What is TrustFi Network (TFI) Crypto Coin? A Real Look at the Platform, Token, and Market Reality

Jan, 31 2026

Jan, 31 2026

TrustFi Network (TFI) isn’t another big-name crypto project with viral hype or a celebrity backer. It’s a quiet, niche tool built for a specific problem: helping early-stage crypto startups manage liquidity and launch tokens without getting lost in the chaos of DeFi. If you’ve ever wondered what happens behind the scenes when a new crypto project tries to raise funds and keep its liquidity locked up safely, TrustFi is one of the tools trying to solve that. But here’s the catch - it’s barely on the radar.

What Exactly Is TrustFi Network?

TrustFi Network is a Blockchain-as-a-Service (BaaS) platform designed to simplify liquidity management and token launches for crypto startups. It doesn’t try to be everything. Instead, it focuses on three core pieces: TrustFi Booster, TrustFi LaunchPad, and TrustFi Farmer. Each handles a different stage of a project’s lifecycle.

TrustFi Booster acts like a pre-launch incubator. It helps new projects build community, run early marketing, and get ready for their token sale. Think of it as the behind-the-scenes team that makes sure a project isn’t just throwing a token into the market with no audience.

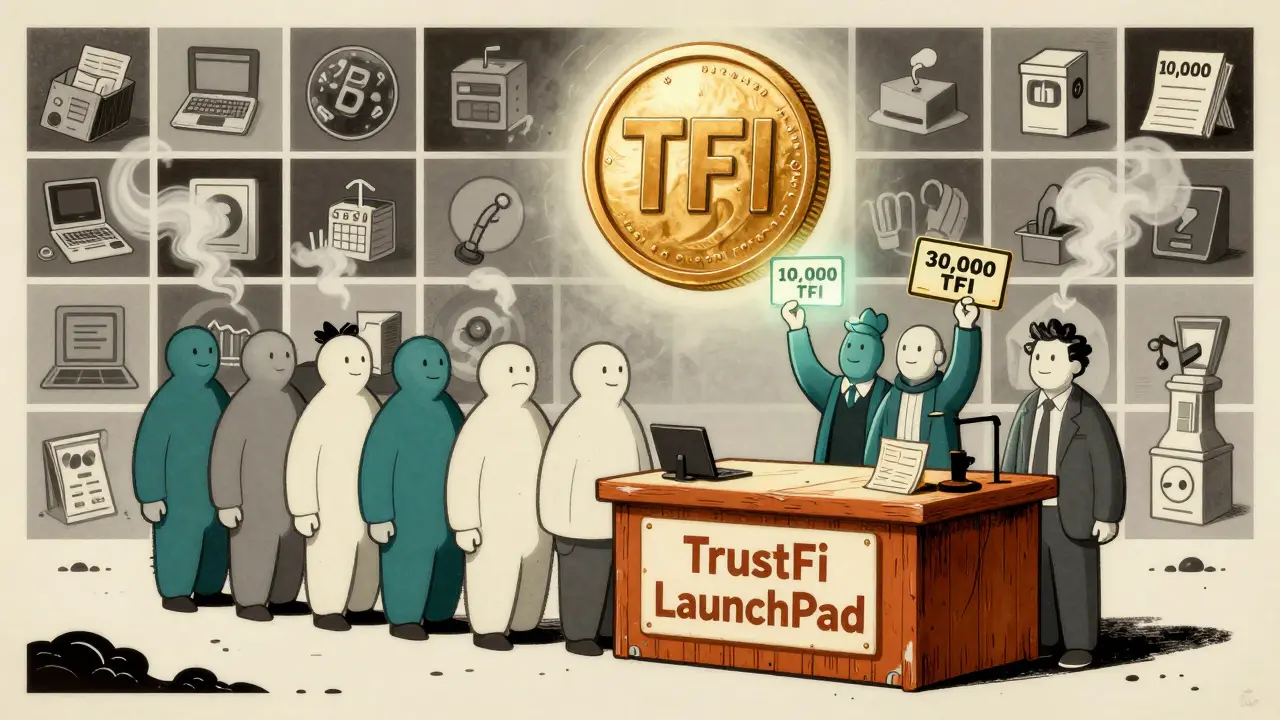

TrustFi LaunchPad is where the actual token sales happen. It runs two types of sales: Flash IDOs (fast, limited-time sales) and Main IDOs (longer, more structured). What’s unusual is its Strong Holder Tier System. If you hold a certain amount of TFI tokens, you get guaranteed access to new token sales - and even a refund guarantee if the project fails. That’s rare. Most platforms don’t offer refunds.

