisible infrastructure. We celebrate the flashy DeFi apps, but the quiet ones? The ones that just… work? Those are the ones that change lives. Sidechains are those quiet ones.

Puspendu Roy Karmakar

December 5, 2025 AT 14:05India is testing sidechains for farmer subsidy tracking. No middlemen. No corruption. Farmers get alerts on phone. Simple. Fast. No crypto jargon. Just money where it should be. Sidechains aren't about Ethereum or Bitcoin. They're about fixing real problems. And that's the best use case of all.

ola frank

December 6, 2025 AT 15:28While the post presents a compelling narrative around sidechain utility, it conspicuously omits the game-theoretic implications of validator incentive alignment under asymmetric risk profiles. The assumption that token rewards can sustain long-term validator participation is predicated on a stationary reward function, yet empirical evidence from the Terra collapse and Ronin breach demonstrates that validator collusion thresholds are not linearly correlated with economic incentives. Furthermore, the conflation of ‘flexibility’ with ‘security dilution’ is not merely an oversight-it is a fundamental mischaracterization of trust assumptions in heterogeneous consensus architectures. Until we formalize sidechain security as a function of validator diversity, economic stake distribution, and cross-chain auditability-not just ‘number of validators’-we are optimizing for throughput at the expense of systemic resilience.