Chivo Wallet and Bitcoin in El Salvador: What Really Happened and Why It Changed

Aug, 27 2025

Aug, 27 2025

Remittance Cost Calculator

Compare Remittance Costs

Calculate how much you'd save using Bitcoin versus traditional services. Based on El Salvador's $1.5B annual remittance fees.

Important: Bitcoin's price volatility could reduce your purchasing power. El Salvador's experience shows how rapid price drops can negate savings.

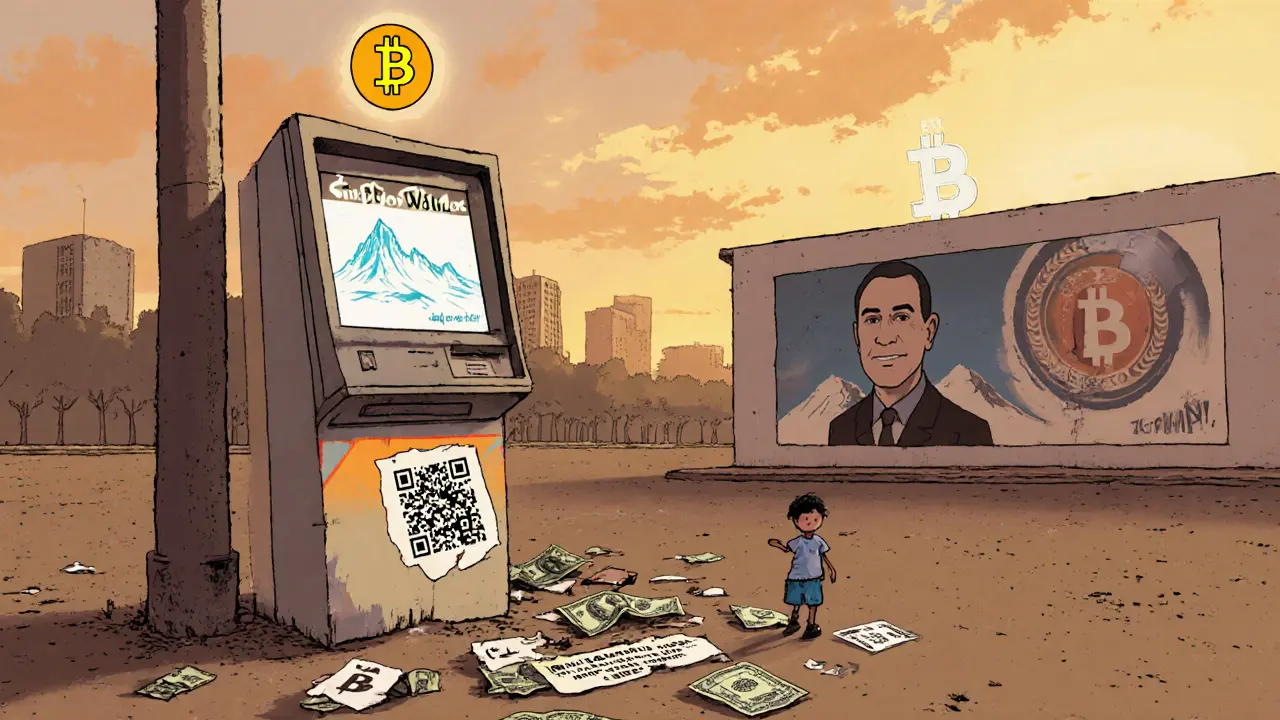

El Salvador didn’t just try Bitcoin-it made it legal tender. On September 7, 2021, the country became the first in the world to give Bitcoin the same status as the U.S. dollar. At the center of that move was the Chivo wallet, a government-built app meant to make Bitcoin easy for everyone. The idea was simple: cut out expensive remittance fees, bring the unbanked into the financial system, and modernize a struggling economy. But what looked like a bold leap forward turned into a messy, complicated experiment with real consequences for real people.

Why Chivo Was Built

El Salvador’s economy runs on money sent home from abroad. Remittances make up nearly 20% of the country’s GDP. For years, families relied on Western Union and MoneyGram, paying up to 10% in fees just to get cash from relatives in the U.S. That’s $1.5 billion a year going to middlemen, not to households. The government said Bitcoin could fix that. With Chivo, you could send Bitcoin to someone in El Salvador with zero fees. No banks. No intermediaries. Just a phone and an internet connection. The wallet wasn’t just a tool-it was a promise. The government gave every Salvadoran who downloaded Chivo $30 in Bitcoin to get started. That alone drove downloads. By the end of 2021, nearly half the population had installed the app. But downloads don’t mean usage. And usage is what matters.How Chivo Was Supposed to Work

