What is Vera (VERA) crypto coin? Token details, price history, and market reality

Feb, 19 2026

Feb, 19 2026

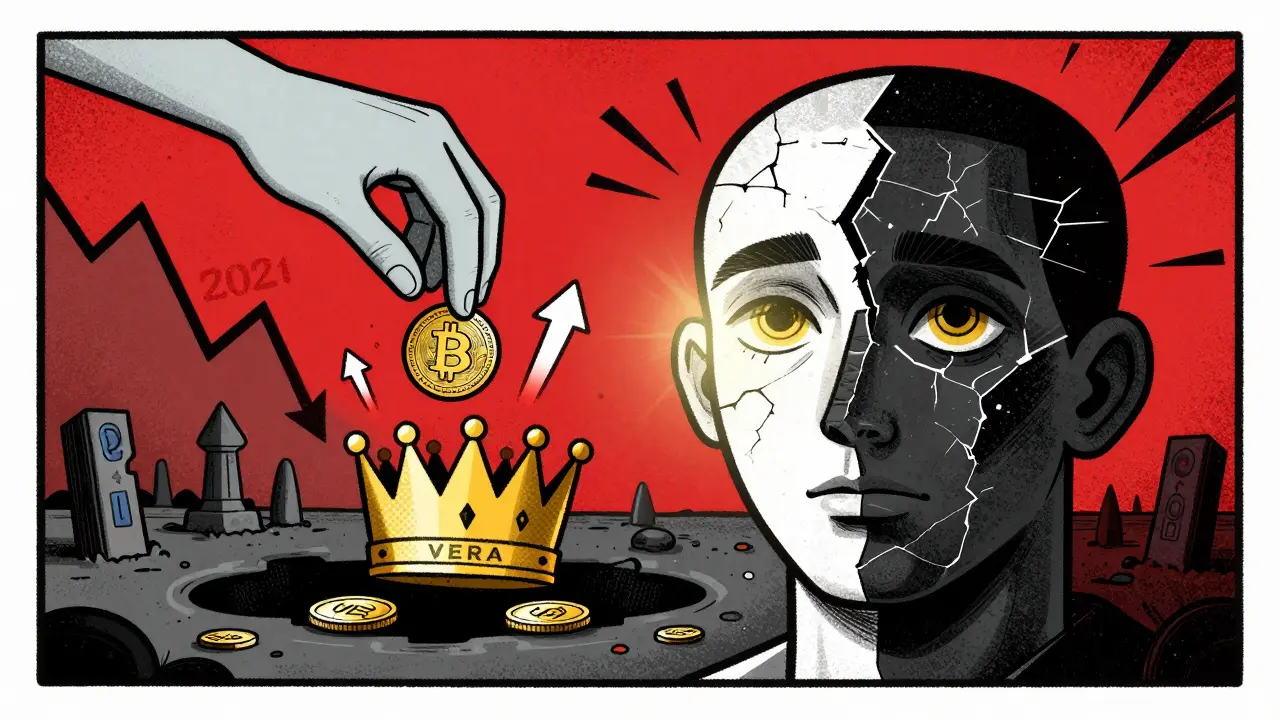

When you hear the name Vera (VERA), you might think it’s another promising crypto project trying to unlock the future of digital assets. But the truth is far more complicated - and far more cautionary. Vera is a cryptocurrency built on Ethereum that was meant to revolutionize how NFTs are rented, financed, and traded. Instead, it became one of the most dramatic collapses in crypto history.

