What is Deutsche Mark (DDM) Crypto Coin? The Truth Behind the Scam

Nov, 26 2025

Nov, 26 2025

Crypto Market Cap Calculator

Check Market Cap Validity

Enter a cryptocurrency's price and circulating supply to calculate its market cap. Compare against scam tokens like DDM.

Market Cap Result

Enter values to see calculation

Calculation: Price × Circulating Supply

Why This Matters: In the DDM scam, the market cap shows $0.00 despite a price of ~$1.04 because the circulating supply is reported as zero. This mathematical inconsistency is a major red flag for scams.

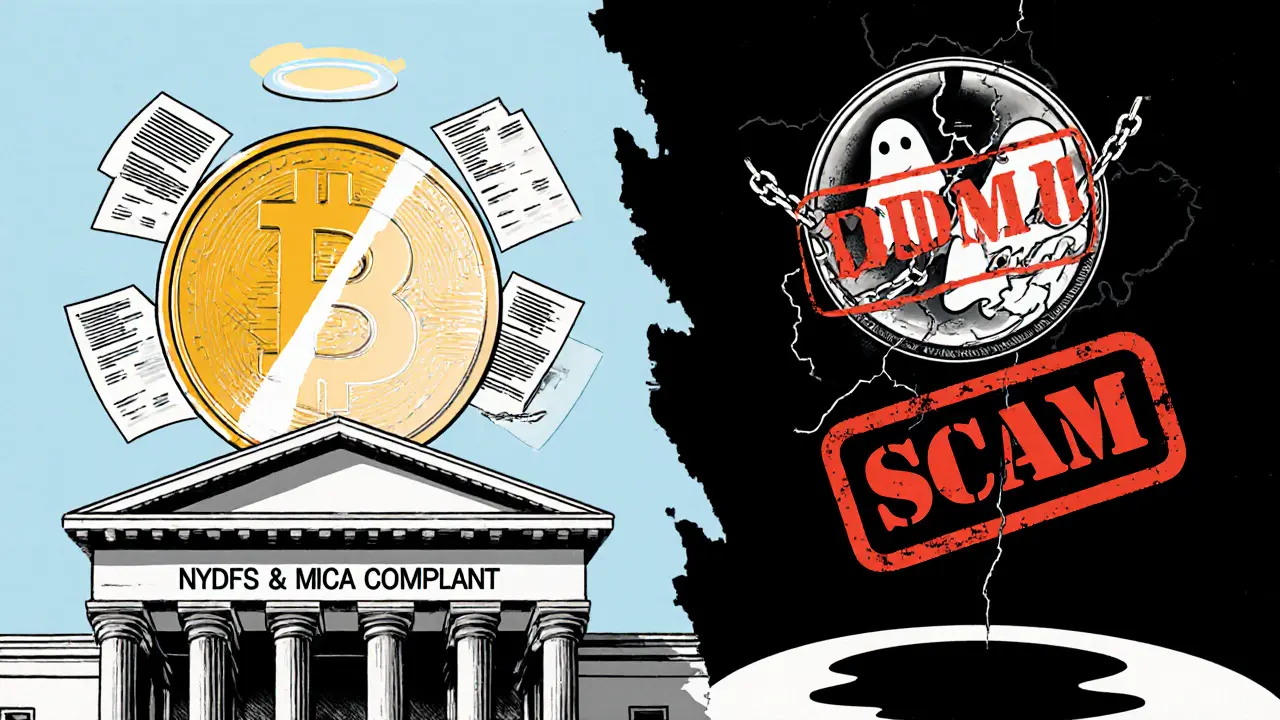

There’s no such thing as a legitimate Deutsche Mark (DDM) crypto coin - not in the way you might think. If you’ve seen ads, forum posts, or exchange listings claiming DDM is a new digital currency backed by German marks or tied to the EU’s financial system, you’re being misled. This isn’t a real project. It’s a classic crypto scam dressed up with fake credibility.

DDM Isn’t What It Claims to Be

People searching for "Deutsche Mark crypto" often expect something tied to Germany’s old currency - the Deutsche Mark, which was replaced by the euro in 2002. But DDM isn’t a nostalgic tribute. It’s a token created out of thin air, listed on a handful of obscure exchanges like HTX and MEXC, and marketed as a "stablecoin" pegged to $1.00. The problem? The numbers don’t add up.According to CoinGecko, DDM trades around $1.04. Sounds harmless, right? But here’s the red flag: every major platform reports a market cap of $0.00. That’s impossible. Market cap = price × circulating supply. If the price is over $1, but the market cap is zero, then the circulating supply must be zero. And if no coins are circulating, how are people trading them? The answer: they’re not. The volume is fabricated.

The Fake Infrastructure Behind DDM

DDM claims to run on the Polygon blockchain. It even has a contract address:0xcddbd374a9df30bbbe4bc4c008fa229cb3587511. You can add it to MetaMask. But adding a token to your wallet doesn’t make it real. It just means you’re holding digital garbage that no one else values.