TrustFi Farmer lets users earn rewards by locking up tokens in liquidity pools. It uses an algorithm called AFP (Automated Farm Pools) to manage how rewards are distributed. It’s not groundbreaking, but it’s designed to be simpler than the messy, multi-step farming systems on other DeFi platforms.

The TFI Token: Supply, Use, and How It Works

The TFI token is the native currency of TrustFi Network, used for governance, access, and rewards. It’s not a speculative play like some memecoins - it’s meant to be functional.

There are exactly 100 million TFI tokens total. Half of them - 50 million - are already in circulation as of January 2026. The rest are locked for future ecosystem growth, team incentives, or planned buybacks.

Here’s how holding TFI gives you real benefits:

- 10,000 TFI: Guarantees you a spot in new IDOs and eligibility for refunds if the project fails.

- 30,000-40,000 TFI: Unlocks DAO voting rights, access to private liquidity pools, airdrops from incubated projects, and entry into the TrustFi Ventures VIP Group.

These aren’t just marketing claims. They’re built into the smart contracts. If you hold the tokens, the system automatically gives you access. No middleman. No waiting for approval.

TFI runs on the Binance Smart Chain (BEP20) with contract address 0x7565ab68d3f9dadff127f864103c8c706cf28235. That means you need a wallet like MetaMask, and you have to manually add the token using that contract address. It’s not listed on major exchanges like Binance or Coinbase - only on decentralized ones like PancakeSwap.

Market Reality: Tiny, But Not Invisible

As of January 2026, TFI trades at around $0.00405. That’s less than half a cent. Its market cap is just $194,798. To put that in perspective, Bitcoin’s market cap is over $1 trillion. Even small DeFi tokens like Aave or Uniswap sit in the billions.

On CoinGecko, TrustFi ranks #6129. On CoinMarketCap, it’s #5300. These aren’t just low numbers - they’re near the bottom of the entire crypto list. The 24-hour trading volume? Around $277. That’s less than what a single person might spend on a new gaming console.

Most of that trading happens on PancakeSwap, in the TFI/WBNB pair. The volume there? Just $240.84. That’s not liquidity. That’s barely a trickle.

There’s no real community presence either. No active Discord. No Telegram group with more than a handful of members. Reddit has zero meaningful threads about TrustFi. Trustpilot has no reviews. Even the project’s own website doesn’t link to any social channels.

That’s not normal for a project that claims to be building infrastructure. Most successful DeFi tools - even small ones - have at least a few hundred active users and a team that talks to them regularly. TrustFi doesn’t.

Who Is This For? And Who Should Stay Away?

TrustFi Network isn’t for casual crypto buyers. It’s not for people looking to get rich quick. If you’re here because you saw a TikTok video or a Twitter ad saying “TFI will 100x,” walk away.

This is for one kind of person: early DeFi builders - people who are launching their own tokens or helping others do it. If you’re running a startup and need a simple, refund-guaranteed way to launch your token and lock liquidity, TrustFi’s tools might actually help you. The tiered access system is smart. The refund mechanism is rare. And the integration between incubation, launch, and farming is cohesive.

But here’s the problem: no one else is using it. If you’re a new project, why pick TrustFi over a platform with 10,000 users and clear documentation? Why trust a team that won’t even name themselves?

There’s also no technical deep-dive available. No whitepaper explaining how the AFP algorithm works. No audit reports from firms like CertiK or Hacken. Just high-level descriptions on their website. That’s a red flag for anyone serious about security.

What’s Next? Roadmap or Wish List?

TrustFi’s roadmap looks ambitious:

- Q4 2024: Launch TrustFi Swap, get listed on centralized exchanges, integrate AI models, and do annual TFI buybacks.

- Q1 2025: Open BaaS to all users, launch DAO governance, upgrade VIP system, and release a BaaS tech litepaper.

These sound good. But they’re all future promises. No one has verified them. No one has seen AI integration. No DAO has been launched. And there’s no public proof that any of the planned CEX listings are even in progress.

