CAMLS: Your Guide to Crypto Coins, Airdrops, and Exchange Truths

When you're looking for crypto coins, digital assets built on blockchain networks that range from stablecoins to gaming tokens. Also known as cryptocurrencies, they're not all created equal—some have real use cases, while others are just fake prices on dead blockchains. That’s where crypto airdrops, free token distributions meant to grow a project’s user base. Often used by new DeFi platforms to attract early adopters come in—most are useless, a few are legit, and many are traps. And if you’re trading, you need to know which cryptocurrency exchanges, platforms where you buy, sell, or swap digital assets. Some are regulated and safe, others are ghost sites with zero reviews and stolen funds to trust. You’ll find real breakdowns here: why Angola banned mining, how Pakistan’s power deal could shift global crypto economics, and why that "new" token you saw on TikTok has zero trading volume. We don’t guess—we check the chain, the team, the volume, and the scams. Whether you’re trying to clear a stuck Bitcoin transaction, avoid a fake airdrop, or understand staking vs mining, this is the place to cut through the hype. Below, you’ll see exactly what’s working, what’s dead, and what’s outright dangerous in crypto right now.

CANDY Airdrop by TripCandy: What You Need to Know About the Travel Token Rewards

No official CANDY airdrop exists from TripCandy as of 2026. Learn how to earn CANDY tokens by booking travel, how the token works, where to trade it, and how to avoid scams. Real rewards, not free crypto.

Read More

XCOEX Crypto Exchange Review: Is This Platform Safe and Worth Using in 2026?

XCOEX is a small, Estonia-based crypto exchange that lets you buy Bitcoin and Ethereum with a credit card. It's simple but lacks apps, audits, and user reviews. Is it safe for long-term use?

Read More

What is SonarWatch (SONAR) crypto coin? A practical guide to the Solana analytics token

SonarWatch (SONAR) is a Solana-only DeFi dashboard that tracks wallets, liquidity pools, and NFTs. The SONAR token unlocks premium features, but the platform has minimal users and trading volume, making it a high-risk, niche tool with little future growth.

Read More

What is Farting Unicorn (FU) Crypto Coin? The Truth Behind the Meme Coin Claimed to Be Elon Musk's Creation

Farting Unicorn (FU) is a Solana-based meme coin with no team, no utility, and no real connection to Elon Musk. It's a high-risk speculative token driven by social media hype and ultra-low pricing - not innovation.

Read More

LEOS Airdrop Details: Leonicorn Swap Mega New Year Event Explained

The LEOS airdrop from Leonicorn Swap rewarded over 87,000 users with free tokens during its Mega New Year Event in December 2025. Learn how it worked, who qualified, and what to do now.

Read More

RACA x BSC Metamon Game Airdrop: How It Worked and What You Missed

The RACA x BSC Metamon airdrop rewarded NFT holders with tokens and Potion NFTs in 2022. Learn how it worked, who qualified, and why the real value wasn't in the tokens.

Read More

Swapsicle V2 (Mantle) Crypto Exchange Review: Low Fees, NFT Perks, and Limited Tokens

Swapsicle V2 on Mantle offers low-fee, fast stablecoin swaps with concentrated liquidity and NFT-powered rewards. Ideal for users seeking efficiency over token variety in a growing Layer-2 ecosystem.

Read More

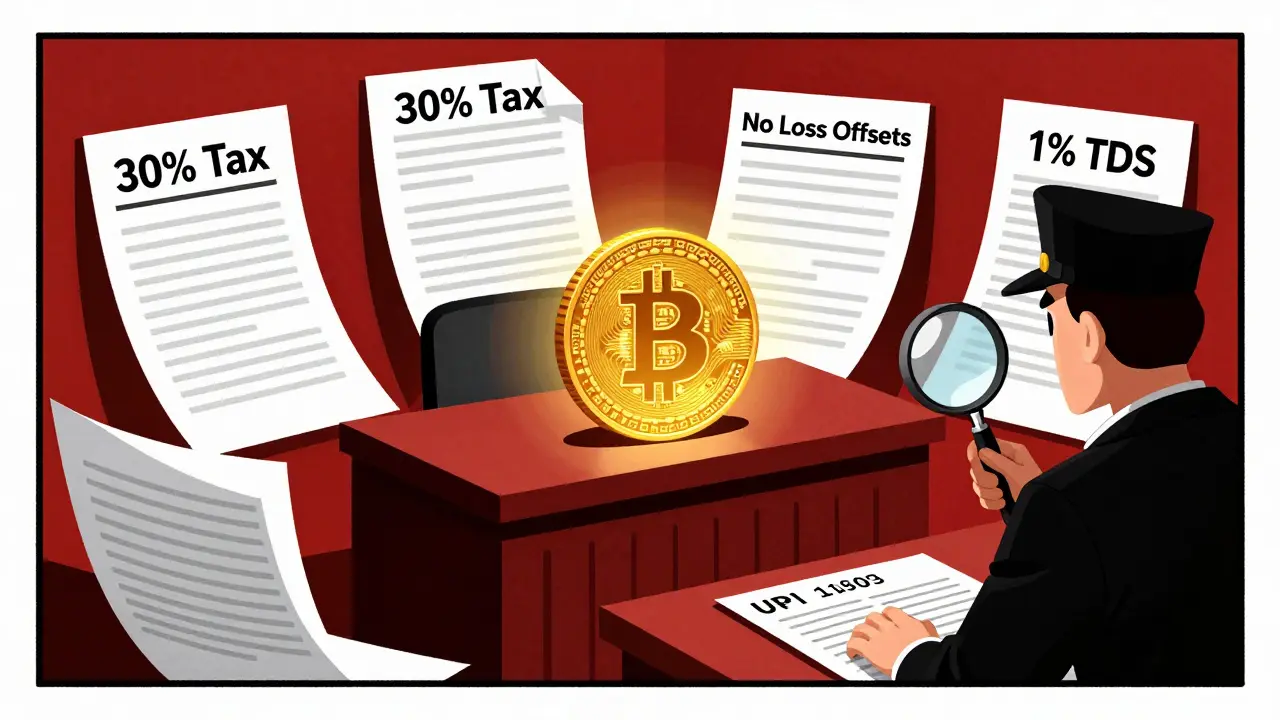

Crypto Tax Enforcement and Penalties in India: What You Need to Know in 2026

India imposes a 30% tax on crypto gains, 1% TDS on trades, and 18% GST on platform services. Penalties for non-compliance can reach 200% of unpaid tax. Here's what you need to know in 2026.

Read More

Online Voting with Blockchain Technology: Can It Really Secure Elections?

Blockchain voting promises secure, transparent elections-but experts warn it doesn't fix the real vulnerabilities. Learn why paper ballots still beat digital systems for democracy.

Read More

Why $4.18 Billion Flew Out of Iran via Crypto in 2024

In 2024, Iranians moved $4.18 billion in cryptocurrency out of the country-not to evade sanctions, but to save their savings from a collapsing currency. This was a grassroots financial rebellion.

Read More

Core Principles of Web3 Technology Explained Simply

Web3 is a new internet built on blockchain where users own their data, assets, and identity. Learn the core principles: decentralization, native payments, trustless systems, and interoperability-and how they’re changing digital ownership.

Read More

How to Avoid Crypto Restrictions in Iran: Practical Methods for 2026

Iranians are using DAI, VPNs, and Telegram bots to bypass crypto bans as inflation hits 43%. Learn the top 5 methods that actually work in 2026 - and what to avoid.

Read More