Chivo wasn’t built by a startup. It was developed by AlphaPoint, a company with years of experience handling Bitcoin infrastructure for exchanges. The app let you hold both Bitcoin and U.S. dollars. You could pay for groceries, bus fare, or electricity in either currency. When you received Bitcoin, it could automatically convert to dollars at the point of sale. That was key-people didn’t have to understand volatility to use it. The system handled the swap behind the scenes. It was designed to scale. The government claimed it could handle millions of users at once. The goal wasn’t just convenience-it was inclusion. In El Salvador, 70% of adults didn’t have a bank account. Chivo promised to change that. No minimum balance. No monthly fees. Just a digital wallet on your phone.What Went Wrong

The technical problems started almost immediately. The app crashed. Transactions failed. People lost access to their $30. Some accounts were hacked. Identity theft surged as criminals used stolen IDs to create fake Chivo accounts and drain funds. The government didn’t have the customer support infrastructure to handle the flood of complaints. People called the help line only to hear silence. But the biggest issue wasn’t the tech-it was Bitcoin itself. In 2021, Bitcoin was trading near $69,000. By early 2022, it had dropped below $30,000. By mid-2023, it was under $20,000. And by 2024, it hovered around $16,000. That meant the $30 bonus many people got was worth less than $7 by the end of the year. People who tried to use Bitcoin to pay for food or rent saw their purchasing power shrink overnight. A meal that cost 1 Bitcoin in January cost 1.5 Bitcoin by June. No one could plan their budget around that. The government kept buying more Bitcoin, hoping the price would rebound. But that didn’t help ordinary citizens. Most Salvadorans didn’t want to gamble their livelihoods on crypto. They just wanted stable money to buy rice, pay rent, and send money to family.

Adoption Was Superficial

By 2024, surveys showed that 8 out of 10 Salvadorans rarely or never used Bitcoin. The $30 incentive got them to download the app. But after that, most went back to cash or dollars. Why? Because Bitcoin didn’t solve their daily problems-it created new ones. Some people did benefit. Those who received remittances from the U.S. saved money on fees. A few small businesses started accepting Bitcoin and saw a boost in customers from crypto-savvy tourists. But these were exceptions. For the average person, Bitcoin was a confusing, risky, and unreliable option. The government pushed hard. Schools taught kids about Bitcoin. Public workers were told to use Chivo. Bus drivers were given QR codes to accept payments. But forcing adoption doesn’t build trust. It builds resentment.The IMF Forced a Change

In early 2025, the International Monetary Fund stepped in. El Salvador was running low on cash and needed a $1.4 billion loan. The IMF said no to Bitcoin as legal tender. Too risky. Too volatile. Too unpredictable for a national economy. The government agreed. On January 15, 2025, Bitcoin lost its legal tender status. That didn’t mean Bitcoin disappeared. It just meant the government stopped requiring businesses to accept it. The Chivo wallet didn’t shut down. But the state stopped backing it. By July 2025, the government planned to fully exit its role in managing the wallet. The Bitcoin reserves? Still there. The government kept its 6,102 coins, worth around $500 million, and called it the Strategic Bitcoin Reserve Fund.What’s Left

The Chivo wallet still exists. People can still use it. But now it’s just another app-not a government mandate. Private companies can build their own Bitcoin wallets. The Digital Assets Issuance Act of 2023 still stands, creating the National Commission of Digital Assets (CNAD) to regulate crypto businesses. El Salvador isn’t abandoning crypto. It’s just backing off the forced experiment. The country still hosts the PLANB Forum, Central America’s biggest crypto conference. Startups are still launching blockchain projects. But now it’s voluntary. No $30 bonuses. No government pressure. Just people choosing crypto because they believe in it-not because they were told to.

Lessons Learned

El Salvador’s Bitcoin experiment wasn’t a failure. It was a lesson. You can’t force a new financial system on people without understanding their needs. You can’t replace stable money with something that swings 30% in a month and expect people to trust it. You can’t build a national wallet overnight and expect it to work without testing, support, and education. But you also can’t ignore the problem of remittance fees. You can’t ignore that 70% of people are left out of the banking system. Chivo proved that digital money can work. It just needs the right conditions-stability, education, and choice-not mandates. The real win? The world is watching. Countries in Africa, Asia, and Latin America are studying what happened in El Salvador. Some are building their own central bank digital currencies. Others are looking at private crypto solutions. El Salvador didn’t get it right-but it showed what’s possible.What You Can Learn From Chivo

If you’re thinking about using Bitcoin in your own country-or even just as a personal tool-here’s what El Salvador’s story teaches you:- Volatility kills adoption. People need predictable value to trust a currency.

- Technology alone doesn’t solve poverty. Education, support, and reliability matter more than apps.

- Forced adoption backfires. People won’t use something they don’t understand-even if it’s free.

