Cryptocurrency Regulations: What’s Legal, What’s Banned, and Where It Matters

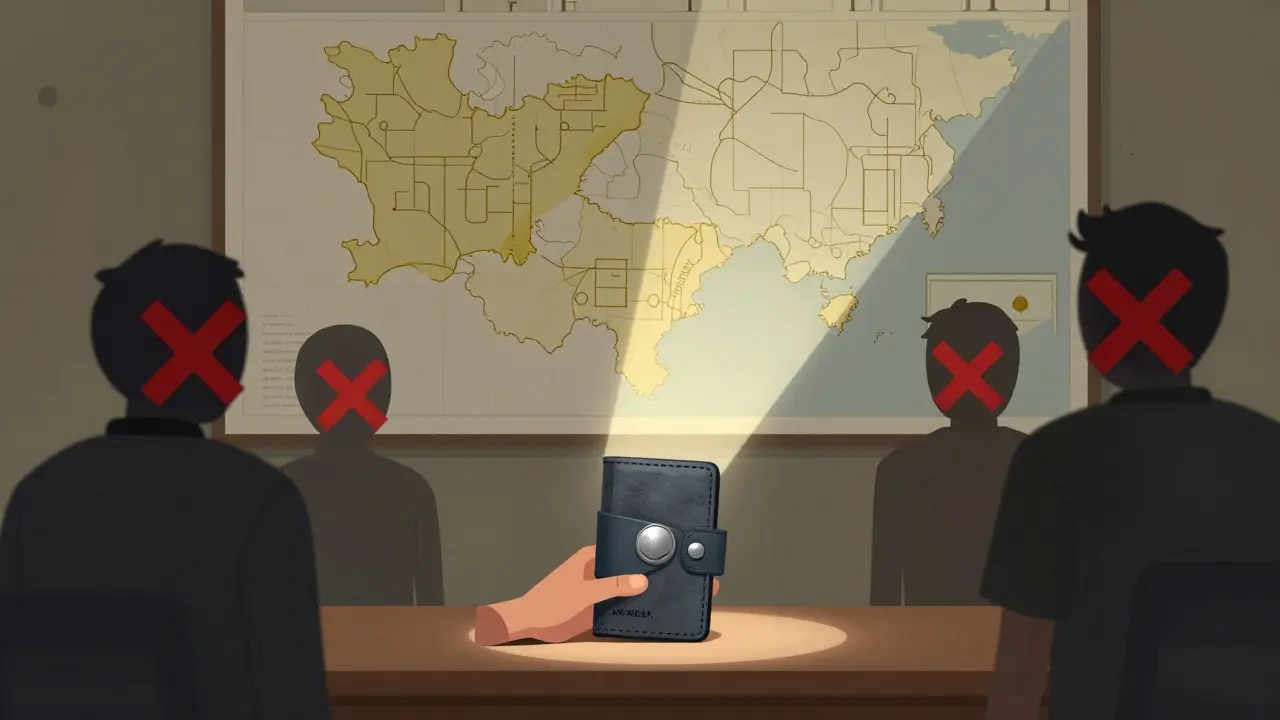

When it comes to cryptocurrency regulations, the rules governments set for buying, mining, taxing, or banning digital assets. Also known as crypto laws, they’re not just paperwork—they decide whether you can trade, earn, or even keep your Bitcoin without risking fines or jail. Some countries treat crypto like property. Others treat it like cash. And a few treat it like a threat.

Take crypto tax, the way governments charge you when you sell, trade, or earn crypto. Also known as virtual asset taxation, it’s a big deal in places like India, where every trade gets hit with 30% tax and 1% withholding. In Australia, you might get a 50% discount if you hold longer than a year. But in the U.S., you need to report foreign holdings under FATCA or risk penalties. These aren’t suggestions—they’re legal obligations backed by audits and fines. Then there’s crypto mining ban, when governments shut down crypto mining to save power or control capital flow. Also known as energy restrictions on blockchain, this happened in Angola, where mining got a 12-year prison sentence. Iran? They let it run wild on subsidized electricity—while citizens get blackouts. Pakistan just gave 2,000 MW to miners. One country sees it as a lifeline. Another sees it as a crime.

And then there’s the FATF blacklist, the global list that cuts off countries from banks if they don’t control crypto crime. Also known as financial action task force sanctions, it’s why Iran’s people now rely on Bitcoin just to buy food. It’s why exchanges like Garantex got shut down. It’s why some crypto platforms vanish overnight—because they’re flagged for helping sanctioned users. This isn’t about morality. It’s about control. Meanwhile, crypto exchange laws, the rules that decide if a platform can operate legally. Also known as licensed crypto trading, they’re why ACE Exchange in Taiwan is the only safe option for TWD traders. Why ErisX shut down after becoming part of Cboe. Why iZiSwap has no reviews and zero audits—because it’s not regulated, and you’re on your own.

These aren’t abstract ideas. They’re real rules that affect your wallet, your access, and your freedom. Some people trade safely under clear rules. Others risk everything because their country banned it. Some miners profit from cheap power. Others get arrested for using it. And every time a government changes its mind, prices shake, apps disappear, and airdrops turn into scams.

Below, you’ll find real stories from the front lines: countries that ban mining, platforms that vanish, taxes that surprise you, and scams that look like opportunities. No fluff. No hype. Just what’s actually happening—and what you need to know before you act.

Compliance-First Approach to Crypto Trading in Restricted Countries

Learn how to trade cryptocurrency legally in restricted countries by prioritizing compliance over convenience. Understand local laws, use self-custody wallets, and avoid banking risks to stay safe and legitimate.

Read More