Underground Crypto Trading in Cambodia: How Criminal Networks Evaded Bans and Lured Global Victims

Sep, 17 2025

Sep, 17 2025

Crypto Scam Risk Checker

Check if a crypto investment opportunity is likely a scam. Based on common red flags from the article about Cambodia's underground crypto trading networks.

On paper, cryptocurrency trading in Cambodia has been illegal since 2019. The National Bank of Cambodia issued a strict ban, warning citizens that using Bitcoin or any digital currency could lead to legal trouble. But if you walked through the streets of Sihanoukville or Phnom Penh in 2024, you’d see something very different: people hunched over phones in hotel lobbies, whispering about “high-return crypto investments,” while armed guards stood outside buildings labeled as “technology parks.” This wasn’t just a few rogue traders. It was a billion-dollar criminal empire built on lies, violence, and digital anonymity.

The Ban That Didn’t Work

The 2019 ban on crypto wasn’t meant to be a suggestion. It was a legal order. The National Bank of Cambodia made it clear: no banks, no exchanges, no digital wallets tied to local accounts. The goal was to protect people from fraud and stop money from flowing out of the country. But instead of killing crypto use, the ban pushed it underground - and into the hands of organized crime. By 2023, a survey by Standard Insights found that 10.63% of Cambodians were still using cryptocurrency. That’s over 1.5 million people. Most weren’t investing for the long term. They were being lured into scams that promised 10%, 20%, even 50% returns in days. The catch? The money never went into real markets. It went straight into the pockets of criminal networks.The Prince Group and the Scam Compounds

At the center of this operation was the Prince Group - a transnational criminal organization that turned entire buildings into forced labor camps. These weren’t offices. They were prisons disguised as tech hubs. One, called the Jinbei Compound in Sihanoukville, was built inside a hotel and casino. Another, the Golden Fortune Science and Technology in Chrey Thom, looked like a startup incubator from the outside. Inside, workers were held against their will. People were tricked into coming to Cambodia with fake job offers - customer service roles, IT support, marketing positions. Once they arrived, their passports were taken. They were forced to work 18-hour days, calling people in the U.S., South Korea, and Australia, pretending to be crypto experts. Their script? “I made $50,000 in two weeks trading Bitcoin. You can too.” Victims were convinced to send money to wallets controlled by the Prince Group. If a worker failed to hit their daily fraud quota, they were beaten. Some were electrocuted. Others disappeared. The U.S. Department of Justice filed a civil complaint on October 14, 2025, naming Prince Group as the operator of these compounds. Court documents revealed internal emails where leaders discussed “BTC laundering” and “BTC money launderers.” These weren’t random criminals. They ran a business - a brutal, profitable one.Huione Guarantee: The One-Stop Crime Platform

While the Prince Group handled the human trafficking and fraud, Huione Guarantee handled the money. Founded in 2014, Huione operated like a dark web marketplace for crypto crime. On Telegram, it sold tools to scammers: fake trading platforms that looked like Binance, fake customer support systems, and, most importantly, ways to turn stolen crypto into clean cash. Huione didn’t just move money. It cleaned it. Using a layered system of exchanges, offshore banks, and cash-out points in Thailand and Malaysia, they turned stolen Bitcoin into real-world currency. Chainalysis estimated Huione laundered at least $4 billion between August 2021 and January 2025. That includes $37 million from North Korean hackers, $36 million from fake crypto investment scams, and $300 million from ransomware payments. In 2024, transactions between Huione and South Korean exchanges jumped 1,400 times compared to the year before. By October 2025, over 3.15 billion Korean Won ($2.2 million) had flowed through these channels in just ten months. The system was so efficient, it kept growing - even after Telegram shut down its public channels in 2015.

How the System Evaded Detection

The Prince Group and Huione didn’t rely on luck. They built their operation around weaknesses in Cambodia’s financial system. The country ranked 128th out of 180 in Transparency International’s 2024 Corruption Perceptions Index. Banks were slow to report suspicious activity. Law enforcement was underfunded. And because Cambodia’s economy runs on cash, digital trails were easy to bury. They used “illegal banks and underground money houses” - unlicensed cash brokers who moved money without paperwork. They mixed crypto through multiple exchanges, making it nearly impossible to trace. And they blended their illegal profits with legal businesses: hotels, casinos, restaurants. A $10,000 crypto deposit? It was labeled as “casino winnings.” A $500,000 transfer from a scam victim? Called “foreign investor capital.” Even when exchanges like Binance or Kucoin flagged suspicious activity, Huione simply switched partners. New exchanges popped up in jurisdictions with no anti-money laundering rules. By the time regulators caught on, the money was already gone.The Regulatory Shift That Made Things Worse

In late 2024, Cambodia changed its approach. Instead of banning crypto, it introduced Prakas B7-024-735 Prokor - a licensing system that allowed some crypto businesses to operate legally. On the surface, this looked like progress. But for criminals, it was a gift. Suddenly, they could apply for licenses. They could open bank accounts. They could rent office space under a “regulated” name. Huione didn’t disappear - it rebranded. Some of its front companies got approved. Now, when a victim reports a scam, authorities can’t tell if the platform is legal or fake. The line between legitimate and criminal blurred - and criminals walked right through it.

