Crypto Money Laundering: How Scams, Sanctions, and Dark Markets Move Illicit Funds

When people talk about crypto money laundering, the process of hiding the origins of illegally gained cryptocurrency through complex transactions. Also known as cryptocurrency laundering, it’s not just theoretical—it’s happening right now in fake tokens, banned exchanges, and sanctioned countries. Unlike banks, crypto moves fast, stays anonymous, and skips traditional oversight. That’s why criminals use it to clean dirty money—whether it’s from hacking, drug sales, or ransomware.

One major tool in this game is the FATF blacklist, a global list that cuts off countries from international financial systems. Financial Action Task Force sanctions force people in places like Iran to turn to crypto just to survive, but that same pressure makes their networks perfect for laundering. Meanwhile, crypto scams, like fake coins with zero trading volume and no team. exit scams, are designed to look real long enough to pull in cash before vanishing. Projects like Deutsche Mark (DDM) or UniWorld (UNW) aren’t just dead—they were built to launder money under the guise of investment.

It’s not just about fake coins. Criminals use unregulated exchanges like LocalTrade and PayCash Swap to move funds without KYC checks. They layer transactions across sidechains and decentralized platforms to hide trails. Some even exploit mining bans—like in Angola—where seized equipment was likely used to process illicit crypto. And when governments crack down, like with Pakistan’s 2,000 MW mining allocation, they’re not just trying to save power—they’re trying to stop crypto from becoming a backdoor for money laundering.

Regulators are catching on. Tools like on-chain analysis and transaction clustering now track how funds flow between wallets. But criminals adapt. They use mixing services, bridge exploits, and nested exchanges to avoid detection. The result? A constant game of cat and mouse. What you’ll find in these posts aren’t just warnings—they’re real case studies. From dead coins with no supply to state-backed mining that doubles as a laundering front, this collection shows exactly how crypto money laundering works in practice. You won’t find fluff here. Just the facts, the scams, and the systems that let them thrive.

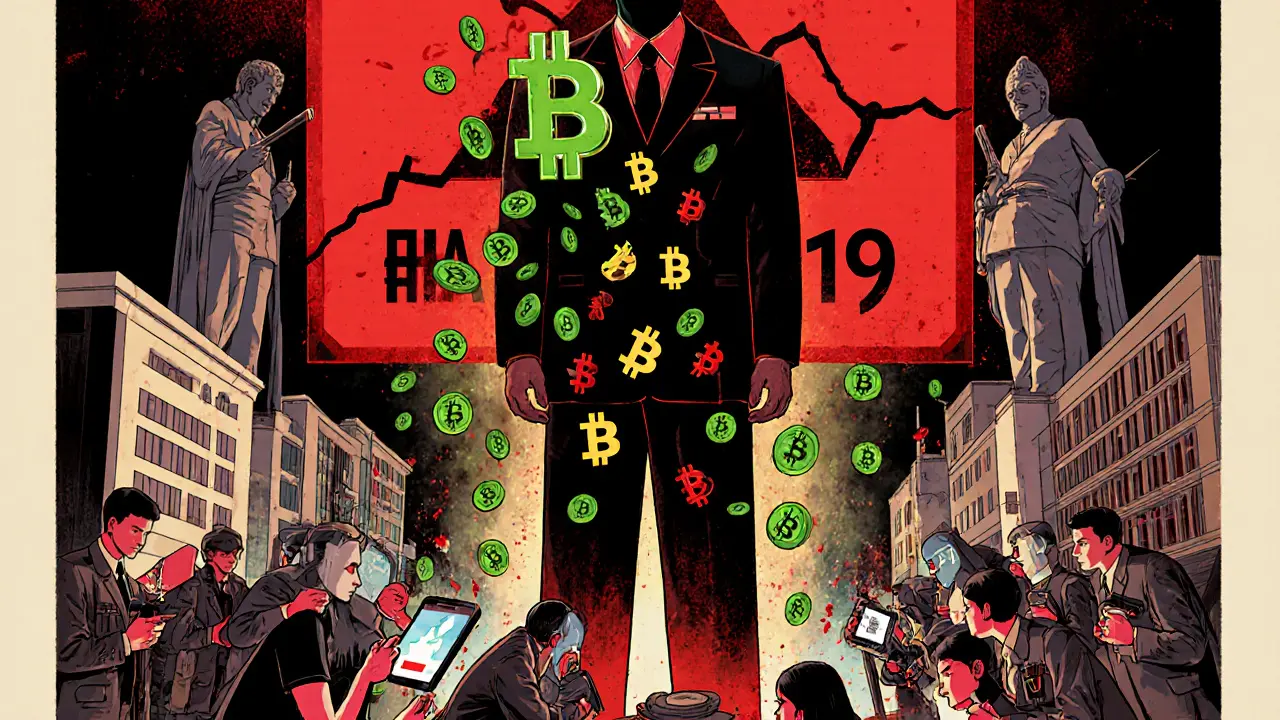

Underground Crypto Trading in Cambodia: How Criminal Networks Evaded Bans and Lured Global Victims

Underground crypto trading in Cambodia thrives despite a 2019 ban, fueled by violent scam compounds and a $4 billion laundering network tied to the Prince Group and Huione Guarantee. Victims worldwide lose billions to fake crypto investments.

Read More