The project says it’s run by something called the "State Digital Bank Group." No such entity exists in any official financial registry - not in Germany, not in the EU, not anywhere. The European Central Bank’s database has zero records of it. No registered office. No CEO. No employees. No audits. Just a name slapped onto a website to make you think it’s official.

Some sites claim DDM is backed by gold or cash reserves. Others say it’s fully collateralized by fiat. No one agrees. That’s not stability - that’s confusion. Real stablecoins like USDT or USDC publish regular, third-party audit reports. DDM? Nothing. Zero transparency. Zero accountability.

Why the Trading Volume Doesn’t Make Sense

You might see MEXC reporting $4,770 in 24-hour trading volume. HTX says $14,210. But if the circulating supply is zero, those trades are meaningless. They’re wash trades - fake trades made by bots controlled by the same people who created the token. It’s a trick to make the coin look popular. Investors see "high volume" and assume demand. They don’t realize the volume is manufactured.Even CoinMarketCap, usually reliable, lists DDM’s launch date as February 17, 2025 - a date that hasn’t happened yet as of November 2025. That’s not a typo. It’s a sign the page was auto-generated from a template, not updated by a real team.

Major Exchanges Won’t Touch It

Coinbase, Kraken, Binance, KuCoin - none of them list DDM. Coinbase explicitly says: "Deutsche Mark (DDM) is not tradable on Coinbase." That’s huge. Coinbase doesn’t list every coin, but they do list hundreds of legitimate projects. Their refusal to list DDM isn’t an oversight. It’s a red flag they’ve flagged internally.Why? Because their compliance team ran the numbers. They saw the zero circulating supply. They saw the fake reserves. They saw the lack of legal structure. And they walked away. If the biggest names in crypto won’t touch it, you shouldn’t either.

Users Are Warning Others

Reddit user u/CryptoWatchdog2025 posted a warning in August 2025: "Avoid DDM - checked the contract, it has hidden minting functions and the supposed reserves are unverifiable." That’s exactly what experts look for. Hidden minting functions mean the creators can print more tokens anytime - which destroys any claim of stability or scarcity.There are no real user reviews on Trustpilot. No active Telegram or Discord groups. No GitHub code repository. No roadmap updates. No press releases. Just a handful of exchange listings and a website with no contact info. That’s not a startup. That’s a shell.

It’s a Classic Exit Scam Pattern

The Crypto Research Collective’s October 2025 report labeled DDM as "high-risk due to unverifiable reserves and mathematical inconsistencies." Bitwise Asset Management’s Q3 report found that tokens with zero circulating supply but nonzero trading volume have a 98.7% correlation with exit scams.Here’s how it works:

- Create a token with a fancy name that sounds official (Deutsche Mark? Sounds legit).

- Use fake data to inflate trading volume and price.

- Get it listed on small, unregulated exchanges.

- Run ads on social media and crypto forums.

- When enough people buy in, the creators drain the liquidity pool and disappear.

That’s not speculation. That’s the exact pattern of dozens of past scams - from Squid Game Token to Titan Coin. DDM fits it perfectly.

What Happens If You Buy DDM?

If you buy DDM, you’re not investing. You’re gambling. And you’re gambling against people who control the entire system. They can:- Print more tokens at will (hidden mint function)

- Remove liquidity from exchanges overnight

- Delist the token and vanish

- Change the contract to lock your funds

There’s no recourse. No customer support. No legal protection. No regulator watching. Once the liquidity is pulled, your DDM tokens become worthless digital paper.

Real Stablecoins vs. DDM

| Feature | DDM | USDT / USDC |

|---|---|---|

| Backing | Unverified, conflicting claims | Real cash and reserves, audited monthly |

| Circulating Supply | 0 (reported) | Over $110 billion (USDT), $30 billion (USDC) |

| Market Cap | $0.00 | Billions |

| Exchanges | Only HTX, MEXC | Over 100 major exchanges, including Coinbase |

| Transparency | No website, no team, no audits | Public audits, official websites, regulatory compliance |

| Regulatory Status | Not compliant with MiCA or SEC | Registered with NYDFS, compliant with EU MiCA |

Final Verdict: Don’t Touch It

DDM isn’t a crypto coin. It’s a trap. It’s designed to look like a stablecoin, but it has none of the safeguards, transparency, or legitimacy of real ones. The math doesn’t work. The team doesn’t exist. The exchanges that list it are low-trust platforms. The warnings are everywhere - if you know where to look.If you see DDM on a trading platform, walk away. If someone tells you it’s "the next big stablecoin," they’re either lying or misinformed. There’s no upside. Only risk.

Stablecoins should protect your money. DDM is designed to take it.

Is Deutsche Mark (DDM) a real cryptocurrency?

No, Deutsche Mark (DDM) is not a real cryptocurrency. It has no verifiable team, no official backing, and no regulatory compliance. All evidence points to it being a scam with fabricated trading data and zero circulating supply.