Compare that to Chainlink, which publishes detailed technical updates every quarter with real data. Or The Graph, which has dozens of developers contributing openly. TrustFi’s roadmap feels like a PowerPoint slide deck - nice to look at, but empty without execution.

The Bottom Line

TrustFi Network (TFI) is not a failed project. It’s a barely alive one. It has a real idea - simplifying DeFi launch tools for startups - and a smart token structure that rewards long-term holders. But it’s missing everything else: users, transparency, community, and proof of execution.

If you’re a developer or founder looking for a simple, refund-backed launchpad, it’s worth a look. But only if you’re willing to go it alone. There’s no support network. No guides. No community. You’re on your own.

For everyone else - traders, investors, or curious newcomers - TFI is a low-risk, low-reward bet. The price is so low that even if it went to $0.10, you’d still only be looking at a 25x return. And that’s a huge "if."

Right now, TrustFi isn’t a coin you buy. It’s a tool you might use - if you’re already deep in the DeFi trenches and need something specific. Outside of that? It’s a ghost in the machine.

Is TrustFi Network (TFI) a good investment?

No, not as a typical investment. TFI has extremely low liquidity, no major exchange listings, and almost no community or user base. Its price is near $0.004, and trading volume is under $300 per day. Even if the project succeeds, the upside is limited by its tiny market cap. Only consider it if you’re a DeFi builder who needs its specific tools - not if you’re hoping for price growth.

Where can I buy TFI tokens?

TFI is only available on decentralized exchanges, primarily PancakeSwap (v2) on the Binance Smart Chain. You’ll need a wallet like MetaMask, and you must manually add the token using the contract address: 0x7565ab68d3f9dadff127f864103c8c706cf28235. It’s not listed on Binance, Coinbase, or any other major exchange.

What makes TFI different from other DeFi launchpads?

TFI’s main difference is its refund guarantee for IDO participants who hold enough TFI tokens. Most platforms don’t offer refunds if a project fails. TFI also combines incubation (Booster), token launch (LaunchPad), and liquidity farming (Farmer) into one ecosystem, which is rare. But its lack of transparency and low adoption make it hard to compare with more established platforms like DAO Maker or Polkastarter.

Does TrustFi have an audit or security report?

No public audit reports from firms like CertiK, Hacken, or PeckShield are available. The project’s website and documentation don’t mention any security audits. This is a major red flag for any DeFi project, especially one handling token launches and liquidity locks. Without an audit, you’re trusting code that hasn’t been reviewed by independent experts.

Can I use TrustFi if I’m new to crypto?

Not easily. TrustFi requires you to interact with MetaMask, add custom tokens, use PancakeSwap, and understand concepts like liquidity pools and IDOs. There’s no beginner guide, no customer support, and no active community to help. It’s designed for experienced DeFi users - not newcomers.

What’s the total supply of TFI?

The total supply of TFI is fixed at 100,000,000 tokens. As of January 2026, 50,000,000 are in circulation. The rest are reserved for future ecosystem development, team incentives, and planned buybacks.

Is TrustFi Network a scam?

There’s no evidence it’s a scam. The smart contracts are live, the token is tradable, and the team’s stated goals are plausible. But the lack of transparency - no team names, no audits, no community, no documentation - makes it high-risk. It’s not fraudulent, but it’s also not trustworthy. Treat it like a prototype, not a proven product.

What’s the future of TrustFi Network?

Its future depends entirely on execution. If TrustFi launches its AI models, opens BaaS to the public, and gets listed on centralized exchanges, it could grow. But so far, there’s zero proof it can deliver on its roadmap. Without real adoption or developer activity, it will likely fade into obscurity like hundreds of other small DeFi projects.

Akhil Mathew

January 31, 2026 AT 18:45TrustFi’s actually one of the more interesting niche plays I’ve seen in a while. Most launchpads are just cash grabs with flashy websites, but this thing has a real workflow - Booster → LaunchPad → Farmer. The refund guarantee on IDOs is insane. No one else does that. Even DAO Maker just leaves you high and dry if a project rug pulls. And the tiered TFI access? Smart. It’s not about speculation, it’s about utility. If you’re building something, this could save you months of dev time.

Yeah, the volume’s trash. Yeah, no Discord. But remember Uniswap in 2019? Barely anyone knew about it. The tech’s there. It’s just not marketed. The real question is: who’s using it behind the scenes? If startups are quietly launching on it, the market cap will catch up when they do.

