What is TitanX (TITANX) crypto coin? The truth behind the price chaos and high-risk DeFi token

Dec, 4 2024

Dec, 4 2024

TitanX Price Discrepancy Calculator

Why This Matters

TitanX shows massive price discrepancies between exchanges - from $0.00000021 on Coinbase to $0.06 on Uniswap. This calculator demonstrates how these differences impact your actual value.

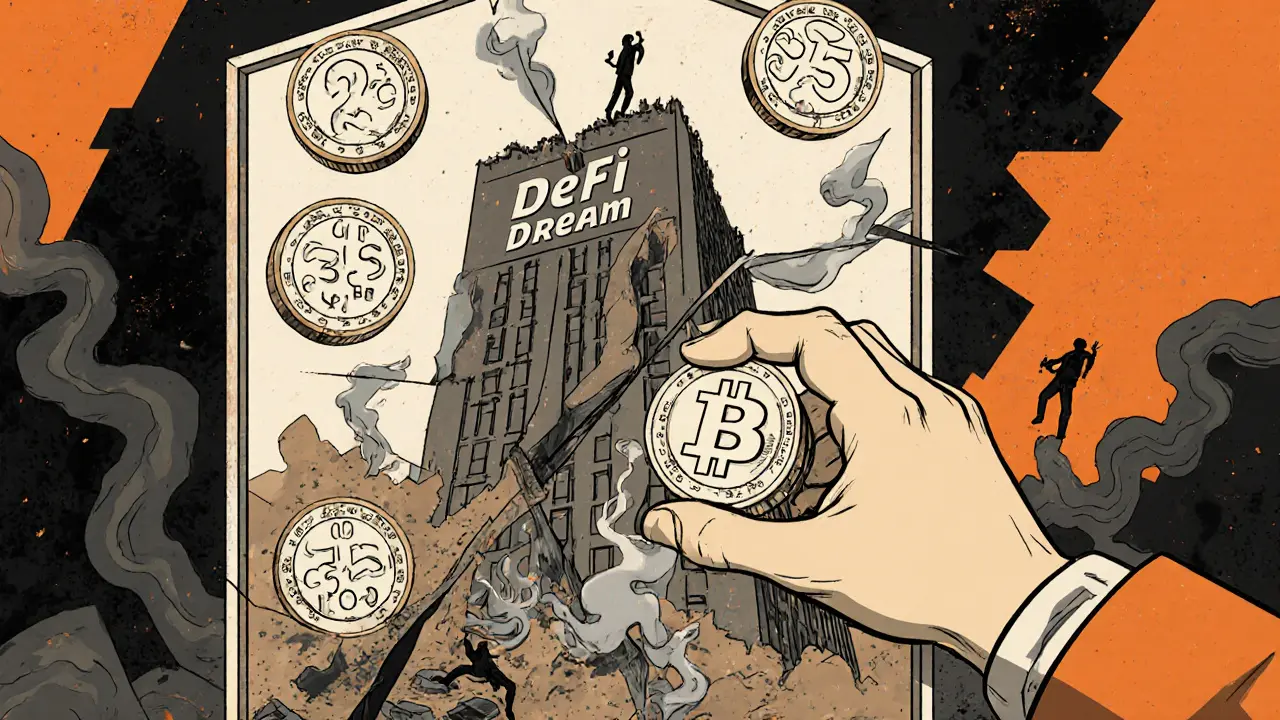

TitanX (TITANX) isn’t a cryptocurrency you buy because it’s promising. It’s one you might stumble into by accident - and quickly regret. On paper, it sounds like a DeFi dream: earn ETH just by holding, burn tokens to boost value, and ride a wave of explosive growth. But the reality? The numbers don’t add up. Prices jump from $0.00000022 to $0.06 on different sites. Supply numbers clash by 44 times. Trading volume flips between $140K and $368K. And no one knows who built it or when.

What TitanX Actually Is (And Isn’t)

TitanX is an ERC-20 token on the Ethereum blockchain. Its contract address - 0xF19308F923582A6f7c465e5CE7a9Dc1BEC6665B1 - is real. You can check it on Etherscan. But that’s where the credibility ends. There’s no whitepaper. No team names. No roadmap. No official website with clear info. It’s a token built on speculation, not substance. Sites like Coinpedia claim it’s a "groundbreaking DeFi ecosystem" that lets you "mine with ETH and time to pay your future self." That’s marketing fluff with zero technical backing. The real mechanic? A buy-and-burn system where 62% of transaction fees are used to destroy tokens. That’s not unique - Uniswap does something similar. But TitanX claims you get "28%+ in ETH yield" just by holding. That’s not how DeFi works. Legitimate yield protocols like Aave or Compound rarely offer more than 5-10% APY. Anything above that without clear, audited mechanics is a red flag.The Price Chaos: Why No One Can Agree on Its Value

This is where TitanX becomes a cautionary tale. Look at the price differences:- Coinbase: $0.00000021

- CoinStats: $0.0000002237

- LiveCoinWatch: $0.06130777 (on Uniswap v3)

- Coinpedia: $0.0623145

Why the Supply Numbers Don’t Match

Supply is another mess. Coinpedia says there are 2.368 trillion TITANX tokens. CoinStats says it’s over 105 trillion. That’s a 44-fold difference. Which one’s right? Neither, probably. There’s no official tokenomics document. No audit. No proof of token distribution. In legitimate projects, supply is locked, transparent, and verifiable. TitanX’s supply? It’s a guess. This matters because supply directly affects price. If there are 105 trillion tokens and each is worth $0.00000022, the total value is around $23,000. If it’s only 2.3 trillion, then it’s closer to $500,000. Neither number is meaningful. Neither supports a real economy. It’s all theoretical.

