Understanding Different Types of Crypto Wallets: Hot, Cold, and Hardware Explained

Apr, 12 2025

Apr, 12 2025

Crypto Wallet Recommendation Tool

Answer a few questions to get your recommendation

Based on your crypto usage patterns and security needs, we'll recommend the best wallet type for you.

When you buy cryptocurrency, you don’t actually store coins in a digital pocket. What you’re really holding is a set of private keys-complex codes that prove you own your crypto on the blockchain. If you lose those keys, your money is gone forever. That’s why choosing the right crypto wallet isn’t just a technical decision-it’s a safety decision.

What Exactly Is a Crypto Wallet?

A crypto wallet doesn’t hold your Bitcoin or Ethereum like a bank holds cash. Instead, it stores the private keys that let you sign transactions and prove ownership. Think of it like a digital keychain. The wallet app or device gives you access to your keys, but the real value lives on the blockchain. There are two main categories: hot wallets and cold wallets. Hot wallets are always connected to the internet. Cold wallets stay offline. The difference isn’t just technical-it’s about risk.Hot Wallets: Convenience Over Security

Hot wallets are the most common. They’re easy to use, fast to set up, and perfect for trading or everyday spending. If you’re buying NFTs on OpenSea, swapping tokens on Uniswap, or sending Dogecoin to a friend, you’re probably using a hot wallet. There are three types: web-based, mobile, and desktop. Web wallets like MetaMask is a browser extension that works on Chrome, Firefox, and Edge. It supports over 1,200 tokens across Ethereum, Polygon, and other chains. It’s what most DeFi users rely on-2.1 million daily transactions happen through MetaMask alone. Mobile wallets like Trust Wallet (owned by Binance) run on Android and iOS. They support 10 million+ token contracts across 70+ blockchains. You can scan a QR code to pay someone or connect to a dApp in seconds. Desktop wallets like Exodus offer a clean interface and built-in exchange features. You can swap Bitcoin for Litecoin without leaving the app. It supports 50+ blockchains and integrates with Trezor hardware wallets. But here’s the catch: because they’re always online, hot wallets are vulnerable. In 2024, hackers stole $2.7 billion from hot wallets, according to CipherTrace. Most breaches happen through phishing emails, fake browser extensions, or malware. If your phone gets infected, your keys can be stolen in seconds.Cold Wallets: The Safe Vault for Long-Term Holdings

Cold wallets are offline. They’re designed for holding crypto long-term-think years, not days. They’re not meant for daily use. They’re your savings account, not your checking account. The most popular cold wallets are hardware wallets. These are physical devices like the Ledger Nano X or Trezor Model One. They look like USB drives. You plug them into your computer or connect via Bluetooth to sign transactions. Your private keys never leave the device. Ledger Nano X costs $149 and supports 5,500+ cryptocurrencies. It has a small touchscreen and Bluetooth 5.0. Trezor Model One is cheaper at $49 and supports around 1,000 coins. Both use secure chips certified to military-grade standards (CC EAL6+ for Ledger). Even if your computer gets hacked, the wallet stays safe. But cold wallets aren’t foolproof. If you lose the device and don’t have your 12- or 24-word recovery phrase, your crypto is gone. And setting them up can be frustrating. About 28% of users on Amazon say the seed phrase verification process took them over 30 minutes on their first try.

Custodial vs. Non-Custodial: Who Controls Your Keys?