What Vera was supposed to do

Vera launched in 2021 at the peak of the NFT boom. Its goal was simple: let people use their NFTs like bank assets. Imagine owning a digital artwork or a virtual land plot - instead of just holding it, you could rent it out, use it as collateral for a loan, or even mortgage it. Vera’s token, VERA, was designed to power this entire system. It wasn’t just a currency. It was the fuel for a whole new financial layer on top of NFTs. The idea made sense. NFTs were selling for millions, but no one could use them to get cash without selling outright. Vera promised to change that. It wanted to build open, decentralized tools so anyone - whether they had $10 or $100,000 - could access NFT-based credit. Sounds smart? It was. But execution, adoption, and market timing turned it into a cautionary tale.Supply and structure

Vera’s tokenomics were straightforward. There are exactly 1 billion VERA tokens in total - no more, no less. That’s a fixed supply, which is common in crypto to prevent inflation. But here’s the catch: only about 250 million are circulating right now. That means 75% of all tokens are locked up, unused, or held by early investors who haven’t sold. This isn’t unusual in crypto. But when combined with what happened next, it became a red flag. If most of the supply isn’t even moving, how many people are really using the platform? The answer, as we’ll see, is almost none.Price history: From $0.67 to $0.00006

Vera’s price tells the whole story. On November 12, 2021, VERA hit its all-time high of $0.6718. That was during the NFT frenzy. People were buying pixelated apes for millions. Vera’s vision seemed like the next big thing. Fast forward to February 6, 2026. Vera crashed to $0.00006391 - a drop of 99.99%. That’s not a correction. That’s a wipeout. For context: if you bought $1,000 worth of Vera at its peak, you’d now have about 95 cents. As of February 19, 2026, prices hover between $0.000064 and $0.000148 - depending on which exchange you check. CoinGecko says $0.000143. CoinMarketCap says $0.000064. Why the difference? Because there’s almost no trading happening. Vera’s daily volume is under $70,000. That’s less than what a single popular meme coin trades in an hour.Market rank and liquidity

Vera is ranked #8561 on CoinGecko. That’s not just low - it’s buried. Out of over 25,000 cryptocurrencies, Vera is in the bottom 3%. Its market cap is around $33,000. For comparison, even obscure tokens with no real use case often trade at $1 million or more. Vera is smaller than many local startup funding rounds. And here’s the scary part: 99.6% of all Vera trading happens on one exchange - AscendEX (formerly BitMax). The rest? A few hundred dollars on Uniswap and PancakeSwap. That’s not a healthy market. It’s a single point of failure. If that one exchange goes down, or if the team pulls the plug, Vera could vanish overnight. There’s no liquidity cushion. No backup. No safety net.

Is Vera still being developed?

There’s no public evidence that Vera’s team is still active. No recent blog posts. No GitHub commits. No new partnerships. No updates on Twitter or Discord. The website still exists, but it’s static - like a museum exhibit of a dead idea. Compare that to real projects. Look at Aave or Compound. They release monthly updates, show user growth, list new features, and publish audits. Vera? Silence. The last major update was in 2022. Since then, it’s been a ghost. The protocol was meant to let people lease NFTs or take out loans using them as collateral. But there are no known users. No transaction logs. No smart contract activity beyond tiny, random trades. If Vera’s system was working, you’d see dozens - if not hundreds - of active loans every week. You don’t. You see nothing.Technical signals: Overbought and fragile

Some people point to recent price moves as a sign of life. Over the last week, Vera jumped 16.2%. That’s more than Ethereum and the whole crypto market. Sounds bullish, right? Not really. The 14-day RSI (a common technical indicator) is at 84.74. Anything above 70 means the asset is overbought - meaning it’s likely due for a drop. The fact that it’s at 84.74 means traders are buying aggressively, but not because the project improved. They’re gambling on a rebound from the all-time low. Volatility is only 2.67%. That’s unusually low for crypto. Normally, when a coin is this cheap, it swings wildly. Vera doesn’t. Why? Because almost no one is trading it. The price doesn’t move because there’s no demand - not because it’s stable.Price predictions: Wild guesses

Some websites claim Vera will hit $0.00024 by 2026. Others say it’ll crash to $0.00007. WalletInvestor says $0.000134. PricePrediction.net says $0.00024097. That’s a 150% spread between forecasts. Why? Because there’s no data to base predictions on. No user growth. No revenue. No adoption. These aren’t forecasts - they’re random guesses. If you’re using price prediction tools on Vera, you’re not analyzing a project. You’re playing roulette.