Parth Makwana

February 2, 2026 AT 13:20While I appreciate the technical architecture of TrustFi Network, one must acknowledge the profound structural deficiencies in its go-to-market strategy. The absence of a publicly verifiable audit trail, coupled with the nonexistence of institutional-grade documentation, renders this protocol vulnerable to systemic risk. Furthermore, the liquidity profile - a mere $277 daily volume - suggests a critical failure in network effects adoption. In the context of modern DeFi infrastructure, such obscurity is not a virtue; it is a liability.

The Strong Holder Tier System, while theoretically elegant, lacks the regulatory clarity required for institutional participation. One cannot build sustainable ecosystems on opacity. The roadmap, though ambitious, reads like a fantasy whitepaper devoid of milestones or deliverables. Until TrustFi publishes verifiable on-chain analytics, developer activity logs, and third-party security attestations, it remains an academic exercise rather than a viable infrastructure layer.

For the discerning builder, the risk-reward calculus is unbalanced. The potential upside is negligible against the existential threat of unaudited smart contracts. One must ask: if this were a traditional SaaS platform, would any VC fund it with zero transparency? The answer is no. And in crypto, transparency is not optional - it is the bedrock of trust.

Elle M

February 3, 2026 AT 15:03Oh wow. A crypto project that doesn’t have a TikTok influencer, a dog logo, or a 1000x promise. How… quaint. You mean to tell me this thing actually has a use case? And no one’s talking about it? Shocking. I guess in America we only care about coins that get memed into oblivion. This is what happens when you let engineers build things instead of marketers. It’s like finding a perfectly tuned engine in a junkyard - no one sees it because it doesn’t glow in the dark.

Also, the fact that you need to manually add the token? That’s not a bug, it’s a feature. It filters out the degens. Only real builders will bother. The rest are busy chasing Shiba Inus and yelling about ‘diamond hands’ while their wallets are empty.

Tom Sheppard

February 5, 2026 AT 04:50bro this is actually kinda cool if you’re into the real grind 😎

no hype, no influencers, just a tool that does one thing and does it decently. i’ve seen so many projects with 100k followers and zero actual code - this feels like the opposite. the refund thing is wild, tbh. like, who even thinks of that? 🤯

and yeah the volume is trash, but maybe that’s because it’s not for you. it’s for the devs building in the shadows. i’d rather use something quiet that works than some coin that’s trending because a celeb posted a selfie with it.

also, adding the contract manually? that’s not hard. if you’re using pancake swap, you already know how to do that. if you don’t… maybe stick to binance for now 😅

Ramona Langthaler

February 6, 2026 AT 14:31low volume = low braincell demand. this isn’t a project, it’s a graveyard with a website. no audit? no team? no community? congrats, you’ve built the crypto version of a ghost town. if you’re not even naming your devs, why should i trust your code? it’s not ‘quiet innovation’ - it’s cowardice. and the fact that people are calling this ‘real’ is the most depressing thing in crypto right now. you’re not a builder, you’re a ghostwriter for a dead idea.

Devyn Ranere-Carleton

February 8, 2026 AT 03:16wait so if i hold 10k TFI and the project i bought into fails, i get my money back? that’s actually insane. no other launchpad does that. even if the volume is trash, that one feature alone makes it worth looking into. i’ve lost money on 3 idos already because they just vanished. if this works, even just for 1 or 2 projects, it’s a game changer. why isn’t anyone talking about this?

Rico Romano

February 9, 2026 AT 11:58It’s amusing how the so-called ‘builders’ in this thread romanticize obscurity as virtue. TrustFi is not a hidden gem - it is a failed experiment masquerading as innovation. The absence of a team, audit, or community is not ‘quiet’ - it is catastrophic. The AFP algorithm? No whitepaper. The ‘Strong Holder Tier System’? A cleverly disguised paywall for a product no one uses. And yet, you call this ‘smart’?

Let me be clear: if you’re building on a protocol that cannot even name its developers, you are not a builder - you are a volunteer for a scam waiting to happen. The market cap is $200k because it deserves to be. This isn’t DeFi. It’s a PowerPoint deck with a blockchain layer.

And for those who compare it to Uniswap in 2019 - Uniswap had code, documentation, a team, and a public GitHub. TrustFi has a contract address and a website built with WordPress. The difference isn’t just scale - it’s integrity.