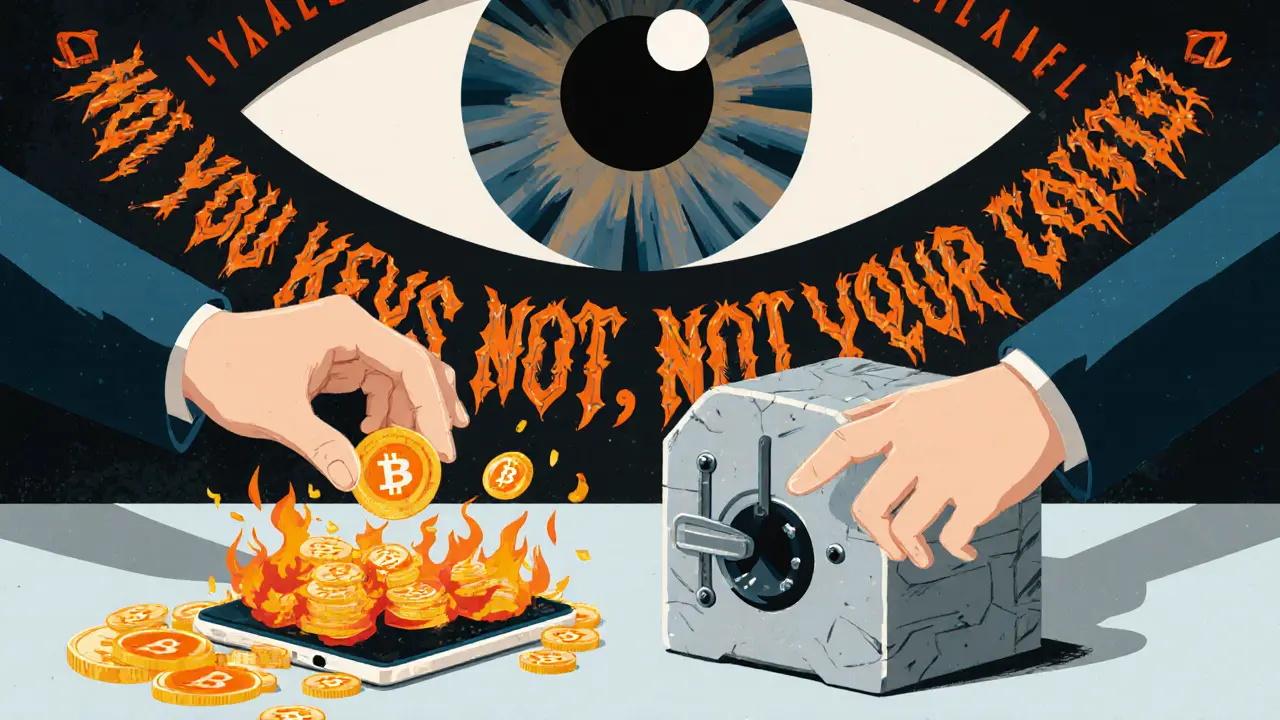

There’s another layer: custody. Some wallets, like Coinbase Wallet, are custodial. That means Coinbase holds your private keys for you. You log in with your email and password. It’s convenient-but you don’t truly own your crypto. If Coinbase goes down or freezes your account, you’re stuck. Non-custodial wallets like MetaMask, Exodus, or Trezor put you in full control. No middleman. No password reset. If you lose your recovery phrase, there’s no customer service to call. That’s why the crypto community says: “Not your keys, not your coins.” For beginners, custodial wallets feel safer. But over time, most serious holders move to non-custodial options. It’s the only way to truly own your assets.Which Wallet Should You Use?

There’s no one-size-fits-all answer. Your choice depends on how you use crypto.- If you trade daily or use DeFi apps like Aave or Uniswap → Use a hot wallet like MetaMask or Trust Wallet.

- If you’re buying and holding Bitcoin or Ethereum for years → Get a hardware wallet like Ledger Nano X or Trezor Model One.

- If you’re new and want simplicity → Try Zengo. It uses biometric login (face or fingerprint) and doesn’t require a recovery phrase. It’s called “keyless security,” and it’s growing fast.

- If you only care about Bitcoin → Sparrow Wallet is the most advanced option, but it’s technical. You need to understand UTXOs and PSBTs.

Real-World Risks and Pitfalls

Even the best wallets can fail if you don’t use them right. The #1 mistake? Writing down your recovery phrase on your phone or cloud storage. That’s like keeping your house key in your front door lock. Hackers can access it remotely. Always write it on paper. Store it in a fireproof safe. Another issue? Connecting to fake websites. Phishing sites look exactly like Uniswap or MetaMask. Always double-check the URL. Bookmark the real ones. Never click links from emails or Discord messages. Hardware wallets aren’t immune either. Security researcher Dan Guido found a flaw in firmware updates affecting three major brands in 2025. The fix? Only update through official apps. Never use third-party tools. And don’t ignore network settings. If you add the wrong blockchain RPC, your transaction might fail or get lost. Always verify chain IDs before sending.The Future of Crypto Wallets

