Compliance in Crypto: What You Need to Know About Regulations, Sanctions, and Legal Risks

When you trade, mine, or hold cryptocurrency, you're not just participating in a financial experiment—you're operating under compliance, the set of legal and regulatory rules that govern how crypto is used, taxed, and reported. Also known as crypto regulation, it's the invisible framework that decides whether your activity is legal, flagged, or criminal. This isn't about fancy blockchain theory. It's about whether you'll get audited, fined, or worse.

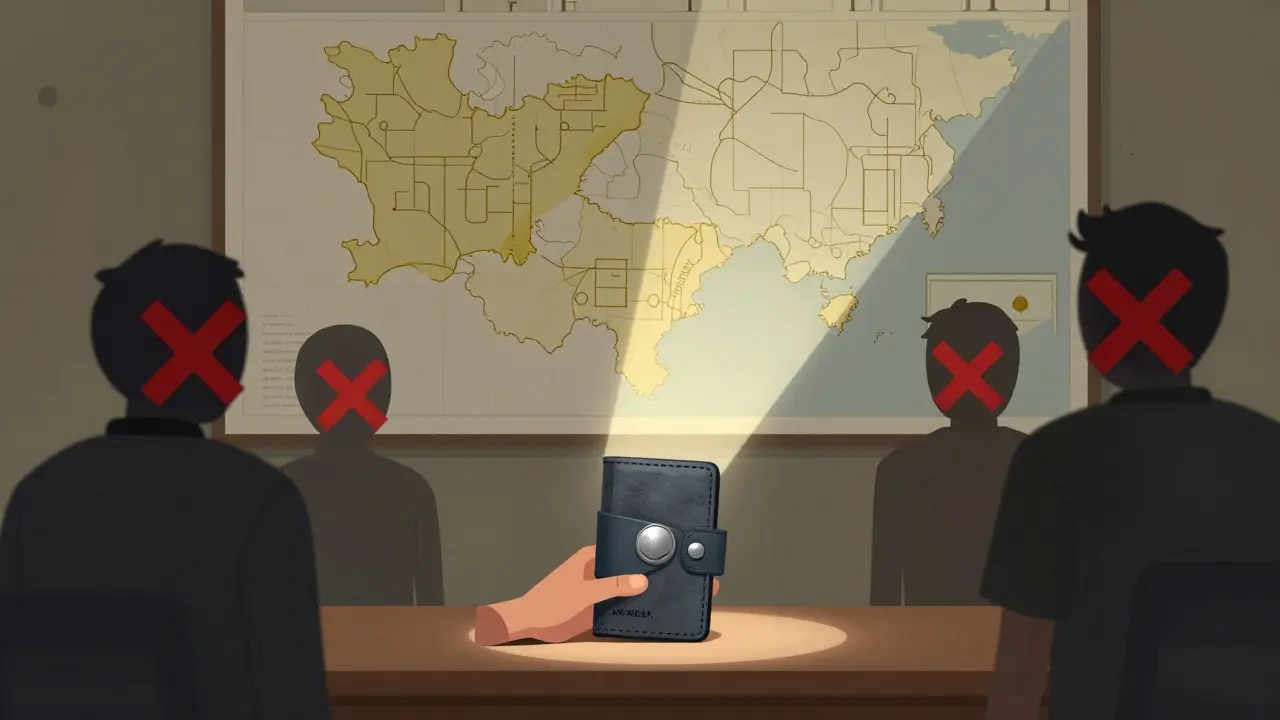

Crypto sanctions, government bans on specific crypto transactions tied to countries, groups, or individuals. Also known as OFAC enforcement, it's why $15.8 billion in crypto flowed to sanctioned entities in 2024—and why exchanges like Garantex got shut down. Countries like Iran and Pakistan use crypto to bypass global banking restrictions, but that doesn’t make it safe for you. If you’re trading with someone in a sanctioned country, or using mining power from a state-subsidized grid, you could be on the wrong side of the law—even if you didn’t know.

Crypto tax, how governments treat crypto as property, not currency, and demand taxes on every trade, staking reward, or airdrop. Also known as VDAs taxation, it’s why India charges 30% on every trade with no loss offsets, and why U.S. citizens must report foreign crypto holdings under FATCA, a U.S. law forcing citizens to declare assets held overseas. Also known as foreign asset reporting, it’s not optional—if you held crypto on a foreign exchange and didn’t file Form 8938, you’re risking penalties up to $10,000 per year. Australia, Canada, and Taiwan have their own versions too. Ignoring this isn’t clever. It’s dangerous.

Compliance isn’t just about taxes or sanctions. It’s about knowing which exchanges are licensed, like ACE in Taiwan, and which are risky ghosts like iZiSwap or ACSI Finance. It’s about recognizing fake airdrops like RBT Rabbit or MDX that pretend to be free money but are actually phishing traps. It’s understanding that a dead token like Blue Protocol or Bitstar isn’t just worthless—it’s a red flag for scams hiding in plain sight.

Some people think crypto is lawless. It’s not. Governments are catching up fast. The FATF blacklist pushed Iran into crypto out of necessity, but it also made every transaction riskier. Angola jailed miners for using too much power. Canada’s rules change by province. India treats every trade like a taxable event. And the U.S. is watching every foreign wallet.

You don’t need to be a lawyer to stay compliant. But you do need to know the basics: who’s regulating you, what you’re required to report, and what’s a scam pretending to be a rule. Below, you’ll find real cases—how Iran’s power subsidies broke its own citizens, how FATCA caught U.S. crypto holders, how fake airdrops target the unprepared, and why a "zero-fee" exchange might be the riskiest option of all. This isn’t theory. It’s what’s happening now. And if you’re not paying attention, you’re already behind.

Compliance-First Approach to Crypto Trading in Restricted Countries

Learn how to trade cryptocurrency legally in restricted countries by prioritizing compliance over convenience. Understand local laws, use self-custody wallets, and avoid banking risks to stay safe and legitimate.

Read More