- Government-backed crypto can look powerful on paper, but it needs real infrastructure to survive.

- Remittance savings are real. Bitcoin can cut costs for cross-border transfers-if users aren’t exposed to price swings.

Michael Fitzgibbon

November 26, 2025 AT 13:57It’s wild how the $30 bonus felt like free money at first, but then turned into a lesson in humility. I know people who cashed out immediately just to buy groceries - no one wanted to gamble their rent on Bitcoin’s rollercoaster. The real tragedy? The tech could’ve worked if it had been rolled out slowly, with real support. Instead, it felt like a PR stunt with real human costs.

Komal Choudhary

November 27, 2025 AT 21:43my cousin in san salvador downloaded chivo and got the 30 btc, then lost it bc the app crashed and no one answered the helpline. she still uses cash. everyone does. the gov just wanted to look cool on twitter.

Ben Costlee

November 28, 2025 AT 18:45Look, I get the vision. Cutting remittance fees? Brilliant. Bringing the unbanked into the system? Essential. But you don’t fix systemic poverty by slapping a crypto wallet on top of it like a Band-Aid on a broken leg. The infrastructure wasn’t there. The education wasn’t there. The patience wasn’t there. And Bitcoin? It’s not money - it’s speculation dressed up as currency. The government didn’t fail because Bitcoin failed. They failed because they misunderstood human behavior.

People don’t need flashy tech. They need reliability. They need to know that the money in their pocket today will still buy the same loaf of bread tomorrow. Chivo didn’t solve that. It made it worse.

And now? The IMF had to step in because the whole thing was destabilizing the national economy. Not because crypto is evil - but because forcing it on a population that didn’t ask for it? That’s not innovation. That’s arrogance.

I’ve seen this script before. Remember the dot-com boom? Everyone thought the internet would fix everything. Turns out, you need more than a website to feed a family.

The real win here? The world is watching. And now, other countries are learning: bottom-up adoption beats top-down mandates every time. Let people choose. Don’t hand them Bitcoin like a Christmas gift and then wonder why they don’t open it.

Chivo’s legacy isn’t in the coins. It’s in the cautionary tale.

ola frank

November 30, 2025 AT 04:09From a macroeconomic standpoint, the decision to adopt Bitcoin as legal tender constituted a structural misalignment between monetary policy autonomy and asset class volatility. The exogenous shock to the currency regime, coupled with the absence of a robust fiat-backed liquidity buffer, created a non-linear risk profile incompatible with the stability requirements of a developing economy. The Chivo wallet, while technically competent in its API layer, failed to address the fundamental disconnect between cryptographic abstraction and socioeconomic reality.

Furthermore, the $30 incentive functioned as a behavioral nudge that exploited cognitive biases - specifically, the endowment effect and loss aversion - but without cultivating long-term utility. The subsequent depreciation of Bitcoin rendered the incentive not merely ineffective, but counterproductive, as users experienced negative real returns on a mandated financial instrument.

The IMF’s intervention was not merely prudent - it was inevitable. Sovereign debt markets do not tolerate asset-backed liabilities with 30% monthly variance. The strategic Bitcoin reserve fund, while a curious hedge, remains a speculative position masquerading as fiscal policy. The only sustainable path forward is a CBDC - not crypto - with interoperable private-sector wallets for remittance efficiency.

Vaibhav Jaiswal

November 30, 2025 AT 21:02Man, I saw a video of a guy in San Miguel trying to pay for a bus ride with Bitcoin and the app crashed. He just stood there holding his phone like it was a magic wand that forgot how to work. Everyone behind him started laughing. Then he paid in cash. That’s the whole story right there.

People don’t hate Bitcoin. They just hate being forced to use something that doesn’t work when they need it most.

Abby cant tell ya

December 1, 2025 AT 17:49Ugh, I knew this would fail. People in El Salvador aren’t crypto bros. They’re moms buying rice. You don’t hand someone a rocket ship and say ‘go to Mars’ when they just need a bike. This was so tone-deaf. The government thought they were being revolutionary - they were just being reckless. And now everyone’s stuck with a glitchy app that’s basically a digital ghost town.

Janice Jose

December 2, 2025 AT 07:43It’s sad, honestly. The idea was good - I get that. But forcing people to use something they don’t understand? That’s not progress. That’s pressure. I think if they’d just let people use it on their own terms, without the $30 hype or the school lessons… maybe it would’ve stuck. But nope. They turned it into a political slogan.

Now it’s just another app nobody uses. Kinda like those smart fridges from 2015.

Vijay Kumar

December 3, 2025 AT 01:01Bitcoin was never the problem. The problem was the cult of the savior complex. El Salvador thought they were the first to break the chains of capitalism. Turns out they just broke their own economy. Crypto isn’t magic. It’s math. And math doesn’t care about your nationalism.