Cross Margin Explained: How It Works and Why It Matters in Crypto Trading

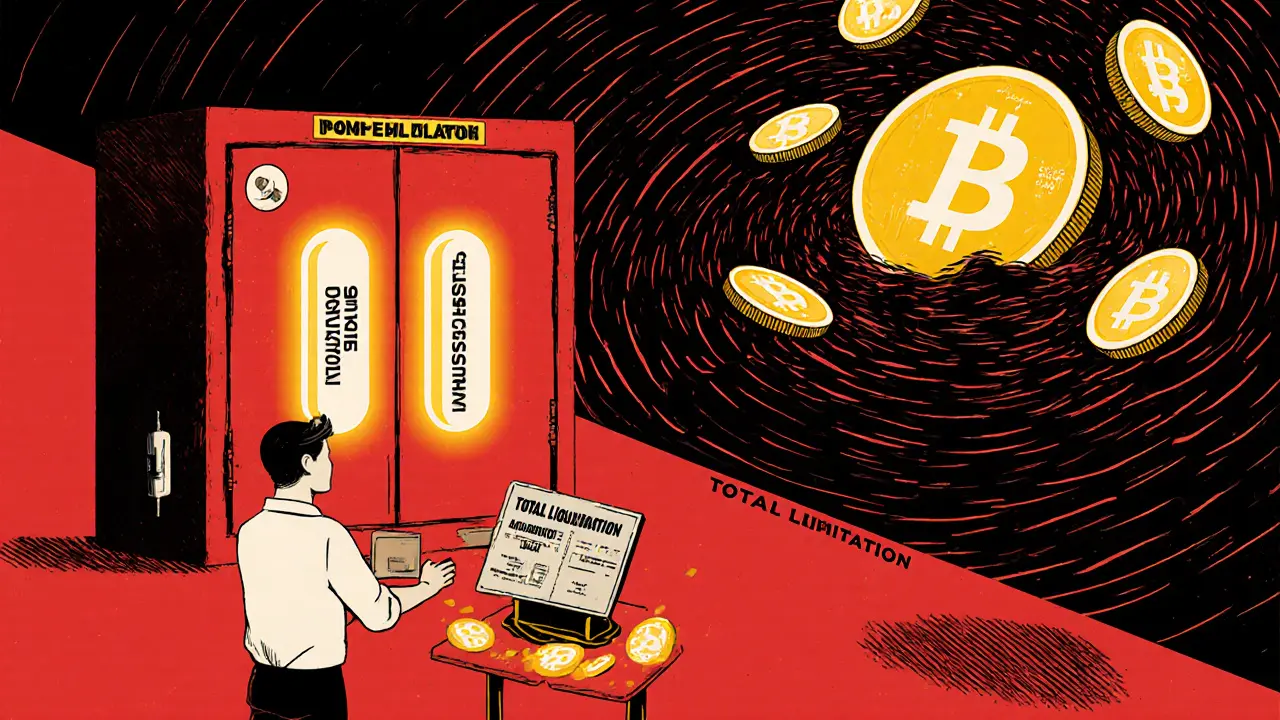

When you trade crypto with cross margin, a trading mode that uses your entire account balance as collateral to support leveraged positions. Also known as portfolio margin, it lets you borrow funds to amplify your trades—using all your available crypto and cash to keep positions open. Unlike isolated margin, where each trade has its own separate collateral, cross margin pulls from your whole account. That means if one trade starts losing money, the system can use funds from your other holdings to prevent a liquidation.

This setup can be powerful—but it’s also dangerous. If the market swings hard against you, your entire balance can be at risk, not just the portion tied to one trade. Many new traders think cross margin is safer because it avoids sudden liquidations, but that’s a trap. It just delays the crash. One big loss can wipe out everything. It’s like using your savings to pay off a credit card debt—temporarily fixes one problem, but leaves you exposed everywhere else.

Real traders use cross margin when they’re confident in their overall strategy and have strong risk controls. They don’t just throw money at leverage. They watch their liquidation price, the price at which a leveraged position is automatically closed to prevent further losses, track their margin ratio, the percentage of collateral relative to borrowed funds, and avoid over-leveraging. Platforms like Binance, Bybit, and OKX offer cross margin, but the features vary. Some let you set stop-losses across all positions. Others don’t. And if you’re trading on an unregulated exchange? You’re gambling with no safety net.

The posts below show you what happens when things go wrong. You’ll see how traders lost everything using cross margin on low-liquidity tokens like TITANX and MEGALAND. You’ll learn why platforms like LocalTrade and PayCash Swap are dangerous when leverage is involved. And you’ll find out how real risk management looks—like using cross margin only with stablecoins, or knowing when to switch to isolated margin before a big news event. This isn’t about getting rich fast. It’s about staying in the game long enough to make smart moves.

Isolated Margin vs Cross Margin: Which One Should You Use for Crypto Trading?

Isolated margin limits your risk to one trade, while cross margin uses your whole account as collateral. Learn which one fits your trading style and how to avoid costly mistakes in crypto leverage trading.

Read More