Global Crypto Adoption Index by Country 2025: Top Nations and What Drives Adoption

May, 24 2025

May, 24 2025

Crypto Adoption Comparison Tool

Top 5 Countries

Key Insight

The country with the highest ranking depends entirely on which metric you use. For example, Ukraine ranks #1 in per-capita adoption but #10 in total users because it has a small population.

By 2025, more than 12.4% of the world’s population owns some form of cryptocurrency. That’s over 960 million people-more than the entire population of the European Union. But where are they? And why are some countries leading while others lag, even when regulations seem similar?

The answer isn’t simple. There’s no single global tracker. Different organizations measure adoption in different ways. Chainalysis looks at transaction volumes and institutional flows. ApeX Protocol tracks search trends and ownership rates. Henley & Partners evaluates legal frameworks for crypto millionaires. Each gives a different picture. And none tells the whole story.

India Leads, But Not Because of Regulations

India tops the Chainalysis Global Crypto Adoption Index for the third year in a row. Why? Not because the government supports it. In fact, Indian regulators have repeatedly warned about crypto risks. But over 100 million Indians use crypto anyway. Why? Because it works for them.

Many use crypto to send money home. Remittances from the Gulf, the U.S., and Europe are huge in India. Traditional banks charge high fees and take days. Crypto transfers happen in minutes for pennies. Others use it to protect savings from rupee inflation. And younger users trade on local exchanges like CoinSwitch and ZebPay, often with small amounts-$5, $10, $20 at a time.

Chainalysis counts these small, frequent transactions. That’s why India leads. It’s not about big investors. It’s about everyday people finding a better way to move money.