Wallets are changing fast. In 2025, MetaMask rolled out passwordless login using Ethereum’s ERC-6492 standard. That means you can sign in with your phone’s biometrics instead of a password. Ledger released the Nano Flex in September 2025 with Bluetooth 5.2 and a customizable touchscreen. It’s designed to make hardware wallets easier to use. Meanwhile, Zengo and other “keyless” wallets are gaining traction. They use multi-party computation (MPC) to split your key across devices. No recovery phrase needed. If you lose your phone, you can recover access using friends or family. But challenges remain. The SEC has cracked down on wallet providers for unregistered securities. The EU’s MiCA rules now require KYC checks for many wallets. And quantum computing could one day break current encryption. Still, the trend is clear: wallets are becoming more user-friendly, more secure, and more integrated into daily life. The goal isn’t to make everyone a crypto expert. It’s to make crypto as easy to use as Venmo or PayPal-without giving up control.Final Advice: Start Simple, Think Long-Term

If you’re just starting out, use a trusted mobile wallet like Trust Wallet or Coinbase Wallet. Learn how to send, receive, and swap tokens. Get comfortable with your recovery phrase. Once you hold more than $1,000 in crypto, move the bulk to a hardware wallet. Don’t wait until you have $10,000. Security isn’t optional-it’s essential. And never, ever trust anyone who asks for your recovery phrase. No legitimate company will ever ask for it. Ever. Your crypto is only as safe as your wallet. Choose wisely.What’s the difference between a hot wallet and a cold wallet?

A hot wallet is connected to the internet, making it easy to use for trading or payments but vulnerable to hacking. A cold wallet is offline, offering much stronger security for long-term storage. Hardware wallets like Ledger and Trezor are the most common type of cold wallet.

Are hardware wallets really safer than software wallets?

Yes, hardware wallets are significantly safer. In 2024, only $147 million was stolen from hardware wallets compared to $2.7 billion from hot wallets. Their private keys never leave the device, and they use secure chips designed to resist physical and digital attacks. However, they’re only as safe as your recovery phrase-if you lose it, your crypto is gone.

Can I use one wallet for all my crypto?

Many wallets support multiple blockchains. MetaMask, Exodus, and Ledger Nano X all handle Bitcoin, Ethereum, Solana, and dozens of others. But not all wallets support every coin. Always check the official list before buying. If you hold niche tokens, you may need a specialized wallet.

What happens if I lose my recovery phrase?

If you lose your recovery phrase and don’t have a backup, your crypto is permanently lost. There is no customer service, no password reset, and no way to recover it. This is why writing it down on paper and storing it securely is the most important step in crypto ownership.

Should I use a custodial wallet like Coinbase Wallet?

Custodial wallets are fine for beginners or small amounts. They’re easy to use and offer customer support. But if you want true ownership of your crypto, you need a non-custodial wallet where you control the private keys. Once you’re comfortable, move your holdings to a wallet like MetaMask or a hardware device.

Is Zengo really safe without a recovery phrase?

Yes, Zengo uses multi-party computation (MPC) to split your key across secure servers and your device. You log in with your face or fingerprint. No recovery phrase is needed. It’s designed for people who find seed phrases intimidating. However, it’s still relatively new, and you’re trusting Zengo’s infrastructure. For maximum control, hardware wallets remain the gold standard.

priyanka subbaraj

November 27, 2025 AT 17:54Hot wallets are basically digital lockboxes with no alarm system. One phishing link and boom - your life savings vanish like smoke. I lost a friend to this. No recovery. No mercy.

Angel RYAN

November 28, 2025 AT 23:46Just use a hardware wallet if you have more than a coffee’s worth of crypto. Seriously. It’s not that hard. Paper backup. Locked drawer. Done.

Mark Adelmann

November 29, 2025 AT 04:35I started with Trust Wallet because it was easy. Then I moved 90% of my stuff to a Ledger after seeing how many people lost everything to fake MetaMask extensions. Now I feel like I can sleep at night. Also, never store your phrase on Google Docs - yes, someone actually did that and got cleaned out.

imoleayo adebiyi

November 30, 2025 AT 06:03For beginners, custodial wallets are like training wheels. You learn how to ride before you take off the training wheels. There’s no shame in starting simple. Just don’t stay there forever.

Tina Detelj

November 30, 2025 AT 19:15Oh my god, the recovery phrase… it’s the last sacred relic of true ownership in this digital chaos. It’s not a password - it’s your soul’s fingerprint on the blockchain. Write it on paper. Burn it into metal. Bury it in a time capsule with your favorite vinyl. But DO NOT let it live on your phone, your cloud, your email, your sticky note beside your keyboard. If you do, you’re not owning crypto - you’re just renting it from fate. And fate? She’s got a really bad memory.

I once saw a guy cry because he took a screenshot of his 24-word phrase while debugging a dApp. He thought it was safe because he deleted it. But the cloud synced. The backup lived. And the hacker? He had it before the guy even hit delete.