The Global Fallout

This wasn’t just Cambodia’s problem. It was America’s, South Korea’s, Australia’s. TRM Labs documented the “Brooklyn Network,” which moved over $18 million from U.S. victims to Prince Group accounts between 2021 and 2022. Reddit threads from September 2025 are filled with stories of people losing $5,000 to $250,000 after being contacted on Instagram, Facebook, or WhatsApp by someone claiming to be a “crypto guru.” Jacob Sims, a fellow at Harvard’s Asia Center, called it “the top form of financial crime impacting Americans now and maybe ever in history.” He compared its profits to the global drug trade. And he wasn’t exaggerating. The U.S. Treasury’s FinCEN estimated that Cambodian-based scams cost Americans over $10 billion in 2024 alone.The Crackdown - And What Comes Next

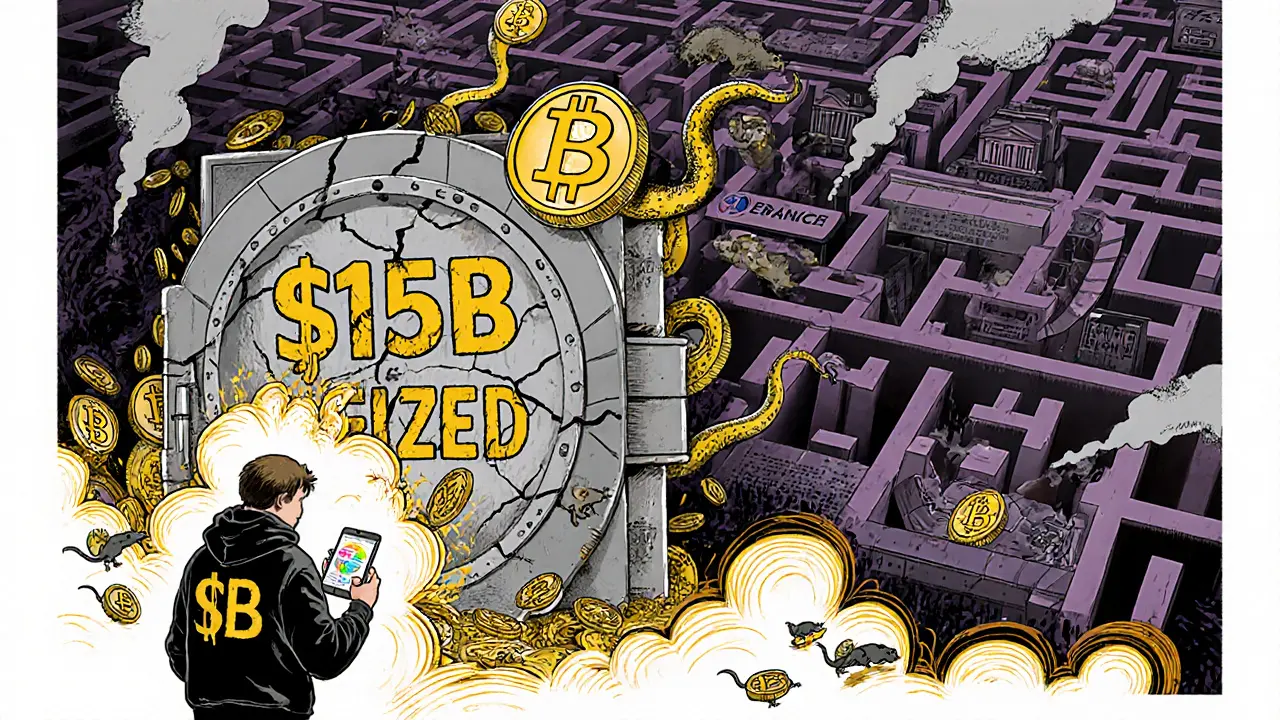

In late October 2025, the U.S. Department of Justice, working with the U.K. and South Korea, seized $15 billion in Bitcoin - the largest forfeiture in U.S. history. The assets belonged to Prince Group and Huione. The move sent shockwaves through the criminal network. Some compounds shut down. Some workers escaped. But the core infrastructure? It’s still there. Transactions with Huione kept rising even after the seizure. New front companies popped up. New Telegram channels opened. The networks adapted - because they have to. They’re not just criminals. They’re businesses. And like any business, they’ll find a way to survive. Cambodia’s central bank is now exploring a Central Bank Digital Currency (CBDC) - a government-backed digital dollar. If rolled out well, it could replace the need for underground crypto. But that’s years away. In the meantime, the scams continue. The compounds still operate. And people are still getting lured in.What You Need to Know

If you’re reading this, you’re probably not in Cambodia. But you could still be targeted. Scammers don’t care where you live. They only care if you’re willing to believe a story that sounds too good to be true. Here’s what to watch for:- Someone you don’t know messages you out of the blue about “guaranteed crypto returns.”