The U.S. Surges Into Second Place

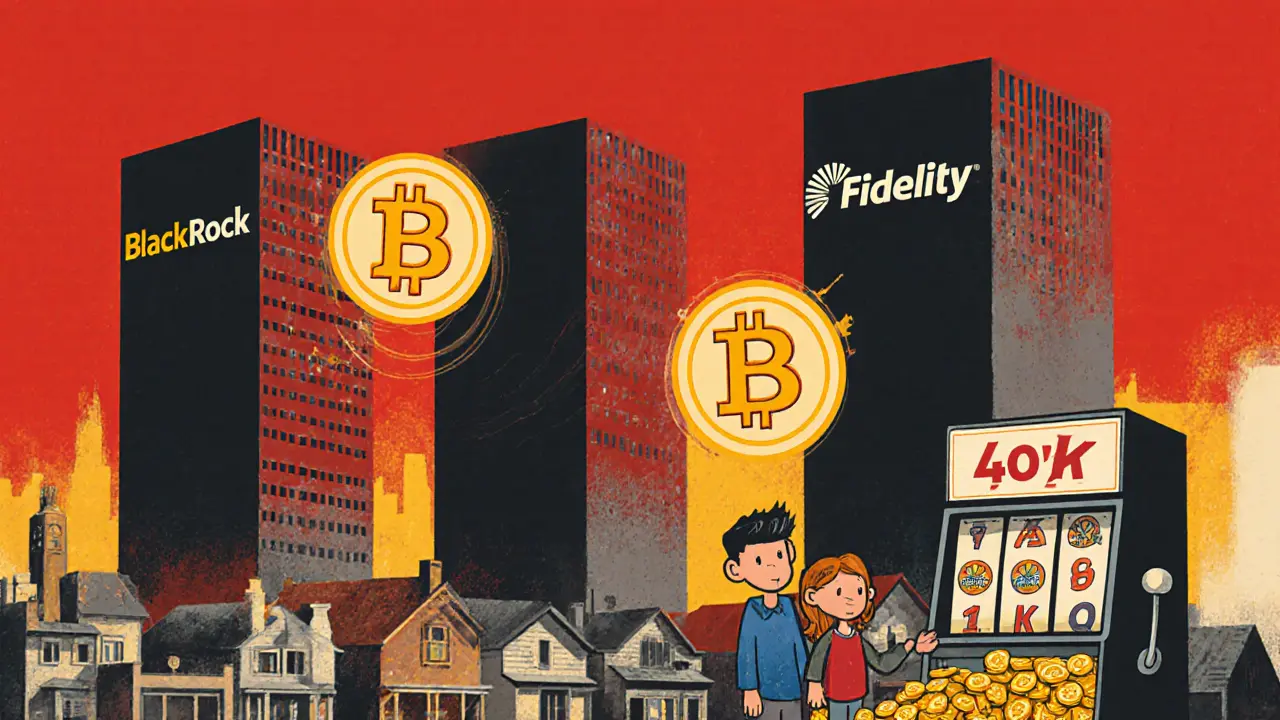

The United States jumped from fifth to second in 2025. The reason? Spot Bitcoin ETFs. When the SEC approved them in early 2024, institutional money flooded in. BlackRock, Fidelity, and Vanguard started offering Bitcoin as a fund option. Millions of Americans bought Bitcoin through their 401(k)s and brokerage accounts for the first time.

But here’s what most people miss: the U.S. ranking didn’t rise because of retail trading. It rose because of transfers over $1 million. Chainalysis added this new category in 2025 to reflect institutional behavior. The U.S. now leads in large-value inflows. Hedge funds, family offices, and even pension funds are moving crypto onto their balance sheets. That’s a structural shift-not a trend.

Still, U.S. ownership sits at 15.56%, according to Triple-A. That’s higher than the global average. But it’s not widespread. Most Americans still don’t touch crypto. The real growth is in the top 5% of investors.

Small Countries, Big Adoption

If you look at population-adjusted rankings, the picture changes completely. Ukraine leads. Then Moldova. Then Georgia. Jordan. Hong Kong.

These aren’t rich nations. Ukraine’s GDP per capita is less than $5,000. Moldova’s is under $4,000. Yet crypto usage there is massive. Why? Because their currencies are unstable. Inflation hit 20% in Moldova in 2024. In Ukraine, the hryvnia lost value after the war disrupted banking systems. People turned to Bitcoin and USDT to save their money.

These countries also have high internet penetration and young populations. Crypto isn’t a luxury-it’s a survival tool. And because these nations have small populations, even a few hundred thousand users make a big difference in per-capita terms.

Chainalysis found that Ukraine and Moldova also rank highest in institutional crypto inflows. That’s not a coincidence. Foreign investors, crypto funds, and even humanitarian organizations are using these countries as gateways to move money in and out of regions with restricted banking.

Singapore and the UAE: Crypto Hubs Built on Policy

While India and Ukraine show organic adoption, Singapore and the UAE show what happens when governments actively build crypto infrastructure.

Singapore leads in search interest: 2,000 crypto-related queries per 100,000 people. That’s double the U.S. rate. It also has the highest percentage of crypto owners in Asia: 24.4%. Why? Because it’s easy to operate here. Crypto exchanges are licensed. Taxes are clear. Banks work with crypto firms. And the government actively recruits blockchain startups.

The UAE is even more extreme. Over 25% of its population owns crypto. That’s the highest rate in the world. Dubai offers virtual asset licenses. Abu Dhabi has a free zone for crypto firms. And there’s no capital gains tax on crypto. The country doesn’t just allow crypto-it’s betting its economic future on it.

These aren’t just places where people trade. They’re places where crypto is embedded in the financial system. You can pay rent in Bitcoin. Buy property with Ethereum. Even open a crypto-backed mortgage.

Why Nigeria Dropped to Sixth

Nigeria used to be the second most crypto-adoption country in Africa. In 2023, it ranked fourth globally. In 2025, it dropped to sixth.

Why? Because of the Central Bank’s restrictions. In 2021, Nigeria banned banks from processing crypto transactions. That didn’t stop adoption-it just pushed it underground. People used peer-to-peer platforms, mobile wallets, and cash-based exchanges. But Chainalysis can’t measure those flows well. Their system relies on data from centralized exchanges and web traffic.

So even though millions of Nigerians still trade crypto, the official numbers dropped. It’s a classic case of policy failing to reflect reality. The people didn’t stop using crypto. The measurement tools just stopped seeing it.

