SEC Nigeria: Crypto Regulations, Scams, and Enforcement in Nigeria

When it comes to SEC Nigeria, the Securities and Exchange Commission of Nigeria, which regulates financial markets including digital assets. Also known as Nigerian SEC, it has become one of the most active crypto watchdogs in Africa, shutting down fake tokens, freezing scam operations, and warning the public about unregistered platforms. Unlike many countries that wait for crypto to grow before stepping in, SEC Nigeria moved fast—because people were losing money fast.

They’ve targeted projects like Deutsche Mark (DDM), a fake stablecoin with no supply, no team, and zero legitimacy, and UniWorld (UNW), a dead coin with fake prices and no users. These aren’t just bad investments—they’re criminal operations. SEC Nigeria works with law enforcement to seize equipment, freeze bank accounts, and even press charges. In 2024, they joined forces with other African regulators to track cross-border scams using crypto to move stolen funds.

But it’s not all crackdowns. SEC Nigeria also publishes official lists of approved exchanges and requires all crypto platforms operating in Nigeria to register. That’s why you’ll find articles here about LocalTrade, an unregulated exchange flagged for scams, and why we warn against platforms like PayCash Swap, a ghost platform with zero reviews and no transparency. If it’s not on SEC Nigeria’s radar, it’s not safe.

People in Nigeria use crypto for remittances, savings, and even paying for groceries because the traditional banking system is slow and expensive. But that freedom comes with risk. Scammers exploit the lack of financial literacy with fake airdrops like CovidToken, a non-existent project designed to steal wallets, or fake mining deals promising free Bitcoin. SEC Nigeria’s job is to cut through the noise—and they’re doing it.

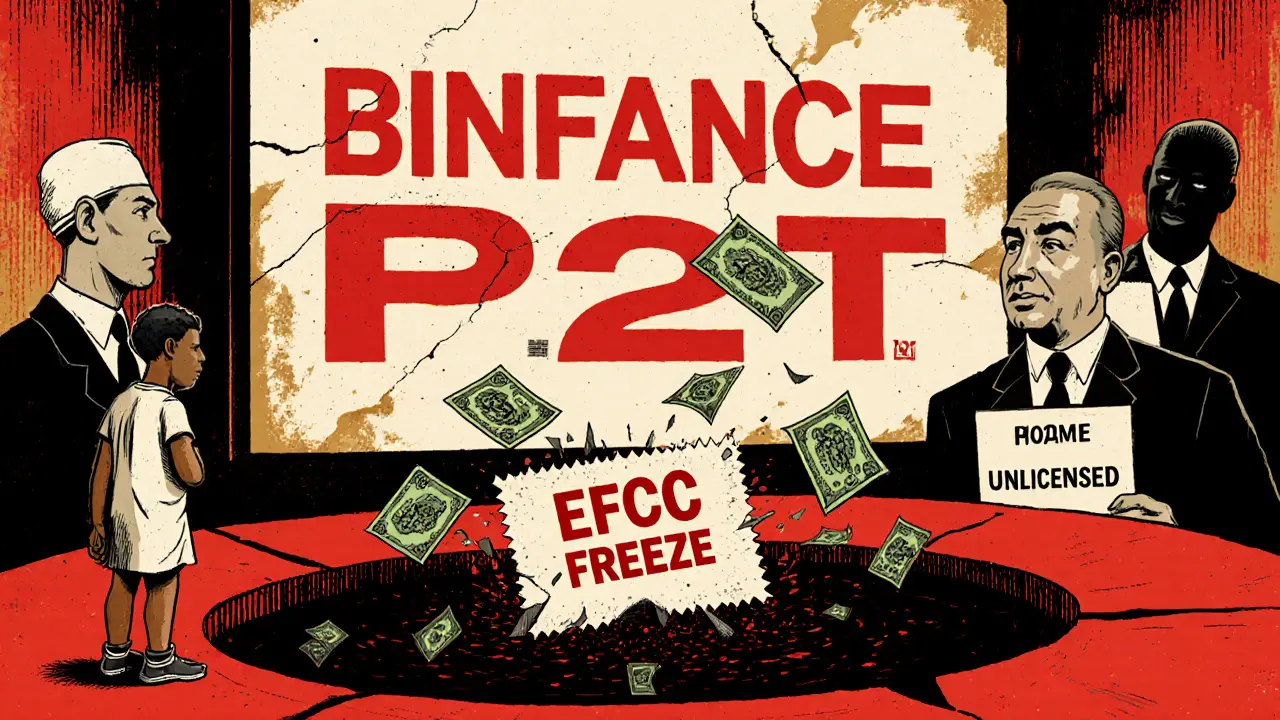

What you’ll find below are real cases of what happens when crypto meets regulation in Nigeria. From banned mining operations and frozen exchanges to the rise of P2P trading under pressure, these stories show how everyday people navigate a system that’s still figuring itself out. Some posts expose scams. Others explain how to spot them. A few even show how Nigerians are building legal, safe ways to use crypto despite the hurdles. This isn’t theory—it’s what’s happening right now, on the ground, in Lagos, Abuja, and beyond.

Crypto Exchanges to Avoid if You Are Nigerian in 2025

In 2025, only Quidax and Busha are legally licensed to operate crypto exchanges in Nigeria. Using unlicensed platforms like Bybit, KuCoin, or Binance P2P risks bank account freezes, asset seizures, and total loss of funds with no recourse.

Read More