Bybit Nigeria: Crypto Trading, Regulations, and What You Need to Know

When you're looking to trade crypto in Nigeria, Bybit, a global cryptocurrency exchange offering futures, spot trading, and staking. Also known as Bybit Exchange, it's one of the platforms many Nigerians turn to for access to Bitcoin, altcoins, and leverage trading—despite unclear official support in the country. But here’s the thing: Bybit doesn’t have a Nigerian office, doesn’t register with the SEC Nigeria, and doesn’t offer local currency deposits like Naira. That doesn’t mean Nigerians can’t use it—many do—but it means you’re on your own when it comes to withdrawals, disputes, or account freezes.

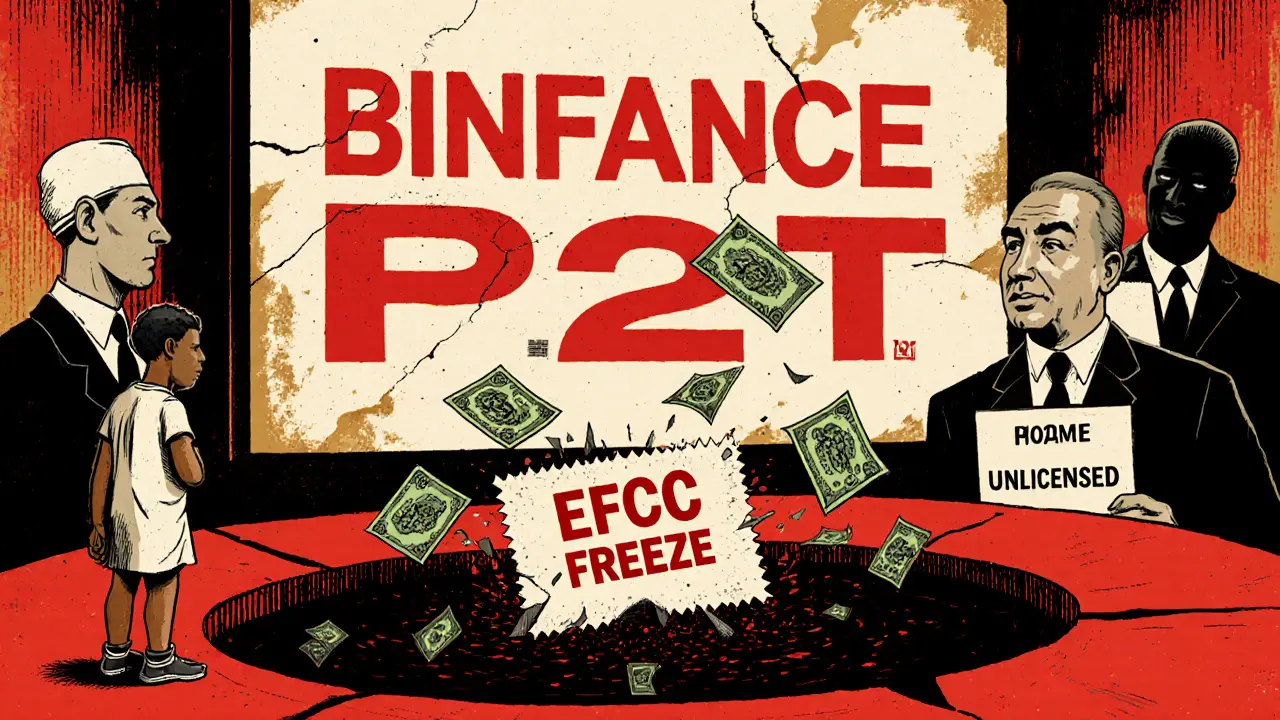

Using Bybit, a global cryptocurrency exchange offering futures, spot trading, and staking. Also known as Bybit Exchange, it's one of the platforms many Nigerians turn to for access to Bitcoin, altcoins, and leverage trading—despite unclear official support in the country. in Nigeria often means relying on P2P payment methods like bank transfers, PayPal, or even gift cards. This setup is risky. Many users report frozen accounts after large deposits, and customer support is slow or nonexistent for non-verified users. The Nigerian crypto regulations, a patchwork of Central Bank of Nigeria restrictions and SEC warnings against unlicensed platforms make it hard to know what’s legal. While owning crypto isn’t banned, operating an exchange without a license is. That puts users in a gray zone—especially when using platforms like Bybit that don’t comply with local rules.

What’s more, Nigerian traders are often targeted by scams pretending to be Bybit support. Fake websites, Telegram bots, and Instagram influencers promise "exclusive bonuses" or "high-yield staking"—all designed to steal your private keys. The crypto exchange Nigeria, the ecosystem of platforms accessible to Nigerian users, including both regulated and unregulated services is full of these traps. Real alternatives like Binance, Luno, and Quidax at least offer Naira on-ramps and local customer service. Bybit? You’re trading in the dark.

So why do so many Nigerians still use Bybit? Because it offers things local exchanges don’t—deep liquidity, low fees on futures, and access to hundreds of obscure tokens. But that freedom comes with major trade-offs. If your account gets flagged, you won’t get help from a Nigerian call center. If the market crashes, you can’t file a complaint with the Central Bank. And if you send funds to the wrong address? Too bad—blockchain doesn’t do refunds.

Below, you’ll find real reviews, case studies, and breakdowns of what actually happens when Nigerians use Bybit. Some users made money. Others lost everything. We’ll show you the red flags, the legal gray areas, and the safer ways to trade crypto in Nigeria—without risking your life savings on an offshore platform that doesn’t answer your calls.

Crypto Exchanges to Avoid if You Are Nigerian in 2025

In 2025, only Quidax and Busha are legally licensed to operate crypto exchanges in Nigeria. Using unlicensed platforms like Bybit, KuCoin, or Binance P2P risks bank account freezes, asset seizures, and total loss of funds with no recourse.

Read More