Why Vera failed

Vera didn’t fail because it was a bad idea. It failed because it was too early, too niche, and too poorly executed. The NFT market crashed hard in 2022. People stopped buying digital art. Investors ran for the exits. Projects that relied on NFT hype vanished. Vera was one of them. It also never built a real user base. No influencers promoted it. No big wallets adopted it. No dApps integrated with it. Without users, a protocol is just code. And code without users is worthless. Worse, the team never explained how they’d get people to use it. There was no roadmap. No clear incentives. No marketing. Just a whitepaper and a token.Should you buy Vera?

If you’re asking this question, you’re probably hoping for a miracle. A 100x return. A comeback story. Here’s the hard truth: Vera is not an investment. It’s a speculative gamble on a dead project. The price is so low because there’s no reason for it to go up. No demand. No utility. No team. No future. If you’re thinking of buying Vera because it’s cheap, remember: the cheapest coins are often the most dangerous. You’re not getting a bargain. You’re buying into a graveyard. Real crypto opportunities don’t need to be cheap to be valuable. They need to solve real problems. Vera doesn’t solve anything anymore.What’s next for Vera?

The most likely outcome? Vera fades into obscurity. It might trade at $0.00005 for the next five years. Someone might buy a few thousand tokens for fun. A few bots might keep the price alive with tiny trades. But it won’t recover. It won’t relaunch. It won’t matter. The NFT finance space still has potential. But Vera isn’t part of it. The real innovation is happening elsewhere - in protocols with active teams, real users, and transparent development. Vera is a reminder: in crypto, vision isn’t enough. Execution matters. Community matters. Transparency matters. Without them, even the smartest ideas die quietly.Is Vera (VERA) a good investment?

No. Vera is not a good investment. Its price has dropped over 99.99% from its peak, trading volume is extremely low, and there’s no evidence the team is still active. The token lacks utility, community support, or development updates. Buying Vera is speculative gambling, not investing.

Can I use Vera to rent or finance NFTs?

No. Despite its original purpose, there are no known users or active smart contracts using Vera for NFT renting, leasing, or financing. The protocol appears abandoned. No dApps integrate with it, and no transactions suggest real-world usage.

Why is Vera’s price so different on different exchanges?

Because trading volume is extremely low and concentrated on one exchange - AscendEX. With only $70,000 traded daily across all platforms, small trades can swing prices dramatically. Different exchanges report different prices because there’s no consistent market activity to anchor the value.

Is Vera built on Ethereum?

Yes. Vera is an Ethereum-based token. It follows the ERC-20 standard and interacts with Ethereum smart contracts. However, its low usage means it has little impact on the Ethereum ecosystem.

What happened to the Vera team?

There is no public information about the Vera team after 2022. No social media updates, no GitHub activity, no press releases. The official website is static. This silence strongly suggests the project has been abandoned.

How many Vera tokens are in circulation?

Approximately 250 million out of 1 billion total tokens are circulating. Different tracking sites report slightly different numbers (250M-253M), but all agree that over 75% of the supply is locked or inactive, which contributes to the token’s lack of liquidity and market depth.

Can Vera’s price recover?

A recovery is theoretically possible, but extremely unlikely. For Vera to rebound, it would need a complete restart: a new team, active development, real adoption, and massive marketing. None of these exist. Without them, the token will continue to trade at near-zero levels.

Where can I trade Vera (VERA)?

Vera trades primarily on AscendEX (BitMax) with VERA/USDT pairs. Smaller volumes exist on Uniswap V2 (VERA/WETH) and PancakeSwap V2 (VERA/WBNB). Due to the low volume and concentration on one exchange, trading Vera carries high slippage and liquidity risk.

What is Vera’s all-time high and low?

Vera’s all-time high was $0.6718 on November 12, 2021. Its all-time low was $0.00006391 on February 6, 2026. The price has fallen over 99.99% since its peak, making it one of the most severely depreciated cryptocurrencies in history.

Is Vera a scam?

There’s no public evidence Vera was a scam from the start. It was likely a legitimate project that failed due to poor execution, lack of adoption, and timing. But after years of silence, zero updates, and no user activity, it’s effectively abandoned. Buying it now is not investing - it’s betting on a ghost.