That’s the thing about crypto - it doesn’t care if you’re smart, rich, or well-intentioned. It only cares if you’re careful. And most people? They’re not careful. They’re distracted. They’re rushed. They’re scrolling while their keys are being stolen.

So if you’re reading this and you’ve got a phrase tucked somewhere digital? Go. Right now. Move it. Write it. Lock it. Breathe. You’re not just securing assets - you’re preserving autonomy.

And if you think Zengo’s keyless magic is the future? Maybe. But until I can hold my private key in my hand and know no server, no algorithm, no corporation holds a shadow of it - I’ll stick with cold storage. No exceptions.

Not your keys? Not your coins. Not your life. Not your peace.

ola frank

December 1, 2025 AT 13:04Let’s address the elephant in the room: MPC-based wallets like Zengo are not inherently more secure - they’re just abstracting risk. Instead of a single point of failure (the seed phrase), you now have three: the device, the server-side shards, and the social recovery network. That’s not security - that’s complexity with a UX veneer. And if Zengo’s infrastructure is compromised? You’ve just given up non-custodial control without gaining any real cryptographic advantage. The ERC-6492 standard is promising, but it’s still in its infancy. Until it’s audited by independent third parties with formal verification proofs, treat it as ‘convenient’ not ‘secure.’

Hardware wallets aren’t perfect, but they’re the only solution where the private key never leaves a tamper-resistant enclave. CC EAL6+ certification matters. The secure element isn’t a marketing buzzword - it’s a hardware-level isolation boundary. And yes, firmware updates can be exploited, but that’s why you only update via official channels. The risk profile is orders of magnitude lower than any software wallet.

Also, the claim that ‘$147M stolen from hardware wallets in 2024’ is misleading. That’s mostly social engineering attacks - users tricked into approving malicious transactions on compromised devices. The wallet itself wasn’t hacked. The human was. That’s not a flaw in hardware - it’s a flaw in user education. Which brings us back to the real problem: we’re teaching people to use crypto like apps, not like cryptographic primitives.

Ben Costlee

December 1, 2025 AT 19:14I remember when I first got into crypto - I thought MetaMask was a bank. I didn’t even know what a private key was. I lost $800 to a fake airdrop site because I clicked ‘connect wallet’ without checking the URL. I was furious at myself. But then I found a Reddit thread that walked me through cold storage step by step. It changed everything.

Now I keep $200 in Trust Wallet for small swaps, and the rest on my Ledger. I’ve got my recovery phrase on a stainless steel plate, inside a fireproof safe, with a copy in a locked drawer at my mom’s house. I don’t talk about it online. I don’t post pictures of it. I don’t even tell my partner where the safe is - just that it exists.

It’s not about being paranoid. It’s about being responsible. Crypto doesn’t forgive mistakes. But it does reward patience. And if you take the time to learn how to protect yourself? You’ll be ahead of 90% of the people out there.

You don’t need to be a tech wizard. You just need to be careful.

stephen bullard

December 1, 2025 AT 22:40There’s something beautiful about the idea that your crypto is yours - no gatekeepers, no banks, no middlemen. But that freedom comes with a price: total responsibility. And that’s scary. Most people don’t want that kind of weight. They want someone else to handle it. And that’s okay - for now.

But if you’re reading this and you’ve got more than a few hundred bucks in crypto? You owe it to yourself to learn how to hold your own keys. Not because it’s trendy. Not because someone on YouTube said so. But because no one else can - or will - protect it like you can.

Start small. Get a hardware wallet. Write down your phrase. Double-check it. Store it like it’s your last connection to reality. Then breathe. You’re doing better than you think.

George Kakosouris

December 3, 2025 AT 19:02Let’s be real - the entire ‘cold wallet’ narrative is a myth peddled by hardware vendors. The real security bottleneck isn’t the device - it’s the user’s ability to not be a fucking idiot. 99% of breaches happen because people enter their seed phrase on phishing sites. Not because Ledger got hacked. Not because Trezor has a flaw. Because humans are weak. We click links. We trust Discord DMs. We screenshot passwords. The wallet type is irrelevant if the operator is compromised. Stop fetishizing hardware. Fix the meatware first.

Also, ‘keyless’ wallets? More like ‘trustless’ wallets - except you’re trusting a startup’s API, not a decentralized protocol. It’s custodial 2.0 with extra steps. Don’t be fooled by the buzzwords.