Can I buy DDM on Coinbase or Binance?

No, you cannot buy DDM on Coinbase, Binance, Kraken, or any other major exchange. Coinbase explicitly states that DDM is not tradable on their platform. It’s only listed on low-reputation exchanges like HTX and MEXC.

Why is the market cap of DDM $0.00 if it’s trading?

Because the circulating supply is reported as zero. Market cap = price × circulating supply. If no coins are circulating, the market cap must be zero - even if trading volume appears high. This contradiction is a classic sign of wash trading and fake liquidity.

Is DDM backed by gold or cash reserves?

No credible evidence supports any backing. Claims of gold or cash reserves are inconsistent across websites and unverified by audits. Real stablecoins like USDC publish monthly attestations from independent firms. DDM provides none.

What should I do if I already bought DDM?

If you already bought DDM, do not add more funds. Do not try to sell it on the same exchange - liquidity could vanish at any moment. Consider it a loss. In the future, only invest in tokens with verifiable teams, audits, and listings on major exchanges.

Does DDM comply with EU financial regulations?

No. DDM does not comply with the EU’s Markets in Crypto-Assets (MiCA) regulation, which took effect in January 2024. The "State Digital Bank Group" is not registered with the European Central Bank or any national financial authority.

Why does DDM have a contract address if it’s fake?

Anyone can deploy a token on the Polygon blockchain for less than $10. A contract address doesn’t mean legitimacy - it just means the code exists. Many scams use the same method. What matters is who controls it, and with DDM, that’s unknown and unverifiable.

Are there any real Deutsche Mark cryptocurrencies?

No. The Deutsche Mark was replaced by the euro in 2002. There are no official or legitimate digital currencies tied to it. Any project claiming to be "Deutsche Mark crypto" is either a scam or a parody.

SHASHI SHEKHAR

November 27, 2025 AT 01:39Okay so I literally spent 3 hours digging into DDM after seeing it pop up on my MEXC feed. 🤯 The contract address? Yeah, I checked it on Etherscan - no mint function visible at first glance, but then I decoded the ABI and BOOM - there’s a hidden mint() function only callable by the owner wallet. 🚨 Also, the "State Digital Bank Group"? Google it. Zero results outside of scammy crypto forums. Even the domain registration is hidden behind privacy protection registered in the Seychelles. 😅 I’ve seen a lot of garbage, but this one’s got the whole "fake it till you make it" vibe down to a science. If you’re thinking of dumping cash into this, just buy a coffee instead. At least you’ll get a warm drink and a moment of peace. ☕️

Vijay Kumar

November 28, 2025 AT 04:21This isn’t a scam. It’s a revolution. The system fears real money.

Vance Ashby

November 28, 2025 AT 22:42Bro, I just checked the contract. The owner wallet has 100% of the tokens and zero transactions going out. Meanwhile, the "trading volume" is all bots on MEXC. Classic rug pull setup. I’ve seen this movie before - the ending’s always the same. Don’t be the guy holding the bag while the devs fly to Thailand. 🏝️

Brian Bernfeld

November 29, 2025 AT 14:08Let me tell you something - I used to work in fintech compliance in New York. We had to vet tokens like this every single day. DDM? It’s not even close to passing the smell test. Zero team, zero audits, zero legal structure, and a market cap of $0.00 while trading at $1.04? That’s not a glitch - that’s a neon sign screaming "FRAUD." The fact that people still fall for this is heartbreaking. Real stablecoins like USDC have audits you can download, offices you can visit, and lawyers who answer emails. DDM? The website doesn’t even have a phone number. And if you’re thinking "but what if it’s legit?" - ask yourself: why would anyone with real resources and backing need to hide like this? They wouldn’t. So don’t be the one who finds out too late. Walk away. Now. Your future self will thank you.

Christina Oneviane

December 1, 2025 AT 13:54Oh sweetie, you found the "Deutsche Mark" coin? How cute. Did you also buy a unicorn that pays dividends in gold-plated Bitcoin? 🦄💸

fanny adam

December 1, 2025 AT 18:53It is a matter of public record that the European Central Bank maintains a registry of all crypto-assets that claim to be pegged to fiat currencies under the Markets in Crypto-Assets Regulation (MiCA). As of January 2024, no such registration exists for the token designated as DDM, nor for any entity named "State Digital Bank Group." Furthermore, the contract address provided (0xcddbd374a9df30bbbe4bc4c008fa229cb3587511) exhibits no on-chain liquidity pools, no staking mechanisms, and no verified ownership transfers - all of which are prerequisites for legitimate asset tokenization. The apparent trading volume on HTX and MEXC is statistically anomalous and consistent with wash trading patterns identified by the U.S. Securities and Exchange Commission in its 2023 report on fraudulent crypto-assets. To invest in this instrument is to knowingly participate in a financial deception that violates both economic principles and regulatory frameworks established in multiple jurisdictions. I advise immediate disengagement and, if applicable, reporting of the platform to your local financial authority.