Isolated Margin: What It Is and How It Works in Crypto Trading

When you trade crypto with isolated margin, a risk management tool that lets you borrow funds for trading while capping your exposure to a single position. It’s different from cross margin because your borrowed money is locked to one trade only—so if that trade goes bad, you don’t drag down your whole account. Think of it like renting a separate room in a house instead of using the whole place. You only risk what’s in that room. That’s why many experienced traders use isolated margin to avoid losing everything when a single bet turns sour.

It’s not magic. You still need to understand leverage trading, the practice of borrowing funds to increase your position size. margin trading lets you control bigger amounts than your actual balance, but it cuts both ways. A 5x leverage move can double your profit—or wipe out your entire margin. Isolated margin doesn’t stop you from losing, but it stops you from losing more than you put in for that one trade. That’s why platforms like Binance, Bybit, and OKX give you the option: use isolated margin if you want control, cross margin if you want to spread risk. And it’s not just for pros. Even beginners use it to test high-risk tokens without putting their whole wallet on the line.

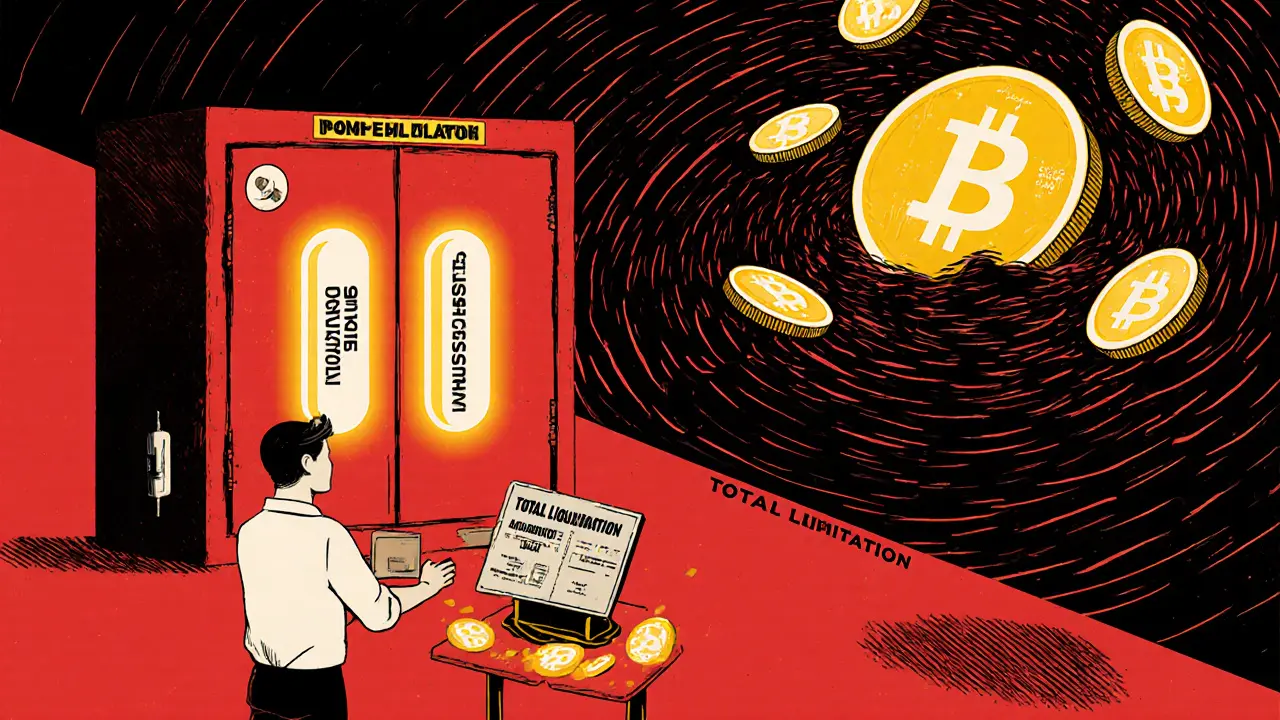

But here’s the catch: isolated margin doesn’t protect you from liquidation. If the price moves too far against you, your position gets closed automatically—and you lose your margin. No warning. No second chance. That’s why knowing your entry, stop-loss, and leverage level is non-negotiable. You also need to watch funding rates on perpetual contracts, exchange fees, and how often the market swings. One bad trade with 10x leverage can erase weeks of gains. That’s why so many posts here warn about risky tokens like TITANX or MAGICK—trading them on margin is like playing Russian roulette with your capital.

What you’ll find below are real stories from traders who used isolated margin, got burned, or nailed it. Some posts show how to avoid scams disguised as high-yield margin bots. Others explain how exchanges like LocalTrade or PayCash Swap don’t even offer proper margin controls, putting users at risk. You’ll see how market crashes, like the ones in 2022, wiped out leveraged positions overnight—and how smart traders used isolated margin to survive. This isn’t theory. It’s what happened to real people trying to make money in crypto.

Isolated Margin vs Cross Margin: Which One Should You Use for Crypto Trading?

Isolated margin limits your risk to one trade, while cross margin uses your whole account as collateral. Learn which one fits your trading style and how to avoid costly mistakes in crypto leverage trading.

Read More