Leverage Trading in Crypto: How It Works and Why It’s Risky

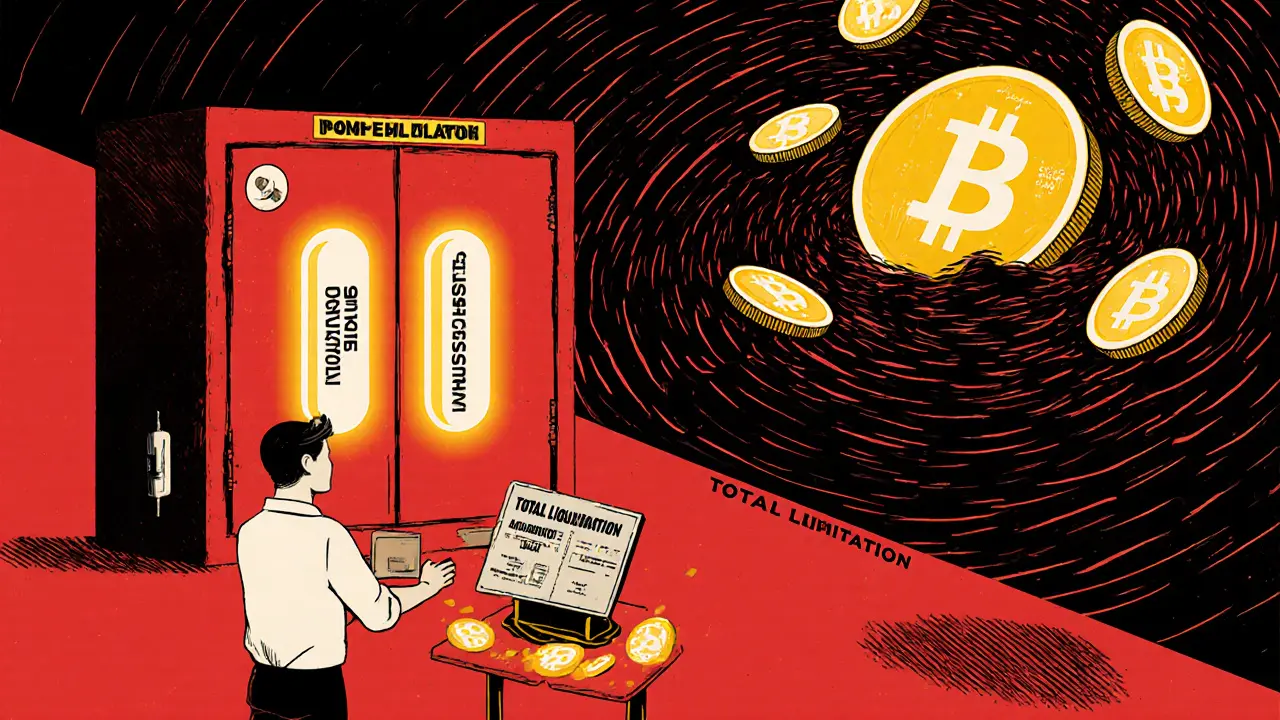

When you use leverage trading, a practice where you borrow funds to increase your position size in crypto markets. Also known as margin trading, it lets you control $10,000 worth of Bitcoin with just $1,000 of your own money. Sounds powerful? It is—until the market moves against you. Most beginners think leverage is a shortcut to big profits. In reality, it’s a fast track to losing everything—if you don’t understand how it works.

Every crypto exchange that offers leverage, like Binance or Bybit, lets you pick how much you want to borrow—2x, 5x, even 100x. The higher the number, the more you stand to gain… or lose. A 5% price drop can erase your entire investment if you’re trading at 20x leverage. And it’s not just about price swings. Funding rates, liquidation triggers, and sudden market gaps can kill your position before you even have time to react. This isn’t speculation—it’s gambling with borrowed cash.

Look at the posts below. You’ll find stories of people who lost everything chasing gains on tokens like TitanX (TITANX), a high-risk DeFi token with wild price swings and no real liquidity, or got trapped trying to trade MDX, a token tied to a DEX that stopped offering real rewards. Others got burned on fake airdrops or dead coins like Bitstar (BITS), a cryptocurrency with zero trading volume and no active team. These aren’t just cautionary tales—they’re proof that leverage doesn’t make bad assets good. It just makes losses bigger.

Real traders don’t use leverage to chase moonshots. They use it to manage risk, not create it. They know when to walk away, when to cut losses, and when to avoid trading altogether. The posts here show you exactly what happens when people ignore those rules. You’ll see how scams prey on leveraged traders, how exchanges liquidate positions without warning, and why most people who try this end up broke. There’s no magic strategy. No secret indicator. Just cold, hard math—and a lot of people who didn’t do the math before hitting "buy".

Isolated Margin vs Cross Margin: Which One Should You Use for Crypto Trading?

Isolated margin limits your risk to one trade, while cross margin uses your whole account as collateral. Learn which one fits your trading style and how to avoid costly mistakes in crypto leverage trading.

Read More