Latin America: Crypto as Inflation Armor

Brazil is fifth on the Chainalysis list. Venezuela is ninth in per-capita adoption. Argentina? Top 10. Why? Because their currencies are collapsing.

In Venezuela, the bolívar lost 99% of its value since 2018. People can’t buy groceries with cash. But they can buy USDT on Telegram groups. In Argentina, inflation hit 300% in 2024. People convert pesos to Bitcoin every payday. Then they spend it on imported goods or send it abroad.

It’s not speculation. It’s survival. And it’s working. Crypto isn’t an investment here-it’s a currency. People price goods in USDT. They pay salaries in Bitcoin. Local businesses accept it because they have no other choice.

What the Numbers Don’t Show

All these indices have blind spots. Chainalysis doesn’t count decentralized exchanges like Uniswap or PancakeSwap well. Many users trade on DEXs to avoid KYC. That’s especially true in countries with strict controls.

Also, these rankings ignore privacy coins. Monero and Zcash are used heavily in Eastern Europe and Central Asia-but they’re invisible to most trackers. Chainalysis says DeFi usage is too niche to count. But in places like Ukraine and Nigeria, DeFi lending platforms are where people earn interest on their crypto.

And then there’s the issue of data quality. Web traffic doesn’t always mean real users. A single server in a data center can generate thousands of fake visits. Some countries inflate their rankings by running bot networks to appear more active.

Bottom line: the rankings are useful-but they’re not perfect. They’re snapshots. Not maps.

What’s Next for Crypto Adoption?

The Asia-Pacific region saw a 69% surge in crypto transaction value in 2025. That’s the fastest growth of any region. India, Vietnam, Indonesia, and the Philippines are driving it. These countries have young populations, high mobile usage, and weak banking systems. Crypto fills the gaps.

In the West, adoption is becoming institutional. More pension funds, endowments, and sovereign wealth funds are adding Bitcoin to their portfolios. The U.S., Canada, and Switzerland are leading here.

Meanwhile, the Global South is using crypto to bypass broken systems. It’s not about wealth. It’s about access. And that’s the real story behind the numbers.

By 2026, we’ll likely see even more countries adopt crypto-friendly laws. But the biggest drivers won’t be governments. They’ll be people-ordinary people who just want to move money, protect savings, and get paid without middlemen.

Which country has the highest crypto adoption rate in 2025?

By total users, India leads with over 100 million crypto owners. But by per-capita adoption, Ukraine is number one, followed by Moldova and Georgia. When measuring ownership percentage, the United Arab Emirates leads at 25.3%, with Singapore at 24.4%.

Why is the U.S. ranked second in crypto adoption?

The U.S. moved to second place primarily because of institutional activity. After the approval of spot Bitcoin ETFs in 2024, trillions in institutional capital flowed into Bitcoin through major financial firms. Chainalysis’s 2025 index now weights large transfers (over $1 million) heavily, which boosted the U.S. ranking significantly.

Does regulation help or hurt crypto adoption?

It depends. Clear, supportive regulations-like in Singapore, the UAE, and Switzerland-boost institutional adoption and public trust. But heavy restrictions, like Nigeria’s bank ban, don’t stop adoption-they just make it harder to measure. In many cases, people adapt by using peer-to-peer platforms, which aren’t captured by traditional indexes.

Why do small countries like Ukraine and Moldova rank so high?

These countries have high per-capita adoption because their currencies are unstable and banking systems are unreliable. People use crypto to protect savings from inflation, send remittances, and access global financial services. Even small numbers of users make a big difference when the population is under 10 million.

Is crypto adoption growing faster than traditional finance?

Yes. From 2018 to 2023, the crypto sector grew at a compound annual rate of 99%. Traditional payment systems grew at just 8% over the same period. In 2025, global crypto ownership reached 12.4%, up from 6.8% in 2024. Growth is strongest in emerging markets where traditional banking is weak.

How accurate are crypto adoption rankings?

They’re useful but incomplete. Most indexes rely on data from centralized exchanges and web traffic, missing peer-to-peer trades, privacy coins, and decentralized finance. Countries with high underground adoption-like Nigeria or Venezuela-often appear lower than they should. The rankings reflect measurable activity, not total usage.