Crypto Tax India: What You Need to Know About Reporting Crypto Gains

When you buy, sell, or trade cryptocurrency in India, the crypto tax India, the legal requirement to report and pay taxes on cryptocurrency profits under Indian income tax laws. Also known as cryptocurrency capital gains tax, it applies to every trade, swap, or sale that results in a profit—no matter how small. The Indian government doesn’t treat crypto as currency. It treats it as property, just like stocks or real estate. That means every time you sell Bitcoin for INR, trade Ethereum for Solana, or even use crypto to buy goods, you’ve triggered a taxable event.

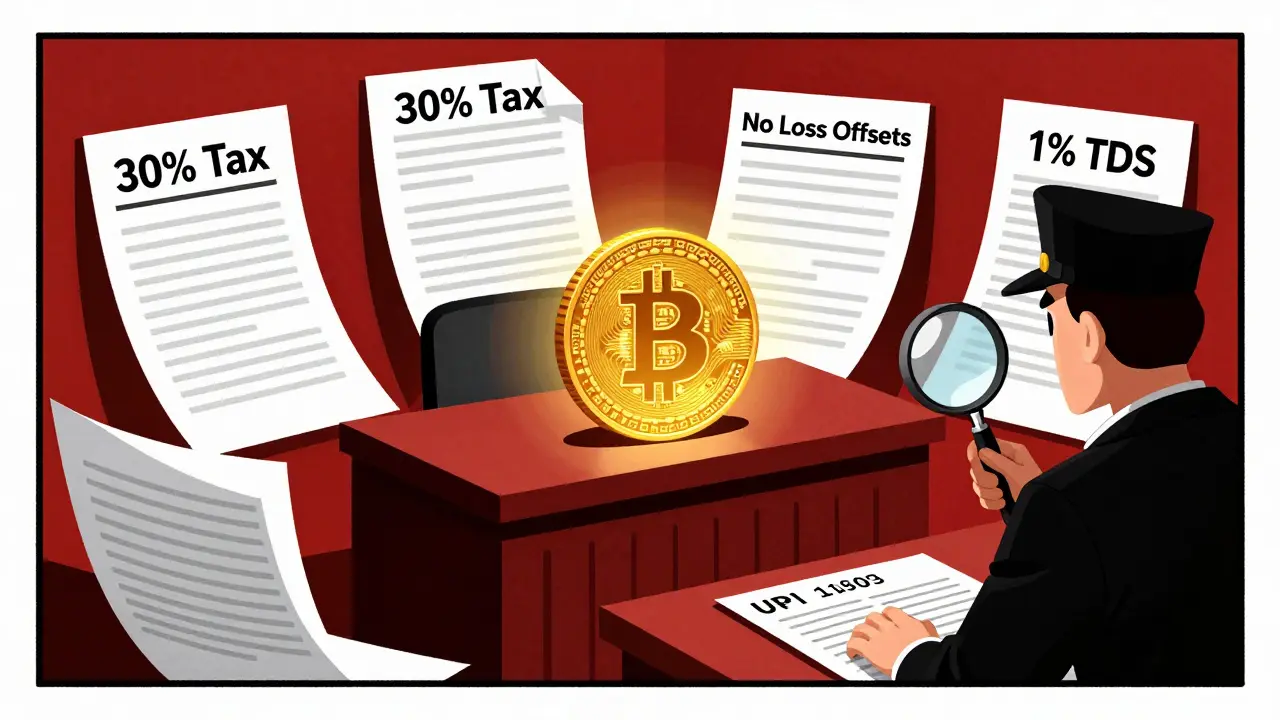

Since April 2022, India has enforced a flat 30% tax on crypto gains, with no deductions for losses. That’s harsher than most countries. Even if you lost money on other trades, you can’t offset those losses against your crypto profits. Plus, there’s a 1% TDS (Tax Deducted at Source) on every crypto transaction over ₹50,000 (or ₹10,000 in a single day). This applies whether you trade on WazirX, CoinDCX, or a foreign exchange. The Indian Income Tax Department, the government body responsible for enforcing tax laws on digital assets in India now cross-checks data from exchanges and blockchain analytics tools to catch unreported activity. If you didn’t keep records, you’re at risk.

Staking rewards, airdrops, and mining income? All taxable as income. If you got 10 SOL from a staking reward, the rupee value of that at the time you received it counts as income. Same goes for free tokens from an airdrop—even if you never sold them. The crypto reporting India, the process of disclosing all crypto transactions to tax authorities using Form ITR-2 or ITR-3 system requires you to track every transaction date, amount, value in INR, and type. No more guessing. No more spreadsheets with missing entries. You need exact records.

Many Indians think if they don’t cash out to bank accounts, they’re safe. They’re wrong. Trading one crypto for another is still a taxable sale. Swapping USDT for SHIB? Taxable. Using BNB to buy an NFT? Taxable. Even if you never touched INR, the tax liability still exists. The crypto capital gains India, the profit made from selling or exchanging cryptocurrency that must be reported under capital gains tax rules in India rules don’t care how you moved your assets—only whether you made a gain.

What you’ll find below are real cases, clear explanations, and hard truths about crypto taxes in India. No fluff. No theory. Just what actually happens when the taxman comes knocking. You’ll see how people got caught, what penalties look like, and how to avoid them. Some posts expose fake airdrops pretending to be tax loopholes. Others break down how to track your trades without expensive software. One even compares how crypto tax rules in India stack up against Canada and Australia. If you’ve ever wondered if you owe taxes on your crypto—this is where you start fixing it.

Crypto Tax Enforcement and Penalties in India: What You Need to Know in 2026

India imposes a 30% tax on crypto gains, 1% TDS on trades, and 18% GST on platform services. Penalties for non-compliance can reach 200% of unpaid tax. Here's what you need to know in 2026.

Read More

Virtual Digital Assets Taxation in India: Complete Guide for 2025

India taxes virtual digital assets at a flat 30% with no loss offsets and 1% TDS on all trades. This guide covers rules, reporting, pitfalls, and strategies for 2025.

Read More