- The platform looks like Binance or Kucoin - but the URL is slightly off.

- You’re told to send crypto to a wallet, not an exchange.

- They pressure you to act fast - “This offer ends in 24 hours.”

- You can’t withdraw your money without paying a “processing fee.”

Is crypto trading illegal in Cambodia?

Yes, but the law changed in late 2024. The National Bank of Cambodia banned all crypto trading in 2019. In 2024, it introduced a licensing system that allows some businesses to operate legally. However, criminal groups have exploited this new system to hide their illegal activities behind fake licenses. So while crypto trading is no longer completely banned, unlicensed and fraudulent trading remains illegal.

Who is behind the crypto scams in Cambodia?

The Prince Group is the main criminal organization behind the largest scam compounds in Cambodia. It operates forced labor camps where trafficked workers are forced to run cryptocurrency fraud schemes. Huione Guarantee (also known as Huiwang Group) is the financial arm - it cleans and moves the stolen money. Both have been named in U.S. Department of Justice filings as key players in a $4 billion laundering operation.

How do these scams target people outside Cambodia?

Scammers use social media, dating apps, and messaging platforms like WhatsApp and Telegram to find victims. They pose as successful investors, sharing fake screenshots of profits. They lure people into fake trading platforms that look like Binance or Kucoin. Once money is sent, it’s instantly moved through multiple wallets and exchanges, making recovery nearly impossible.

How much money has been lost to these scams?

U.S. authorities estimate Americans lost over $10 billion to Cambodian-based crypto scams in 2024 alone. The Prince Group and Huione Guarantee are believed to have laundered at least $4 billion between 2021 and early 2025. The October 2025 U.S. seizure of $15 billion in Bitcoin represents the largest asset forfeiture in U.S. history, but experts believe this is only a fraction of the total amount stolen.

Can victims get their money back?

Almost never. Once crypto is sent to a scam wallet, it’s moved through multiple layers of exchanges and mixing services within minutes. The National Bank of Cambodia offers no recovery system. The U.S. government can seize assets from criminals, but only if they’re still traceable - and most aren’t. The best defense is prevention: never send crypto to someone you don’t know, no matter how convincing they seem.

Are there any legitimate crypto exchanges in Cambodia today?

Technically, yes - a few companies have received licenses under the 2024 regulatory framework. But because the licensing process is new and poorly enforced, it’s nearly impossible for the average person to tell which exchanges are real and which are fronts for criminals. The National Bank of Cambodia has not published a public list of licensed entities. Until that changes, all crypto trading in Cambodia carries high risk.

Rachel Thomas

November 27, 2025 AT 14:00This is insane. People are getting tortured for pushing crypto scams?? And we’re still trading Bitcoin like it’s Monopoly money?? I told my cousin not to invest in that ‘guaranteed 50% return’ thing-she said ‘but the guy had a Rolex and a Tesla pic’-LOL. What even is real anymore?

SHIVA SHANKAR PAMUNDALAR

November 28, 2025 AT 23:36It’s not about legality. It’s about human desperation. Cambodia didn’t create this-it exposed it. The world wants easy money. So criminals built a factory to feed that hunger. The ban didn’t fail. The dream did. We all wanted to believe the algorithm would make us rich without working. Now we’re paying in blood.

Shelley Fischer

November 30, 2025 AT 01:39It is deeply concerning that regulatory ambiguity has been weaponized by transnational criminal enterprises. The introduction of a licensing framework without transparent oversight, public disclosure of licensed entities, or meaningful enforcement mechanisms effectively institutionalized fraud. This is not merely a failure of policy-it is a calculated exploitation of institutional weakness. The U.S. Treasury and FinCEN must collaborate with ASEAN financial regulators to mandate KYC/AML protocols for all digital asset intermediaries operating within or targeting Cambodian jurisdictional zones. Anything less is complicity.

Puspendu Roy Karmakar

November 30, 2025 AT 07:40Bro, I’ve seen this happen in my own family. My uncle got scammed last year-sent $12k to some ‘crypto coach’ on Instagram. Said he’d double it in a week. He didn’t even know what blockchain was. But he believed it because the guy posted videos of himself on a yacht. We’re not stupid-we’re lonely. These scammers don’t sell crypto. They sell hope. And hope? It’s cheaper than therapy.

Evelyn Gu

December 2, 2025 AT 04:56I just… I can’t even. I read this whole thing and I’m crying-not because it’s shocking, but because it’s so, so familiar. I’ve lost friends to this. One guy, 24, from Ohio, sent $80,000 after being DM’d by a ‘girl’ on TikTok who said she was ‘a crypto queen from Phnom Penh’-turns out it was a 60-year-old guy in a call center with a fake accent. And now he’s in debt, his girlfriend left him, and he won’t talk to anyone. And the worst part? The system knew. The banks knew. The platforms knew. And they let it happen because they made money off the clicks, the ads, the engagement. We’re not victims of scammers-we’re victims of capitalism that doesn’t care if you live or die, as long as you keep scrolling.