Dangerous Crypto Platforms: How to Spot Scams and Avoid Losing Your Money

When you hear about a new crypto project promising 100x returns with no risk, that’s not a chance—it’s a dangerous crypto platform, a deceptive project designed to steal funds, manipulate prices, or vanish overnight. Also known as a crypto scam, these platforms often mimic real exchanges, mimic stablecoins, or fake airdrops to trick users into sending crypto they’ll never see again. You don’t need to be an expert to get burned. In 2024, over $2 billion was lost to crypto scams, and most of them looked exactly like the real thing.

One common trick is the dead cryptocurrency, a token with zero trading volume, no team, and no future—but still listed on sketchy sites with fake price charts. Examples like Bitstar (BITS), UniWorld (UNW), and Buggyra Coin Zero (BCZERO) look active until you check the blockchain—and then you find out no one has traded them in months. Then there’s the fake airdrop, like CovidToken or fake MDX rewards, where scammers ask you to connect your wallet or pay a "gas fee" to claim free tokens that don’t exist. These aren’t bugs—they’re designed thefts. And it’s not just tokens. Some unregulated exchange, like LocalTrade or EQONEX, operate without licenses, hide their team, and vanish when users try to withdraw. They lure you in with low fees, no KYC, or promises of high staking rewards. But when you deposit, your funds disappear—or worse, they lock you out and demand more money to release your own crypto. Regulators have shut down these platforms before. But new ones pop up every week, using the same scripts, same logos, same fake testimonials.

What makes these platforms dangerous isn’t just the money they steal—it’s how they exploit trust. They use real-sounding names like Deutsche Mark (DDM), mimic official-looking websites, and even copy the branding of legit projects like TON or Avalanche. They prey on people who are new, excited, or desperate for quick gains. But the signs are always there: no whitepaper, no GitHub activity, no real community, and prices that move only because bots are pumping them. If a project can’t show you who’s behind it, don’t trust it. If you can’t find it on CoinMarketCap or CoinGecko, it’s not real. If someone messages you on Telegram offering free tokens, it’s a trap.

Below, you’ll find real breakdowns of exactly how these dangerous crypto platforms work—what they promise, what they hide, and why they fail. From fake mining bans in Angola to ghost tokens in Pakistan, from dead exchanges in Canada to rigged airdrops in the U.S., every post here is based on actual cases, not theories. You won’t find fluff. Just facts, red flags, and clear warnings so you never get caught again.

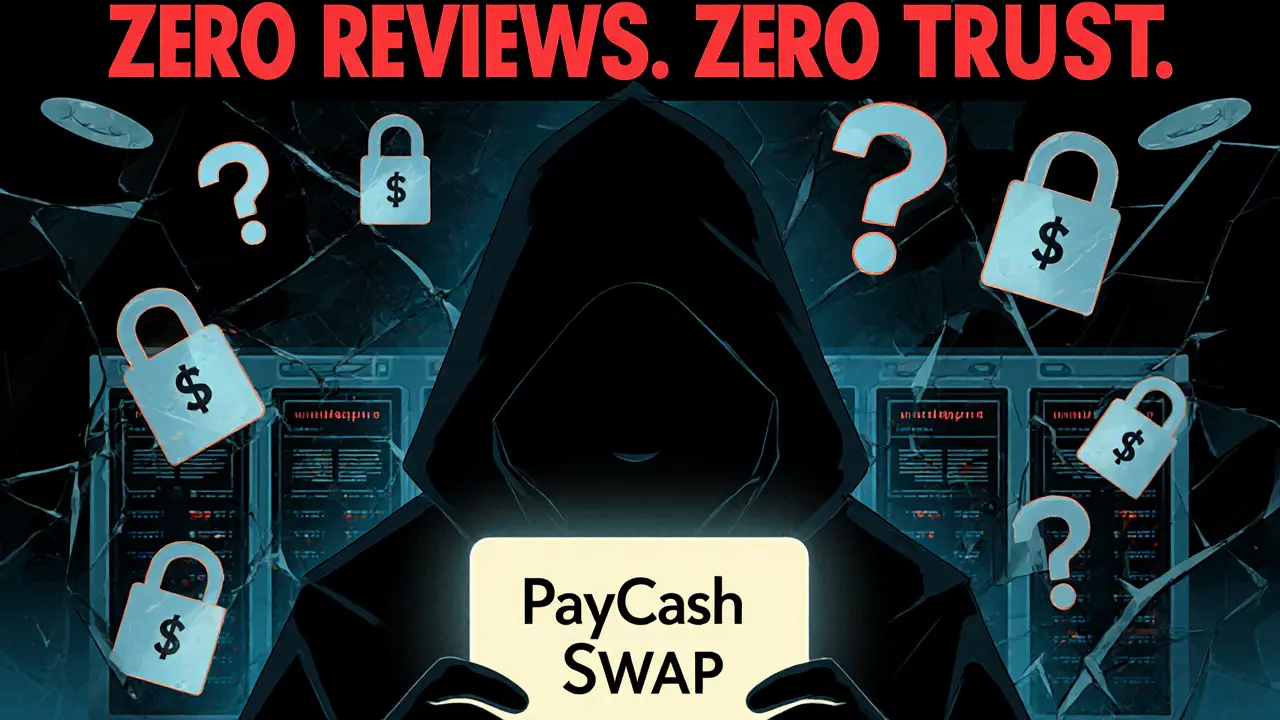

PayCash Swap Crypto Exchange Review: Red Flags and Why to Avoid It

PayCash Swap is a crypto exchange with zero reviews, no security details, and no verifiable history. Every sign points to a scam. Avoid it at all costs.

Read More