Crypto Scam Compounds: How Fake Projects Multiply and How to Avoid Them

When you hear about a new crypto coin promising 1000% returns with no team and no code, that’s not innovation—that’s a crypto scam compound, a type of fraudulent project that grows by layering deception on top of previous lies, often using fake volume, cloned websites, and stolen identities to appear legitimate. These aren’t one-off scams; they’re systems designed to recycle victims, reuse tactics, and spread like a virus across forums, Telegram groups, and social media. What makes them dangerous isn’t just the money they steal—it’s how they make you doubt your own judgment. You read a post that looks real. You see trading volume that seems healthy. You hear people talking about it. But behind the scenes, there’s zero supply, no wallet activity, and a team that doesn’t exist.

These scams often hide in plain sight. Look at Deutsche Mark (DDM), a token that pretends to be a stablecoin backed by real currency but has no trading history, no blockchain presence, and zero circulating supply. Or Bitstar (BITS), a dead coin with no exchange support, no updates, and no community—yet still listed on sketchy sites with fake prices. These aren’t outliers. They’re textbook examples of how scam compounds evolve: start with a familiar name, copy a real project’s branding, then vanish once people invest. The same pattern shows up in UniWorld (UNW), a zombie token with no developers, no liquidity, and fake market data, and in CovidToken, a non-existent project that uses fear and urgency to lure in the unsuspecting.

Scam compounds thrive where regulation is weak and trust is high. They use fake airdrops, cloned websites, and influencer shills to create the illusion of legitimacy. You’ll see the same tricks over and over: fake trading volume on decentralized exchanges, bots pretending to be users, and promises of "limited-time" rewards that disappear the moment you send crypto. Even when a project is dead—like Buggyra Coin Zero (BCZERO), a token tied to truck racing that has no adoption, no buyers, and no real use case—scammers keep listing it, hoping someone will fall for it again.

Real crypto projects have transparency. They show code. They have active wallets. They answer questions. Scam compounds do the opposite. They avoid audits. They hide team members. They delete their GitHub repos. They change their whitepapers every week. If you can’t find a single honest detail about a project, it’s not a coin—it’s a trap. And the worst part? Once you’re in, there’s no way out. No customer service. No chargebacks. No recovery.

What you’ll find below isn’t just a list of bad coins. It’s a collection of real cases—each one showing how these scams are built, how they fool people, and how you can spot them before it’s too late. From fake airdrops to dead tokens masquerading as investments, these posts cut through the noise. No fluff. No hype. Just facts. If you’re holding a crypto coin and can’t answer three simple questions—who made it, where’s the code, and who’s buying it?—you’re already in danger. Let’s look at what’s really out there.

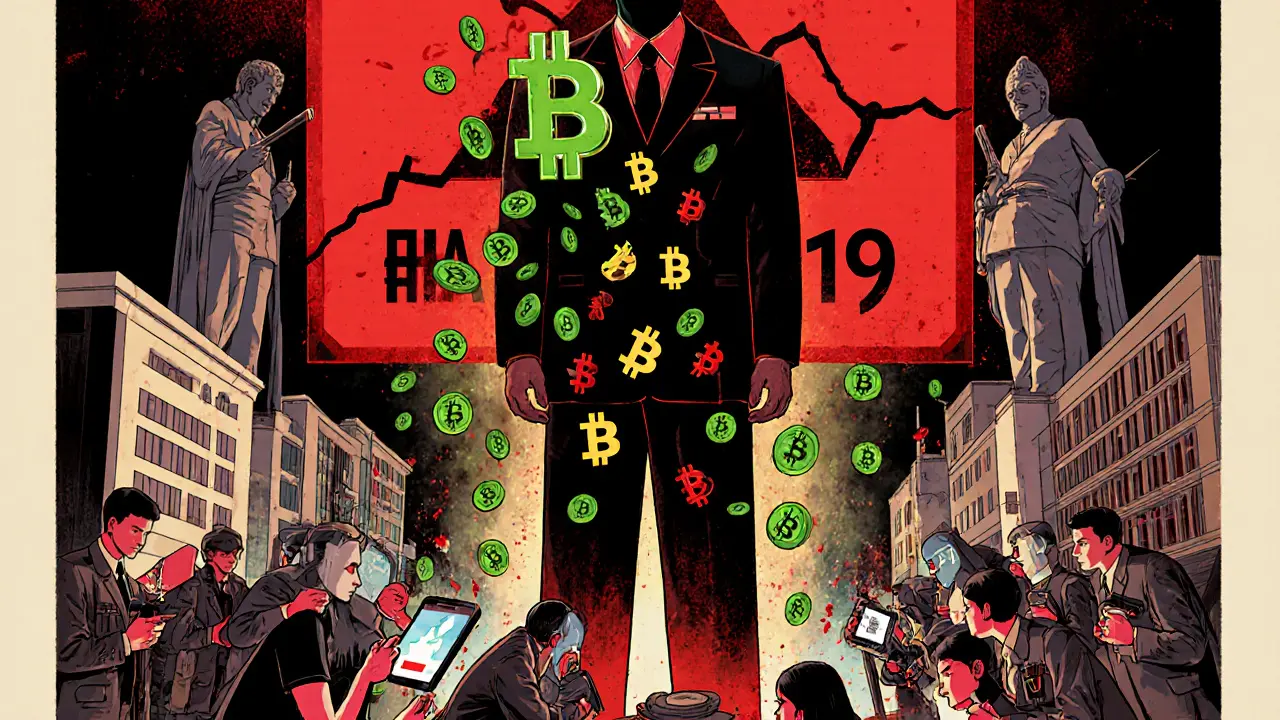

Underground Crypto Trading in Cambodia: How Criminal Networks Evaded Bans and Lured Global Victims

Underground crypto trading in Cambodia thrives despite a 2019 ban, fueled by violent scam compounds and a $4 billion laundering network tied to the Prince Group and Huione Guarantee. Victims worldwide lose billions to fake crypto investments.

Read More