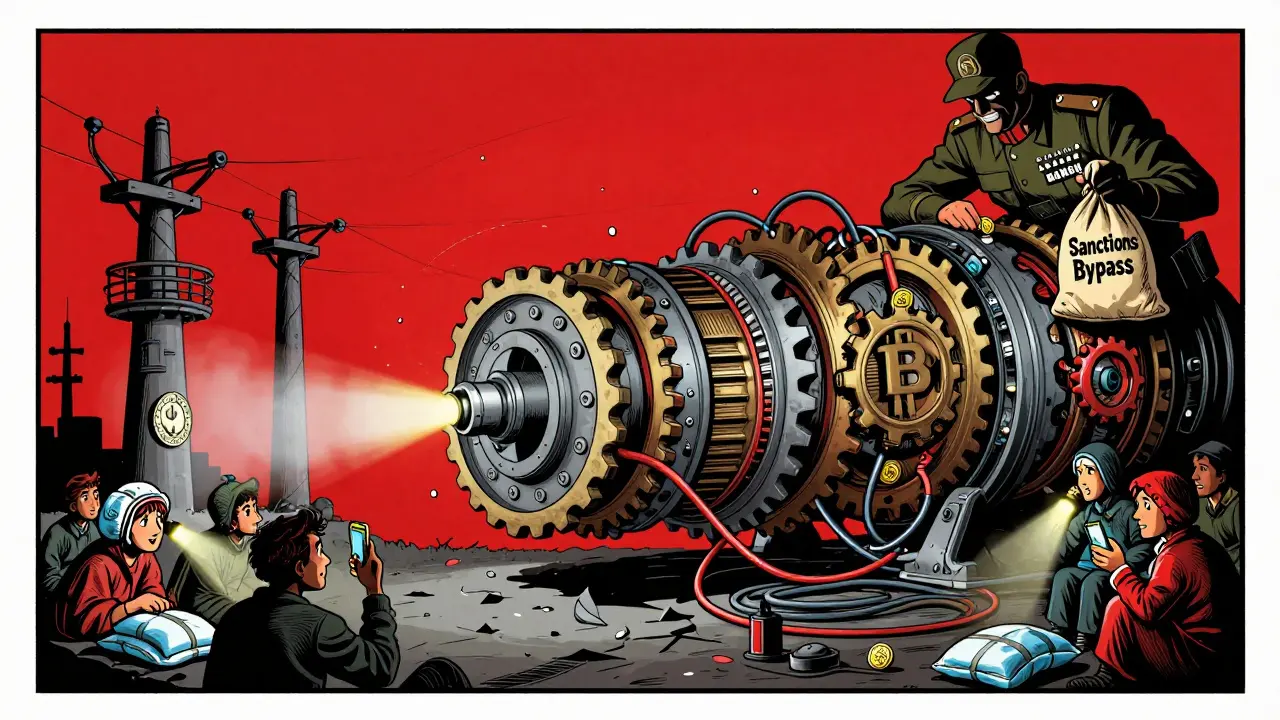

Iran Crypto Mining: How Sanctions and Survival Drive Bitcoin Operations

When Iran crypto mining, the large-scale use of hardware to validate Bitcoin transactions in Iran, often driven by economic necessity rather than speculation. Also known as Bitcoin mining in restricted economies, it has become a lifeline for millions facing hyperinflation and frozen bank accounts. This isn’t a tech trend—it’s a response to being cut off from the global financial system. After the FATF blacklist, a global financial isolation list that cuts off countries from SWIFT and international banking slapped Iran in 2023, ordinary people lost access to dollars, credit cards, and even remittances. With no other way to store value, many turned to Bitcoin—not to get rich, but to stay afloat.

What makes Iran unique isn’t just the number of miners—it’s why they mine. Unlike in the U.S. or Kazakhstan, where mining is a business, in Iran it’s a household activity. Families run rigs in basements, using cheap, government-subsidized electricity to power ASICs. Some sell their mined Bitcoin on peer-to-peer platforms like LocalBitcoins or Paxful to buy food, medicine, or school supplies. The crypto trading restricted countries, nations where traditional banking is blocked, forcing citizens to rely on decentralized networks for basic financial access category now includes Iran as a textbook case. And it’s not just individuals—small businesses use crypto to pay suppliers and import goods when banks refuse to process transactions. The government, while officially banning crypto trading, quietly tolerates mining because it brings in foreign currency and reduces pressure on the national grid.

But it’s not without danger. The U.S. Treasury has targeted Iranian mining farms, seizing equipment and freezing digital assets. And with the cryptocurrency sanctions, official restrictions on crypto use by sanctioned nations, designed to block financial evasion tightening, even simple transactions can trigger compliance alerts. Still, the numbers don’t lie: Iran ranks among the top five countries in Bitcoin hash rate, despite having no legal crypto exchanges. People aren’t ignoring the risks—they’re calculating that the cost of doing nothing is worse.

What you’ll find in the posts below are real stories and hard facts about how Iranians navigate this system: from the underground mining clusters in Tehran to the P2P traders who risk jail to send money home. You’ll see how sanctions shaped a new kind of digital economy—one built not on innovation, but on necessity. There are no get-rich-quick schemes here. Just people using technology to survive.

Iranian Energy Subsidies for Crypto Mining: How Cheap Power Fuels a National Crisis

Iran uses heavily subsidized electricity to fuel cryptocurrency mining, earning billions in foreign currency while millions of citizens suffer daily blackouts. The policy prioritizes sanctions evasion over public welfare.

Read More