Pakistan Cryptocurrency Policy: What’s Legal, What’s Blocked, and How People Are Getting Around It

When it comes to Pakistan cryptocurrency policy, the official stance bans financial institutions from handling crypto transactions, but doesn’t outlaw personal ownership or peer-to-peer trading. Also known as crypto regulations in Pakistan, it’s a policy built on fear of capital flight and money laundering — not on understanding blockchain technology. The State Bank of Pakistan issued a circular in 2021 telling banks to block any activity tied to cryptocurrencies. But that didn’t stop millions from using Bitcoin, USDT, and other tokens. Why? Because remittances, inflation, and a lack of banking access made crypto the only real option for many.

People in Pakistan aren’t using exchanges like Binance or Coinbase. They’re using P2P crypto, peer-to-peer trading platforms where buyers and sellers connect directly using local payment methods like JazzCash and EasyPaisa. Also known as crypto peer-to-peer networks, these systems bypass banks entirely. A trader in Lahore might pay Rs. 30,000 in cash to someone in Karachi for $100 in USDT. No bank account needed. No KYC. No trace. This is how crypto survives under ban — not through official channels, but through trust, cash, and WhatsApp groups. The government knows this is happening. They’ve raided homes, seized phones, and arrested people for running P2P operations. But the arrests don’t stop the flow. In 2023, Chainalysis ranked Pakistan in the top 10 globally for crypto adoption per capita — higher than the UK, Germany, and Japan. That’s not because people are investing in NFTs or DeFi. It’s because they’re using crypto to send money home, buy groceries, or protect savings from rupee devaluation.

What about mining? It’s technically not banned, but the power grid can’t handle it. A single mining rig in Islamabad draws as much electricity as three households. When the government tried to crack down on miners in 2022, they found rigs running in basements, garages, and even mosques. The crackdown was loud, but the miners just moved underground — literally. Now, most mining is done quietly, with solar panels or off-grid generators. It’s not profitable anymore, but for some, it’s still cheaper than paying for electricity from the national grid.

There’s no clear path forward. The State Bank keeps warning about risks. The public keeps trading. The FATF keeps watching. And the crypto market keeps evolving. What you’ll find in the posts below are real stories from people navigating this mess — from how to avoid scams pretending to be "legal crypto services" in Pakistan, to why some exchanges are blocked while others aren’t, to how people are using crypto to pay for education, medical bills, and even rent. This isn’t about speculation. It’s about survival. And in Pakistan, crypto isn’t a trend — it’s a necessity.

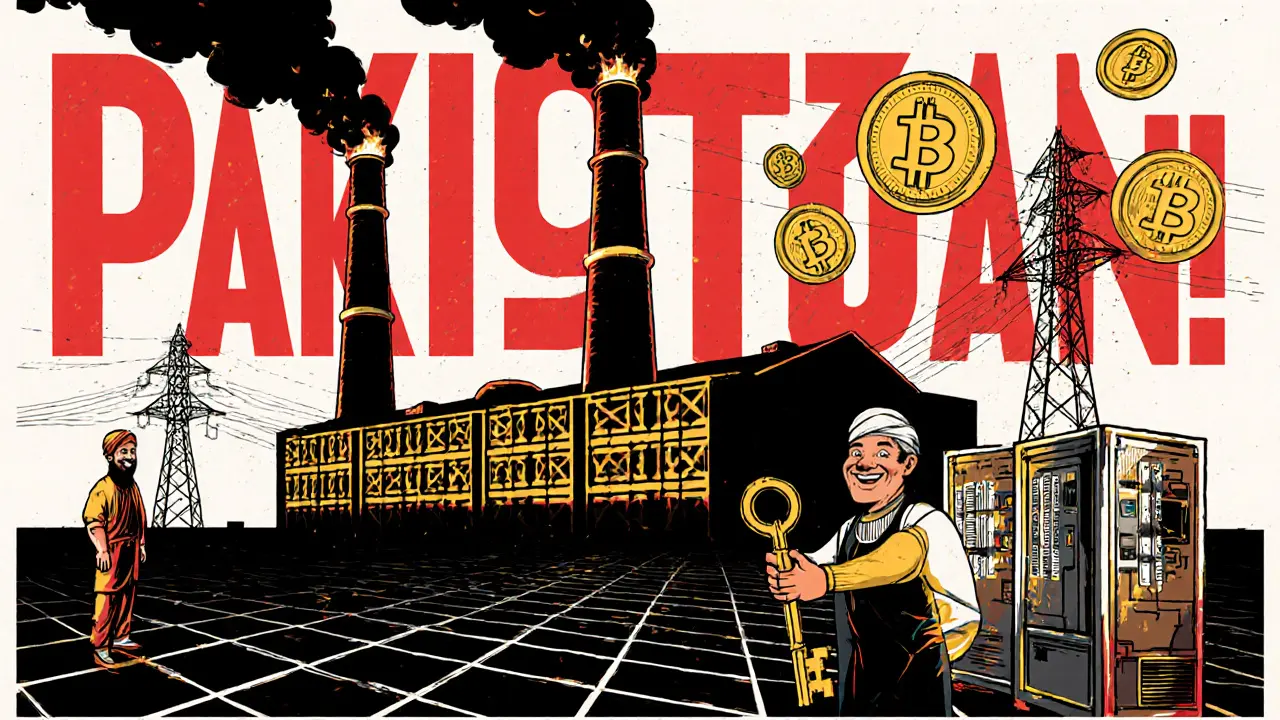

Pakistan's 2,000 MW Electricity Allocation for Crypto Mining: What It Means and Why It Matters

Pakistan allocated 2,000 MW of surplus electricity to crypto mining and AI data centers in 2025, creating one of the world's largest state-backed mining initiatives. With cheap power and new regulations, it could reshape global crypto economics.

Read More