Margin Trading in Crypto: How It Works, Risks, and Real Cases

When you use margin trading, a practice where you borrow funds from a crypto exchange to increase your position size. Also known as leveraged trading, it lets you control more crypto than your balance allows—but with stakes that can go up or down sharply. It’s not magic. It’s math. And math doesn’t care how sure you feel.

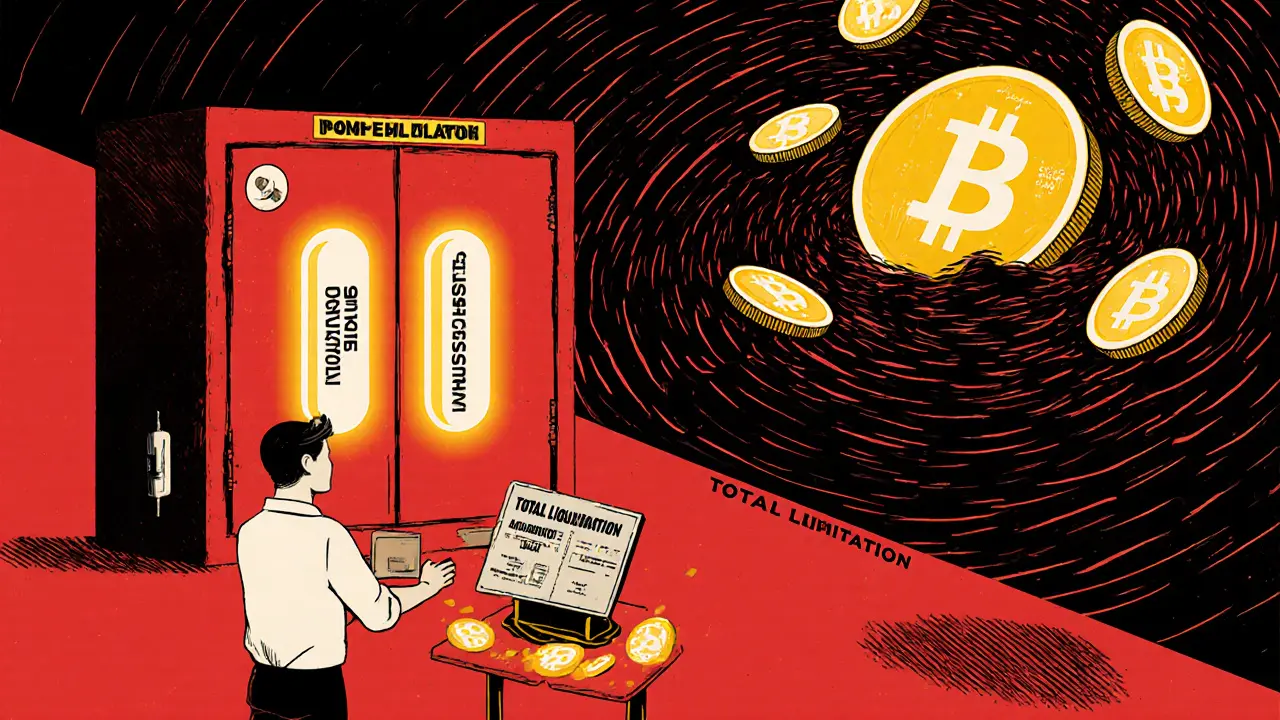

Most people start margin trading because they see someone else make 5x returns in a week. But what they don’t see is the 9 out of 10 traders who lose everything. The biggest risk isn’t the market moving against you—it’s the margin call, when your exchange automatically closes your position because you don’t have enough collateral left. That can happen in minutes, even if the price only dips 10%. You don’t need a crash to get wiped out. Just a normal dip, and you’re gone.

Crypto exchanges, platforms that offer borrowing for trading. Also known as leveraged trading platforms, offer everything from 2x to 100x leverage. But higher leverage doesn’t mean higher rewards—it means higher chances of losing your entire deposit. Some exchanges, like the ones covered in our posts, have shut down because users lost too much money and demanded refunds. Others hide behind weak rules and no KYC, making recovery impossible when things go south. You can’t blame the market when you trade with 50x leverage on a coin with zero volume. That’s not investing. That’s gambling with someone else’s money.

Real cases show this isn’t theoretical. Look at the traders who used platforms like LocalTrade or PayCash Swap—both flagged as risky or outright scams. They didn’t just lose crypto. They lost trust, time, and sometimes their savings. Even on legit exchanges, margin trading is where most beginners crash. The market doesn’t need to crash. It just needs to move.

What you’ll find in these posts isn’t a guide to getting rich fast. It’s a collection of real stories: people who used leverage on dead coins like BITS or UNW, got caught in fake airdrops pretending to be margin rewards, or tried to dodge restrictions by hopping between exchanges—all while ignoring the basic math of risk. Some posts warn about platforms that vanish. Others explain how to spot a rigged chart or a fake volume pump. A few even show how people used margin to survive in places like Iran or Pakistan, where crypto became a lifeline—not a casino.

Margin trading isn’t evil. It’s a tool. But tools don’t protect you from your own mistakes. If you’re reading this, you’re probably wondering if it’s worth it. The answer isn’t in the charts. It’s in the stories of those who lost everything trying to beat them.

Isolated Margin vs Cross Margin: Which One Should You Use for Crypto Trading?

Isolated margin limits your risk to one trade, while cross margin uses your whole account as collateral. Learn which one fits your trading style and how to avoid costly mistakes in crypto leverage trading.

Read More