Trading TitanX: High Risk, Low Reward

If you’re thinking of trading TitanX, here’s what you’re up against:- Slippage: Users report needing 15% slippage to complete swaps on Uniswap. That means if you try to buy $100 worth, you end up paying $115 because there’s not enough liquidity.

- Failed transactions: Many trades don’t go through. One user on Bitcointalk said they tried three times - all failed.

- Exchange confusion: CoinSwitch claims TitanX is on Solana. It’s not. It’s on Ethereum. That kind of error means even major aggregators can’t be trusted.

- Price swings: The token moved -17.8% in a week, but spiked 12% in 24 hours. That’s not volatility - it’s manipulation.

Who’s Behind TitanX? No One Knows

There’s no team. No LinkedIn profiles. No GitHub. No Telegram group with real activity. The Twitter account @TitanXCrypto has 2,147 followers - and hasn’t posted since September 1, 2025. That’s not a project in development. That’s a ghost. Compare that to real DeFi projects. Uniswap has a public team, quarterly reports, and a treasury. TitanX has silence. And silence in crypto usually means one thing: the founders are long gone.Is TitanX a Scam?

It’s not labeled a scam by regulators - because no one’s paying attention. But it ticks every box for a rug pull candidate:- No verified team

- No audit

- Extreme price discrepancies

- Low liquidity

- Unrealistic yield claims

- No official documentation

What You Should Do

If you’re curious about TitanX, here’s what to do:- Don’t invest money you can’t lose. This isn’t a gamble - it’s a lottery ticket with 99.9% odds of losing.

- Verify the contract address. Always check 0xF19308F923582A6f7c465e5CE7a9Dc1BEC6665B1 on Etherscan. Scammers copy names - never trust the ticker alone.

- Use Coinbase or CoinGecko for price data. Avoid Coinpedia and obscure sites. They’re the ones pushing the inflated numbers.

- Never trust yield claims over 10%. If it sounds too good to be true, it is. Especially when no one can explain how it works.

- Walk away. There are thousands of legitimate DeFi projects with audits, teams, and real usage. TitanX isn’t one of them.

Angel RYAN

November 26, 2025 AT 07:35Been down this road before. Tokens like this are digital ghosts. You check the contract, it's real. You check the price, it's a lottery ticket. You check the team? Nothing. Walk away. Save your gas fees and sanity.

stephen bullard

November 27, 2025 AT 18:24It's wild how crypto keeps reinventing the same trap over and over. The promise of easy ETH yield, the fake charts, the silence after the pump. People don't get burned because they're dumb-they get burned because they're hopeful. And hope is cheaper than due diligence.

But hey, if you wanna gamble, at least know you're gambling. TitanX isn't a project. It's a mood. A glitch in the matrix. A bot's fever dream.

Real DeFi doesn't need hype. It needs audits, teams, and transparency. TitanX has none of that. Just noise and a contract address that looks like it was typed by someone's cat walking on the keyboard.

Vaibhav Jaiswal

November 29, 2025 AT 13:30Bro I saw this on Uniswap last week. Thought I found a gem. Bought $50 worth. Slippage hit 22%. My transaction failed twice. Third time it went through but I lost $15 just in fees. Then I checked CoinGecko-price was 0.00000021. LiveCoinWatch said 0.06. I felt like I was in a horror movie where the monster is just a spreadsheet error.

Now I just ignore anything with no team, no audit, and more than 10% APY. If it sounds like a TikTok ad, it’s a rug pull. Period.

And that Twitter account? Last post was 2025? That’s not a roadmap. That’s a tombstone.

Michael Labelle

November 30, 2025 AT 13:35Just wanted to add one thing-don’t trust any aggregator that says TitanX is on Solana. It’s on Ethereum. Full stop. That kind of basic error means the platform doesn’t even verify the basics. If they can’t get the chain right, why would you trust their price?

Also, 62% burn rate sounds cool until you realize no one can explain where the ETH for the ‘yield’ is coming from. If burning tokens creates value, why don’t we burn all the other tokens too? Magic doesn’t work in DeFi. Math does.

Stick to the big names. Or at least check the audit reports first.

Joel Christian

December 2, 2025 AT 12:16ok so i just bought 10m titanx bc i thought it was gonna moon and now my wallet is full of dust and i cant even sell bc the slippage is 30% and my tx keeps failing and i think i got scammed but im too ashamed to admit it to my friends lol

jeff aza

December 3, 2025 AT 00:51Let’s be precise: TitanX is a textbook example of a non-fungible entropy trap. The tokenomics are not just unverified-they’re mathematically incoherent. The 44x supply discrepancy alone invalidates any meaningful market cap calculation. The price variance of 278,000x is not volatility-it’s arbitrage impossibility. Liquidity depth is below the threshold of functional market efficiency (under 2K wallets, average holding < 0.001 ETH). The purported 28%+ ETH yield is a non-sequitur; no on-chain mechanism exists to substantiate it, and the burn rate doesn’t generate yield-it reduces supply. Without an audited, verifiable revenue stream (e.g., protocol fees, staking rewards, or governance-based treasury allocation), the yield claim is a semantic illusion. This isn’t DeFi. It’s a liquidity vacuum dressed in marketing fluff. The only ‘yield’ here is the yield of regret for the late entrants. The fact that Coinpedia and LiveCoinWatch are propagating conflicting data? That’s not a data issue-it’s a systemic failure of aggregation logic. Bottom line: TitanX is a data artifact. Not an asset. Not an investment. A ghost in the blockchain ledger. Avoid. Like a bad DNS record.