KuCoin Nigeria: What You Need to Know About Trading Crypto in Nigeria

When people in Nigeria talk about KuCoin, a global cryptocurrency exchange that supports hundreds of tokens and offers low trading fees. Also known as KuCoin Exchange, it’s one of the few platforms that still allows Naira deposits through P2P trading, making it a go-to for users locked out of traditional banking channels. Unlike centralized exchanges that shut down Naira access, KuCoin keeps the door open — but that doesn’t mean it’s risk-free.

Many Nigerian traders use KuCoin because it doesn’t force KYC for basic trading, unlike Binance or Coinbase. But this freedom comes with trade-offs. Without ID verification, you can’t withdraw directly to a Nigerian bank account — you’re stuck using P2P buyers or third-party exchangers, which opens the door to scams. Some users report getting ghosted after sending crypto to fake buyers. Others get trapped by inflated prices on LocalTrade-style P2P listings. And while KuCoin itself isn’t a scam, the ecosystem around it in Nigeria is full of traps. You’re not just trading crypto — you’re navigating a gray zone where regulation is weak and enforcement is almost nonexistent.

It’s not just about the platform. It’s about what’s happening around it. Nigeria’s Central Bank has banned banks from handling crypto transactions, so traders rely on mobile money, bank transfers, and cash meetups to buy and sell. That’s why P2P volume on KuCoin Nigeria is so high — it’s the only way out. But this also makes it a target for fraudsters. Fake KuCoin support accounts, cloned apps, and phishing links are everywhere. One user lost over ₦800,000 after clicking a fake KuCoin login page on WhatsApp. Always double-check URLs. Never share your seed phrase. And never trust anyone who messages you first.

There’s also the issue of liquidity. While KuCoin lists thousands of tokens, most of them are dead coins with no real buyers. You might find a token like FERMA or BCZERO listed, but if no one’s trading it, you can’t sell it. Stick to major coins — BTC, ETH, USDT — and avoid anything with less than $100k daily volume. The same goes for airdrops. If someone says you can claim free tokens on KuCoin Nigeria, they’re lying. KuCoin doesn’t do random airdrops. Any claim otherwise is a scam.

And let’s not forget taxes. Nigeria doesn’t have clear crypto tax laws yet, but that doesn’t mean you’re off the hook. The IRS and FATF are watching. If you’re making profits, keep records. If you’re trading frequently, you’re already in the crosshairs. Many Nigerian traders don’t realize that even small gains can trigger reporting requirements in the U.S. or EU if they use KuCoin’s global infrastructure.

So what does this mean for you? KuCoin Nigeria works — if you know how to use it. It’s not a magic solution. It’s a tool, and like any tool, it can cut both ways. The best traders here don’t chase new tokens. They stick to stablecoins, use cold wallets, avoid P2P unless they know the buyer, and never trust anything that sounds too easy. They treat every trade like a real transaction — because it is.

Below, you’ll find real stories from Nigerian traders who’ve been burned, saved, and learned the hard way. Some posts expose fake KuCoin promotions. Others break down how to safely move funds out of the platform. A few even show you how to spot the difference between a real KuCoin P2P buyer and a con artist. This isn’t theory. It’s what’s happening right now — in Lagos, Abuja, Port Harcourt, and beyond.

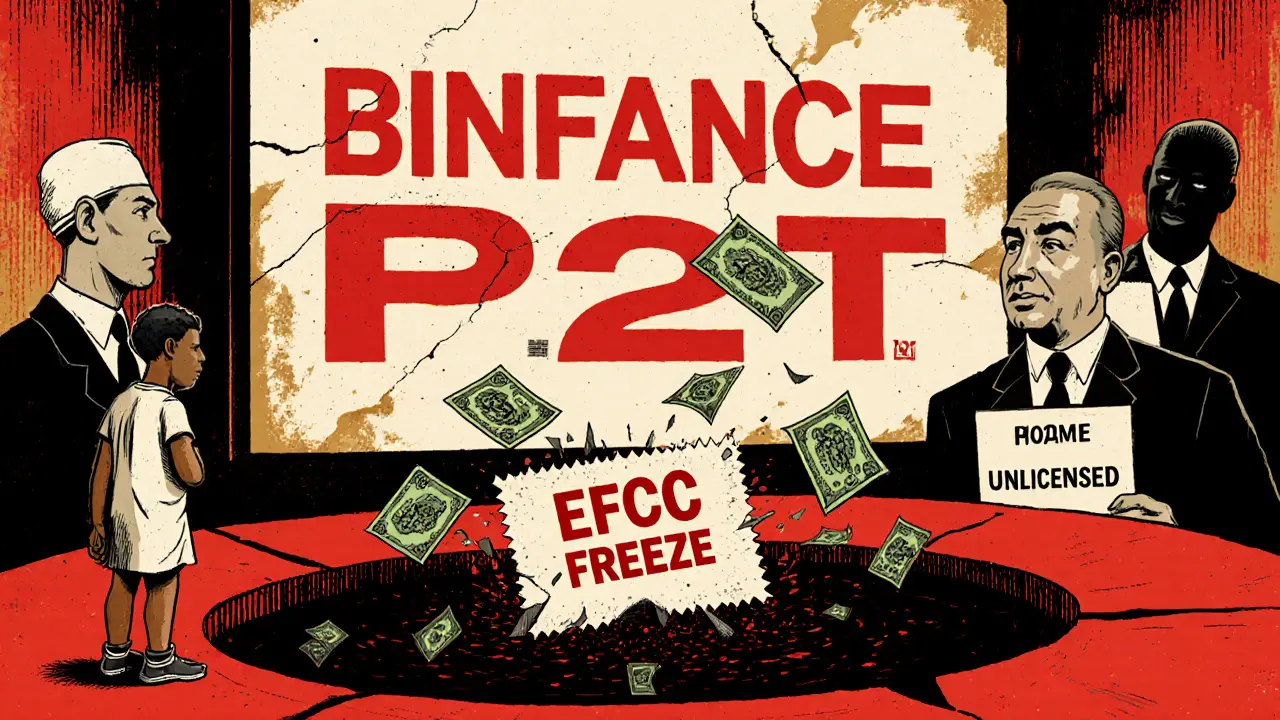

Crypto Exchanges to Avoid if You Are Nigerian in 2025

In 2025, only Quidax and Busha are legally licensed to operate crypto exchanges in Nigeria. Using unlicensed platforms like Bybit, KuCoin, or Binance P2P risks bank account freezes, asset seizures, and total loss of funds with no recourse.

Read More